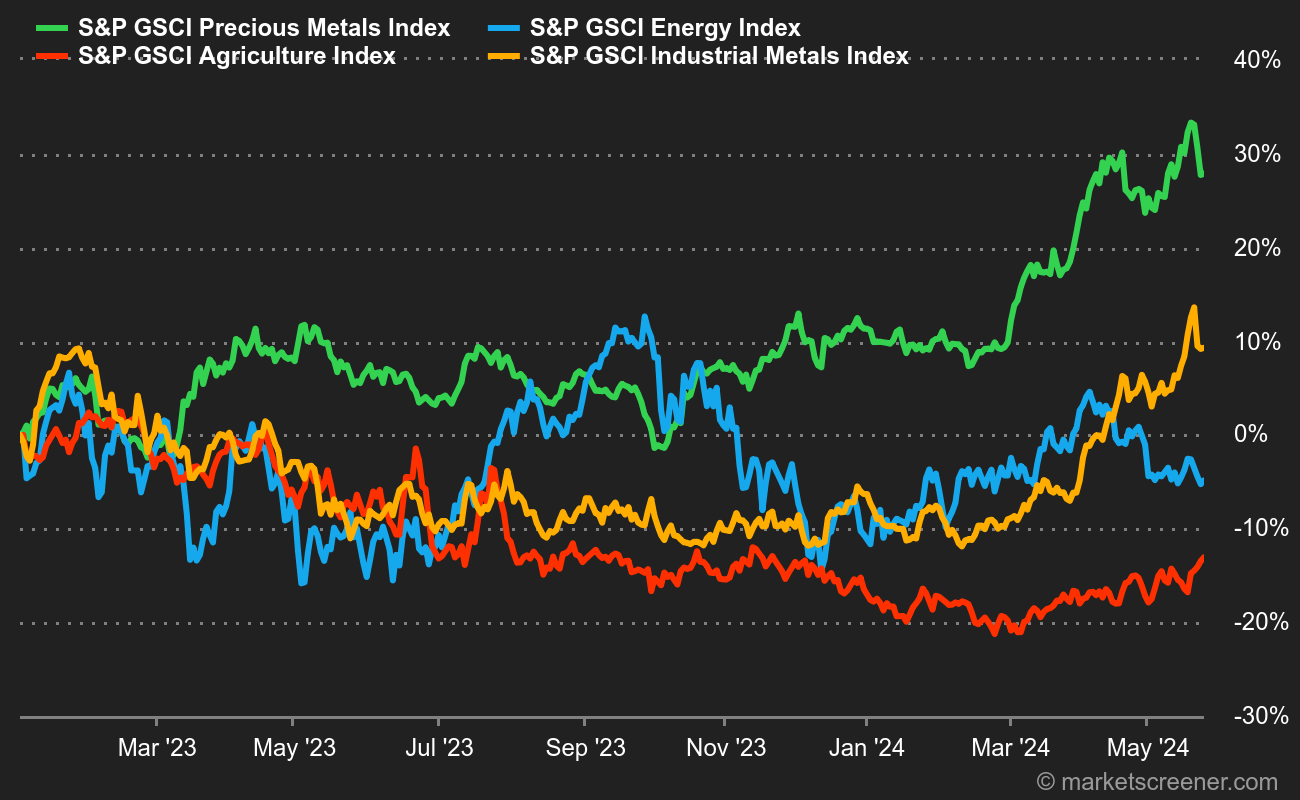

Energy: Oil is rising slowly but steadily, buoyed by prospects of a tighter market this year. Against this backdrop, geopolitical frictions are adding further leverage to the buying flow. The European benchmark, Brent, is advancing to USD 89, as is US light crude, WTI, which is back above USD 85 a barrel. However, the latest report on US inventories was once again mixed, with crude stocks up by 3.2 million barrels, whereas the consensus was for a decline. The explanation lies in US imports, which have risen over the past 5 days. Finally, OPEC+ held a meeting of energy ministers yesterday. Unsurprisingly, the enlarged organization made no changes to its production quotas.

Metals: Copper is back near USD 9,000 per tonne in London. This renewed rise is linked to the good performance of the Chinese manufacturing PMI compiled by Caixin, which rose to 51.1 points (thus in the extension zone). Aluminum also advanced to USD 2330. Gold, meanwhile, broke new records. The precious metal briefly broke the USD 2300 /oz barrier.

Agricultural commodities: It's hard to miss cocoa, which monopolizes attention in the agricultural commodities segment. Its price briefly exceeded the USD 10,000 per tonne mark, a surge probably linked to unfulfilled margin calls on futures contracts. The cocoa market is expected to see a new deficit this year, of between 400,000 and 500,000 tonnes. Traders are also keeping a close eye on coffee, whose price jumped by around 10% this week. Lack of rainfall and rising temperatures could put a strain on harvests in Southeast Asia. As for cereals, there's still no improvement in sight for corn, which is trading at around 435 cents a bushel. Wheat is stagnating at 560 cents.

By

By