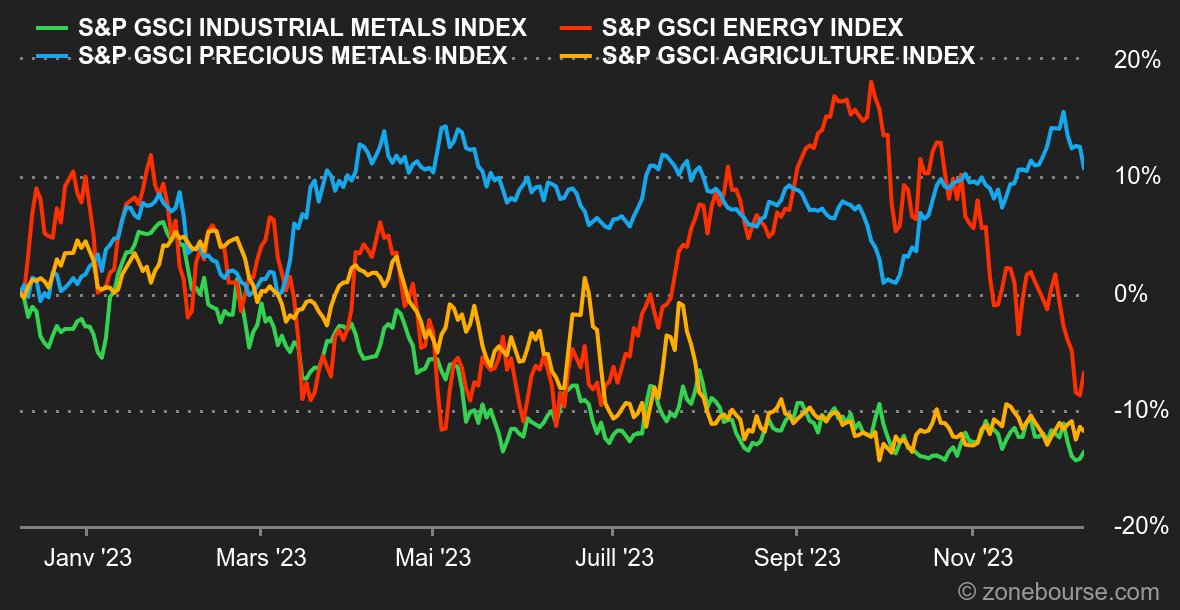

Energy : The message is clear: the market isn't really concerned by OPEC+'s new production cuts, which intend to take just over 2 million barrels a day out of circulation. In reality, it seems difficult to achieve this target, as some producers are unwilling or unable to cut production. Against this backdrop, the slowdown in Chinese crude imports has taken its toll. More than half of the growth in demand for oil comes from China, so the slightest sign of a slowdown in demand is significant. The proof is in the barrel price, which has fallen for another week (the seventh in a row), with European Brent at USD 75 and US WTI at USD 71.

Metals : Consolidation sequence for industrial metals, which took a nosedive last week in London, with the exception of tin (up to USD 24400). A tonne of copper is trading at around 8200 USD, aluminum at USD 2100 and zinc at around USD 2400. In the week's highlights, Beijing unveiled some rather robust figures on metal imports in November, with copper imports up 10% on October. In precious metals, gold was back to square one, dropping back below USD 2,000 an ounce.

Agricultural products : unlike oil and metals, grain prices gained ground last week in Chicago. The price of corn climbed to around 490 cents a bushel, compared with 640 cents for wheat.

By

By