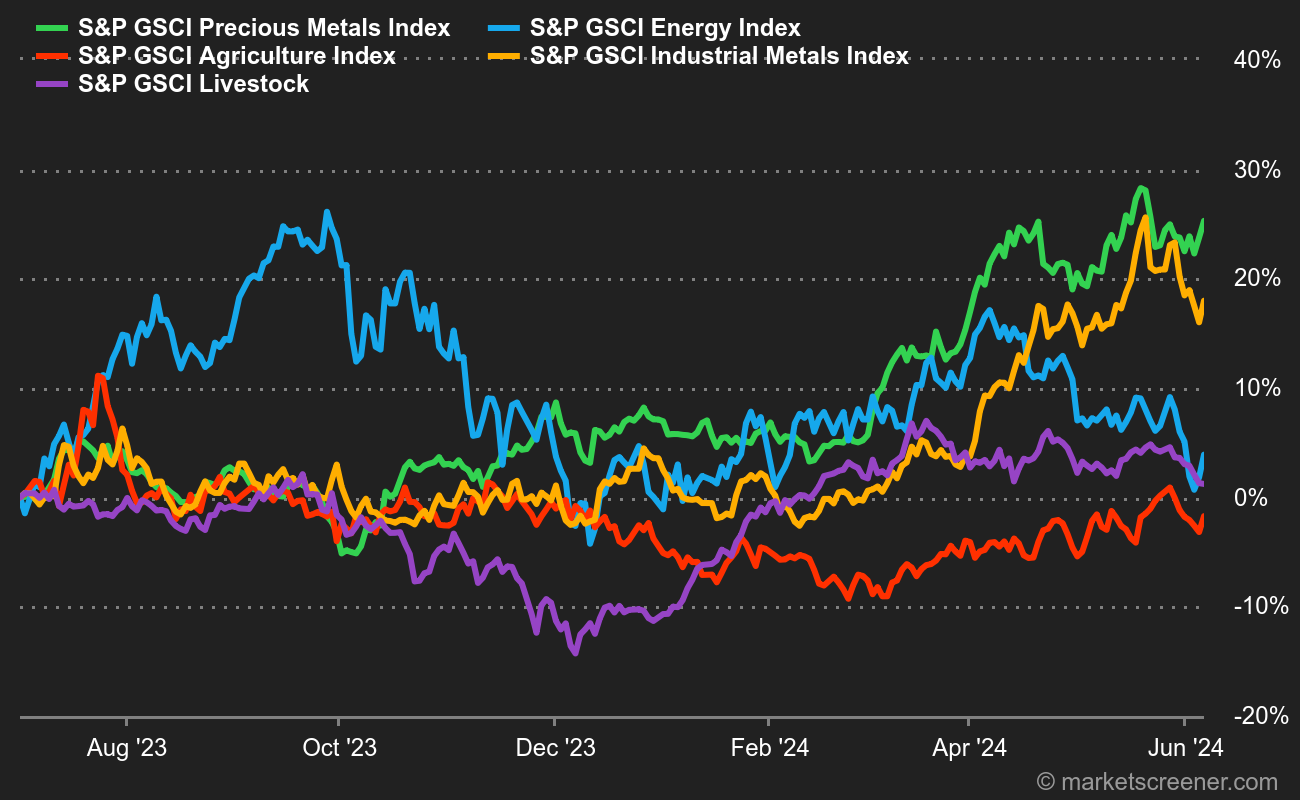

Energy: In the space of a week, oil had entirely erased September's price gains. In other words, oil prices plunged 10% in just five sessions, weighed down by a strong dollar and rising bond yields. On the fundamentals front, OPEC+ held an online meeting last week (named JMMC for Joint Ministerial Monitoring Committee) to update oil market conditions. There were no major changes to report at the end of the meeting, as Saudi Arabia and Russia intend to maintain their production cuts until at least the end of the year. On Friday, Brent crude was trading at around $84 a barrel, compared with $82 a barrel for WTI.

But this was without the sudden resurgence of tensions in the Middle East. The Hamas attack on Israel stirred up old demons. Brent climbed back above USD 87 and WTI around USD 85.60. In the short term, the tug-of-war east of the Mediterranean is the main determinant of prices, all the more so after accusations that Iran is the eminence grise of the assault.

Metals: The rise of the greenback has not only wreaked havoc on oil, metals have also been impacted. As proof, the price of copper has fallen for five consecutive sessions to trade around USD 7,800 on the LME. Aluminum (USD 2200) and zinc (USD 2450) followed suit. In addition to the dollar's strength, the latest Chinese data are mixed, in particular September's Caixin Manufacturing, which admittedly remained in the expansion zone (at 50.6 points) but fell short of expectations (51.1 points). In precious metals, the refrain changed slightly. After being crushed by rising bond yields, the barbarian relic has been recovering since the weekend, in a risk-averse move. Last week, the gold metal was trading at a low of around USD 1812. It climbed back to USD 1850 on Monday.

Agricultural products: The US Department of Agriculture revised downwards its estimate of national corn stocks. This was enough to support corn prices in Chicago, which rose to 498 cents a bushel. Wheat, on the other hand, was flat at 574 cents.

By

By