Xtrackers MSCI North America High Dividend (XDND):

The XDND is issued by DWS and provides exposure to large and mid-cap north American equities. The ETF offers a slight diversification, with 179 companies spread over one geographical area for seven sectors. In fact, it is 94.4% based in the U.S and 5.6% in Others for 21.7% in Health care, 16.4% in Consumer staples, 14% in Financials, 11.8% in Information technology, 11.7% in Industrials, 8.6% in Consumer discretionary and 15.9% in Others. At the same time, the 15 major companies that make up this ETF have a strong balance sheet, with good growth prospects and thus account 36.94% of it. Despite a slight increase of 2.32% over the past six months, it increased by 15.11% over the past year which is a good performance compared to other similar products.

What’s good about this ETF:

According to the World Economic Forum’s 2018 Global Competitive Index, the United States has a competitive edge thanks to business dynamism, strong institutional pillars, financing mechanisms, and a vibrant innovation ecosystem. Innovation is a trademark feature of American competitiveness and can lead the world in generating advanced technologies. This ETF leverages the full productive capacity of businesses that have a strategic competitive advantage. American companies are among the most attractive. They offer high dividends to shareholders, which have been paid out continuously for years, thus increasing confidence. Moreover, the current complicated period on markets is pushing investors to take refuge in safe havens, or at least in stocks with low volatility. The health sector – which is defensive - is the largest in the ETF.

Vaneck Vectors Semiconductor (SMH):

