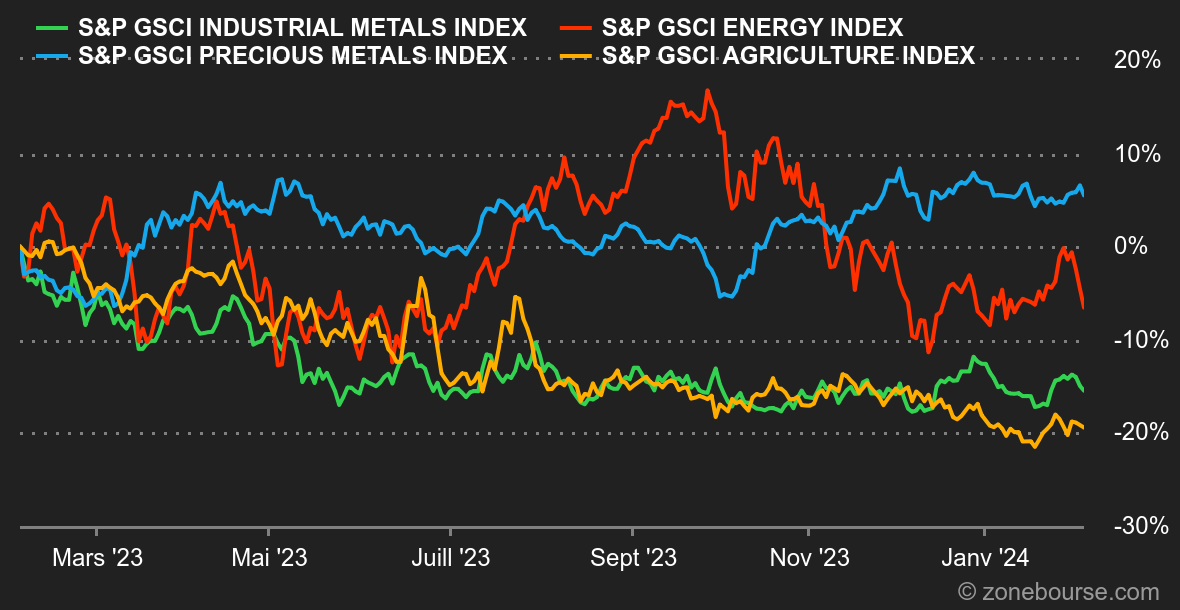

Energy: One step forward, one step back. Oil prices retreated last week despite intensifying geopolitical tensions in the Red Sea and the Middle East in general. Brent crude failed to stay above the USD 80 mark. This price weakness is partly due to concerns about the robustness of the Chinese economy, which accounts for so much of global demand. Finally, the Fed's comments wiped out investors' bets on an imminent rate cut in March. In other oil news, OPEC+ decided to maintain its production strategy for the first quarter, while in the United States, oil inventories rose while economists were expecting a fall. Brent, as we have seen, is trading down at USD 76.70, while WTI is trading around USD 72.

Metals: We're still talking about Chinese data here, as the second reading of China's January manufacturing PMI came out slightly below market expectations, at 49.20 points, thus still in contraction territory. Nevertheless, metal prices are holding up well, with a tonne of copper still trading slightly down at USD 8,400 in London. Aluminum (USD 2,200) and lead (USD 2,160) are also holding up well. Gold had resisted the Fed's announcements, but the US employment report had the better of its bullish momentum. After reaching USD 2065, the gold metal also reversed course and is now trading at around USD 2020. In its latest report, the World Gold Council reports that demand for gold reached a record high in 2023. One of the driving forces behind this attraction is the appetite of central banks for the barbaric relic.

Agricultural products: No change in Chicago, where the mood remains gloomy for grain prices. Corn is struggling to bounce back, holding steady at 447 cents a bushel, while wheat is slowly sliding towards the 600-cent mark.

By

By