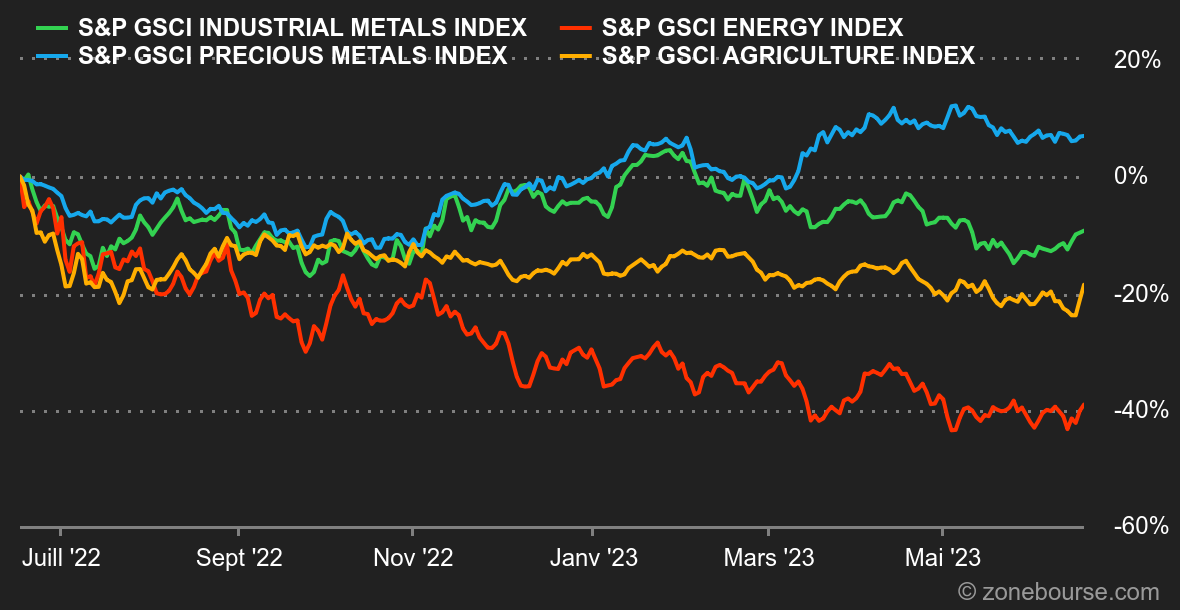

Energy: Last week, the International Energy Agency (IEA) published its latest monthly report. The report states that the Agency expects oil demand to rise slightly this year (by 0.2 million barrels per day), before levelling off in 2024, as the IEA estimates that demand will slow by 0.9 mbpd next year. Supply is also set to rise this year, driven unsurprisingly by non-OPEC production. OPEC has also updated its forecasts. The cartel left its overall outlook unchanged, while emphasizing as usual the various risks weighing on the supply/demand balance, such as geopolitical tensions and the global economic slowdown. In terms of prices, North Sea Brent is trading at around USD 76.40 a barrel, compared with USD 71.70 for its US counterpart, WTI. We should also mention the surge in European natural gas prices, which last week reached the 40 EUR/MWh mark for Rotterdam TTF (today, this benchmark is trading at around 32 EUR). Norway, which has become the main supplier of gas to continental Europe, is experiencing leakage problems and is carrying out maintenance on some of its fields, causing a drop in supply flows via Norwegian gas pipelines.

Metals: The base metals segment surged last week, with the exception of aluminum, which hovered around USD 2,200 on the London Metal Exchange. Despite continued mixed economic data from China, metals benefited from renewed risk appetite with the Federal Reserve's status quo on rates. The sharp fall in the value of the greenback also helped to support prices. In this context, a tonne of copper rose to USD 8,500, as did nickel (USD 2,2700) and zinc (USD 2,460). In precious metals, gold stabilized at around USD 1960.

Agricultural products: The US Department of Agriculture (USDA) has revised its estimate of US corn production downwards. The USDA is pointing to the effects of dry weather, which may compromise part of the harvest. In Chicago, the price of corn rose to 688 cents a bushel, while wheat gained a little ground to 630 cents.

By

By