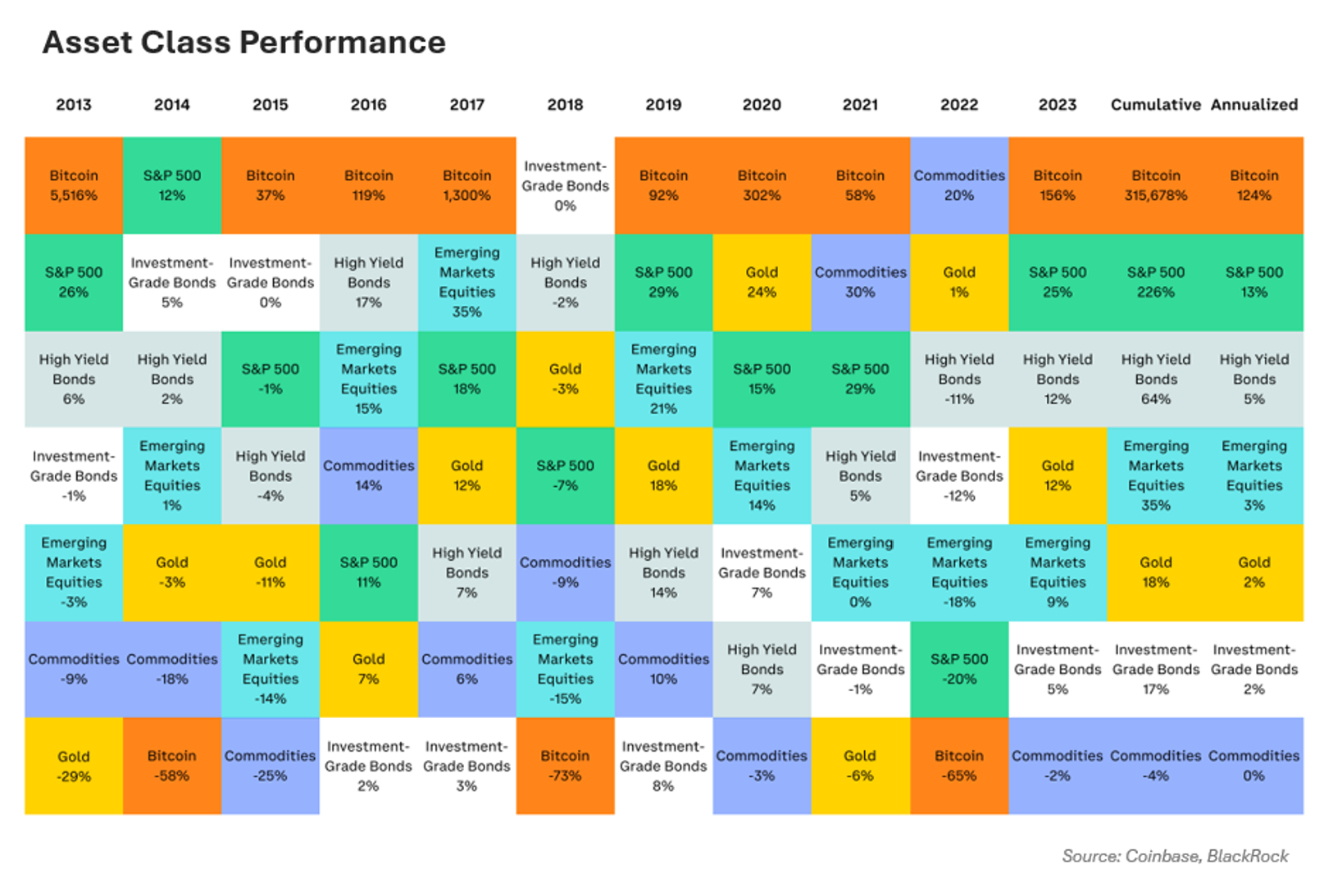

Since its early days, bitcoin has been delivering strong returns relative to traditional assets on both an absolute and a risk-adjusted basis, as calculated by BlackRock and showcased in the recent report by Coinbase. Even more, with an annualized return of 124%, it can be called the top-performing asset compared to 13% for the S&P 500 and much lower numbers on other popular investments. Over the past 11 years, only 3 were bad for the bitcoin price (bear markets of 2014, 2018, and 2022).

Such noteworthy performance naturally attracts investors, yet bitcoin’s volatility and unique nature as a blockchain-based asset (which might pose technological or compliance hurdles), may dissuade some from investing. This is where derivative products come in handy. Market participants use them for a variety of reasons, including gaining capital-efficient access to BTC, speculative trading, hedging spot exposure, as well as mitigating mining risks.

Hedging crypto

While there is a cost to hedging any investment, crypto or traditional one, the costs of not hedging can be significantly higher. History is rife with examples of institutions (remember Lehman Brothers?) that have collapsed, largely as a result of their failure to properly hedge their exposure to different risks. The crypto market is young, volatile, and full of surprises, which makes hedging a strategy worth implementing.

