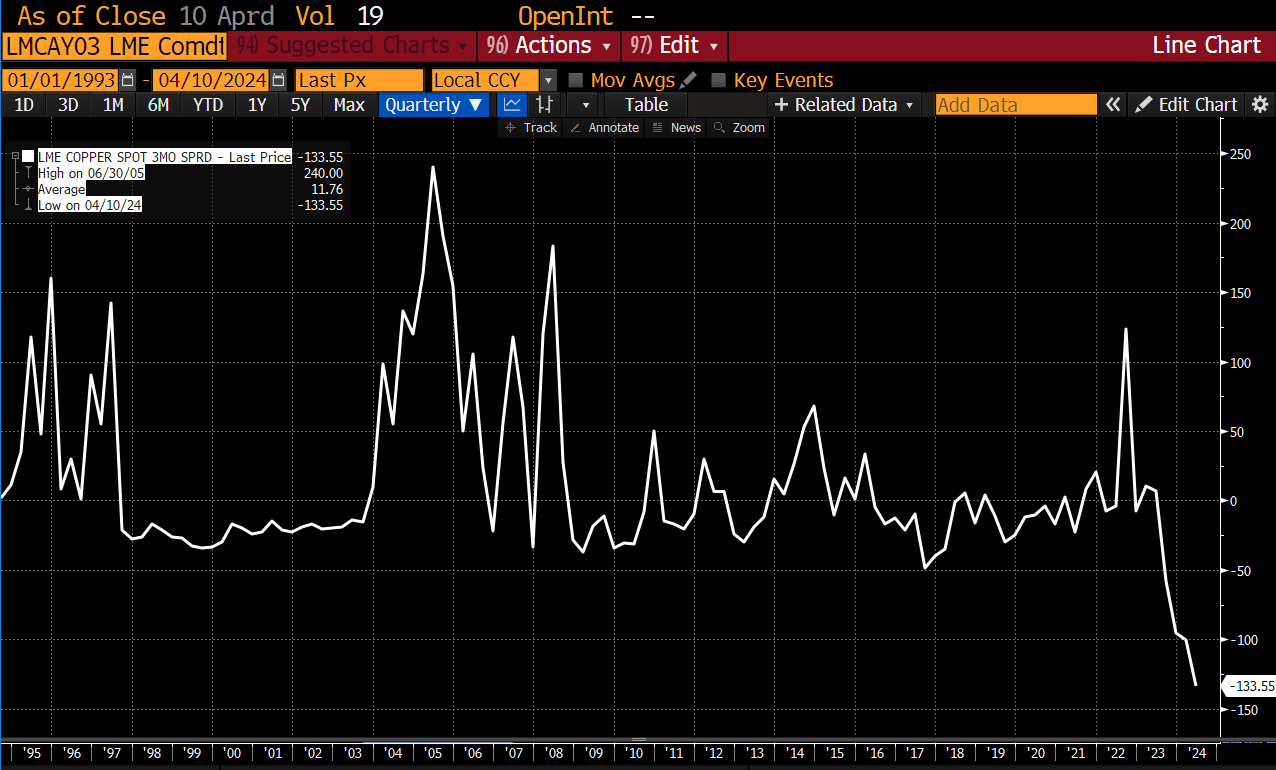

The spread between LME Cash (spot) and LME 3-month (future) is under heavy pressure, suggesting abundant supply in the short term, but raising concerns about a possible supply squeeze in the future.

Source : Bloomberg

Chinese demand, a key factor for copper, has been revised downwards following stimulus measures deemed insufficient. However, demand growth is still expected to reach 3.9% for the current year.

At the same time, interest rate rises are also influencing the market, prompting traders to favor futures contracts. Prospects for a reduction in global copper supply, with a forecast drop of 1 million tonnes by 2024, and the difficulties faced by copper smelters struggling for limited supply, could lead to higher prices.

Goldman Sachs expects copper prices to reach $10,000 per tonne by the end of the year, due to Chinese demand and supply constraints.

Investors considering investing in copper have two main options: specialized copper ETFs or shares in copper-related companies. Each option has its advantages and drawbacks.

Copper ETFs (e.g. the"WisdomTree Copper", which replicates the Bloomberg Copper Index) offer direct exposure to the metal's price, and are a simple way to benefit from rising prices without having to manage individual stocks. However, they can also be affected by management fees and do not always perfectly reflect copper price movements.

On the other hand, investing in shares of copper mining or smelting companies can offer greater leverage if these companies are well managed and positioned to capitalize on rising copper prices. However, this also implies a thorough analysis of the company's fundamentals, cost management and ability to navigate the regulatory environment.

In a scenario where demand for copper continues to grow, particularly for energy transition applications, and supply remains constrained, mining companies well positioned to increase production could be wise investments.

Companies such as Southern Copper Corporation (SCCO), Freeport-McMoRan (FCX) and BHP Group (BHP) could benefit from this trend. On the other hand, if fears of a supply squeeze fail to materialize and demand slows, copper prices could stagnate or fall, making investment in mining stocks less attractive.

Investing in copper at its current price may make sense, given forecasts of supply compression and growing demand linked to the energy transition. However, investors need to weigh up the risks carefully. Much of this news has already been anticipated by market heavyweights. Like all industrial metals, the copper market is cyclical.

By

By