Against a backdrop of drought exacerbated by the El Niño phenomenon, cocoa prices on international markets have reached unprecedented levels. The price of a tonne of cocoa topped the $6,000 mark in New York, a rise that is weighing heavily on the global chocolate industry. The S&P Cocoa has gained over 120% since January 1, 2023.

Unprecedented!

The situation is particularly critical for chocolate giants such as Hershey, which is already forecasting limited profit growth as a result of this price surge. Michele Buck, CEO of Hershey, is not ruling out the possibility of passing on these costs to consumers.

Price trends for the three biggest chocolate companies

Although chocolate consumers have yet to feel the full impact of this rise, higher cocoa costs should inevitably be passed on to consumer prices later this year and next, as costs generally take 6-12 months to reach consumers.

Supply under pressure

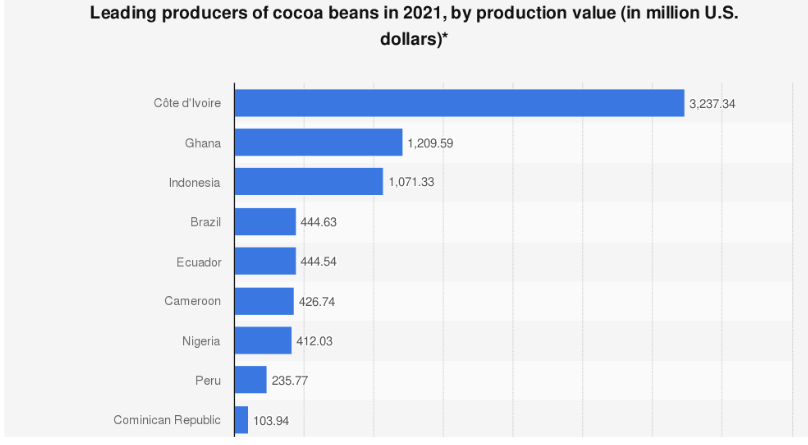

West Africa, which dominates world production along with Ivory Coast and Ghana, has been hit hard by unfavorable weather conditions. The Harmattan winds, more intense and harmful this year, have aggravated the situation, leading to a drastic reduction in harvests and shipments. The figures are alarming: a 39% drop in shipments from Côte d'Ivoire and a 35% fall in cocoa arrivals from Ghana.

West Africa accounts for over 50% of world exports

The long-term outlook is also worrying. Experts warn that weather phenomena linked to climate change could intensify. These conditions could have a lasting impact on cocoa production and other essential confectionery ingredients, such as sugar, whose prices are also on the rise due to disappointing harvests in India.

The cocoa industry is therefore at a turning point, with prices set to reach a new threshold. Experts such as Paul Davis of Sucres et Denrées SA believe that the market will remain under pressure for the next three years if nothing changes. New trees planted to increase production take several years to produce beans, which means that world cocoa supply could remain below demand for a third consecutive season.

The stock market

Several listed companies operate in the chocolate sector. Here are just a few of them:

The Hershey Company, is the iconic leader in the US chocolate and confectionery market, has been hardest hit by the recent economic turmoil, recording a 13% drop in its share price in one year.

Nestlé, the Swiss food giant, generates a modest share of its sales from chocolate (8.6% of the total). With emblematic brands such as Kit Kat, Smarties, Cailler and Terrafertil, etc... Nestlé benefits from a global presence and a solid reputation, which could make it a stable choice for investors.

Mondelez International is another industry powerhouse, known for brands such as Cadbury, Milka and Toblerone, which account for a quarter of its revenues. Mondelez's core business, however, is cookies and snacks, which account for almost half its sales, thanks to such must-have brands as Oreo, LU and Prince.

Lindt is synonymous with premium chocolate, known for its famous Lindor and high-quality chocolate bars. The Swiss company has maintained an image of luxury and excellence, enabling it to retain its pricing power.

For those who prefer to invest early in the value chain, Barry Callebaut is the world's leading manufacturer of high-quality chocolate and cocoa. With cocoa farms around the world and a diverse customer base ranging from artisans to multinationals.

Finally, for a more niche investment, Josef Manner, the Austrian confectioner, offers a European perspective. In the US, Rocky Mountain Chocolate Factory could be just what you're looking for. The French agri-food group Savencia is also home to a specialist chocolate division, which includes the Valrhona and Weiss brands.

By

By