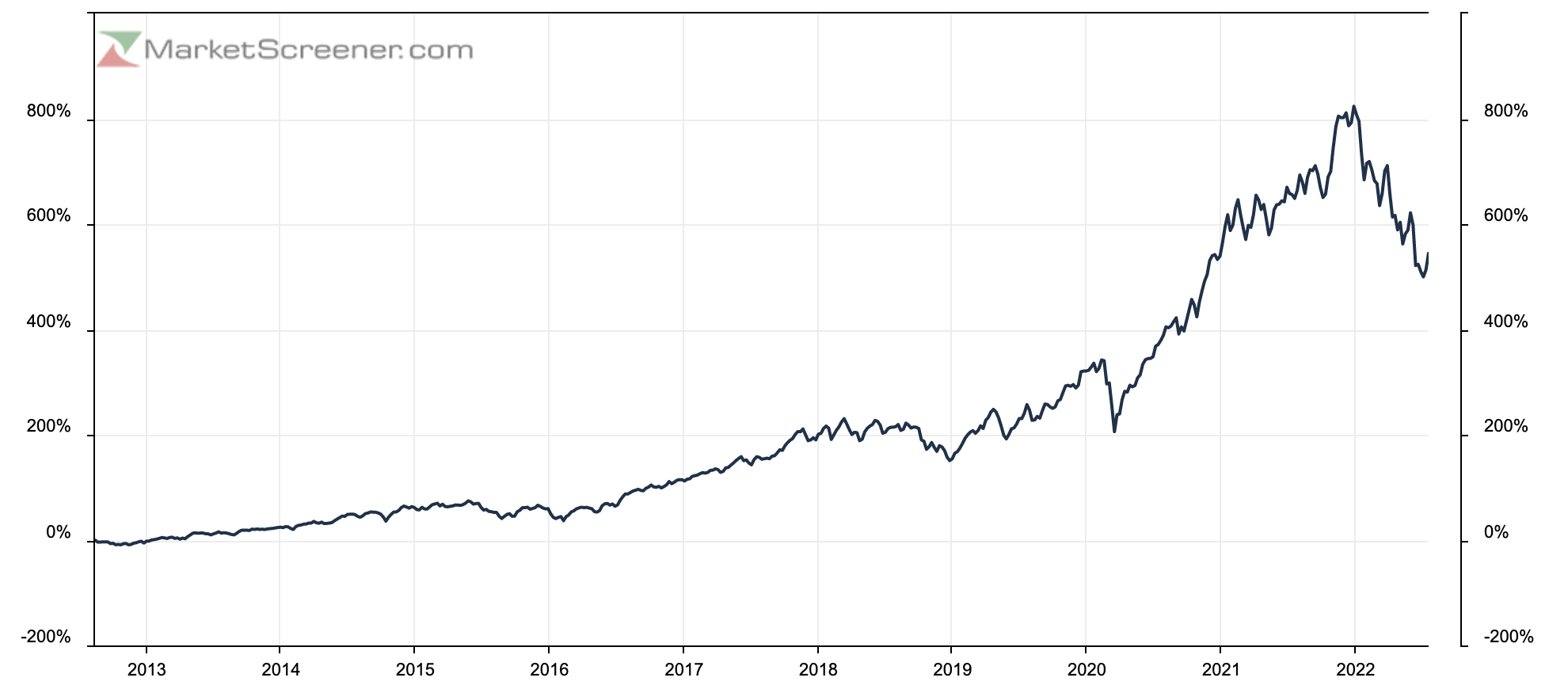

The SMH is built to track an index: The “MVIS Us Listed Semiconductor 25 Net Total Return Index”. It provides physical exposure, which means you own its shares and earn returns on these securities. This share class generates a stream of income by distributing dividends. The ETF includes 25 companies, 15 of which represent 78.99% of the total weight. Taiwan Semiconductor is SMH’s largest holding with 10.31%, which is good for the ETF as the company has a strong financial foundation with a rising market capitalization, rising EBITDA and rising ROA. However, this ETF includes four areas: the US (78.1%), Taiwan (10.3%), Netherlands (9.2%) and Others (2.4%), for two sectors: Information technology (97.6%) and Others (2.4%). At the beginning of the year, the SMH touched his ATH and shows a ROI of +800% before decreasing to +600%.

What’s good about this ETF:

Today’s economies are dramatically changing, triggered by developments in emerging markets, the accelerated rise of new technologies, sustainability policies, and changing consumer preferences around ownership. But for vehicle manufacture, semiconductors are essential and cannot be replaced. The sector is also very cyclical, causing severe shortages due to increasing demand for a constant supply. The sector is down 31.12% for one year (day for day) and shows for some time, a certain upward trend. The global automotive semiconductor market was valued at $37 billion in 2020 and is expected to reach $101 billion by 2026, representing a market CAGR of 17.3%. The automotive sector is facing various challenges, such as improved electric charging infrastructure and consumer expectations for further technological improvements to reduce vehicle prices and provide better range. As a result, competition can be expected to be fiercer and margins less generous on the automotive side compared to semiconductor manufacturers. This ETF can be interesting because of the growing craze around semiconductors, offering some diversification while taking advantage of a generalized rise. The increasing popularity of electric vehicles among private individuals is motivating designers to innovate and develop more than ever before.

SPDR S&P Aerospace & Defense (XAR):

This ETF is issued by SPDR and provides exposure to Equally Weighted US Aerospace & Defense Equities. The XAR offers slight diversification with 33 companies spread across one principal geography and one sector. In fact, it is 96.2% based in the US for 100% in Industrial. The investment objective of the funds is to seek total return where the fund’s investment strategy is to focus on distributions and current dividends paid to shareholders. At the same time, the 15 major companies that make up this ETF account 56.25% of it. Over ten years, it increased by 300% despite the pandemic.

What’s good about this ETF:

One man's misfortune is another man's gain. The end of the Covid pandemic allowed aerospace companies to recover some growth, while the war in Ukraine benefited American defense and aerospace companies. These industries are strategic to the economy and are among the fastest growing sectors. Aerospace sector is focused on production and services for commercial aircraft, while defense sector provides military weapons and systems. At the same time, they have been most impacted by the pandemic, which has had a huge financial impact, due to global travel restrictions and various border closures. International flights have seen a 68% drop resulting in a 60% drop in revenue compared to 2019. Nevertheless, thanks to the US – which provides the biggest market for commercial aircraft and US military – they are likely to increase in attractiveness thanks to various restructuration, despite higher ticket prices due to a lower influx than before. They also remain at healthy levels despite the severe impact, which is a sign of investor confidence. The prospects for a rebound in the sector are therefore positive. Long-term contracts offer the possibility of continued growth.

By

By