Bitcoin futures and options - contracts obligating/allowing the buyer to purchase an asset or the seller to sell an asset at a predetermined future date and price – allow to offset potential losses (and gains) that may be incurred by investors.

Interestingly, bitcoin derivatives can be used to hedge not only bitcoin exposure but also many altcoins (other cryptoassets) that do not have liquid and/or regulated derivatives themselves. Since BTC is usually leading the larger crypto market, investors can calculate their correlation and construct cross hedges.

Bitcoin futures

To hedge a crypto investment, an investor can take an opposite position in a futures contract for a part (or the entirety) of that investment. This strategy allows the investor to lock in the current price, reducing risk from price fluctuations, but also without benefiting from potential gains beyond the futures contract price.

The most popular type of BTC futures are perps, or perpetual swaps – cash-settled contracts without expiration or settlement date. They are usually accessed via centralized crypto exchanges (Binance, Bybit, and Bitget being the biggest ones) and used not only for hedging but also for speculative trading.

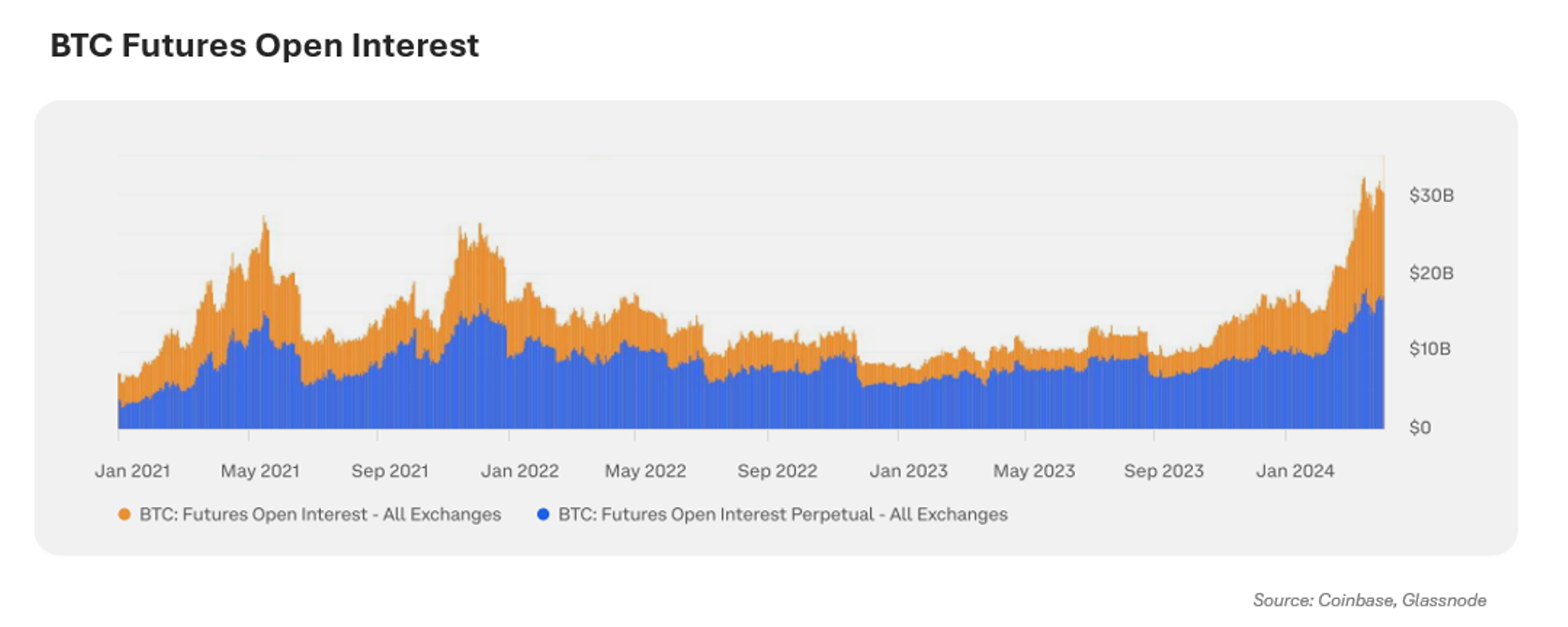

By the end of Q1 2024, the open interest (number of outstanding derivative contracts) for BTC perpetual swaps was at its all-time high of above $15 billion daily, according to Coinbase and Glassnode.

Many market participants also use traditional futures for hedging and to put on cash-and-carry trades (arbitrage strategy that seeks to exploit price differences between a commodity's spot price and its future price). The most important TradFi actor allowing to trade BTC futures is the Chicago Mercantile Exchange, which also makes up a significant portion of total BTC futures open interest. By the end of March, it registered over $11.5 billion of open contracts (data from Coinglass).

Open interest in traditional and perpetual futures moved substantially higher in 2024, as bitcoin price hit an all-time high of $74,000 and the introduction of spot ETFs led to increased liquidity throughout bitcoin markets.

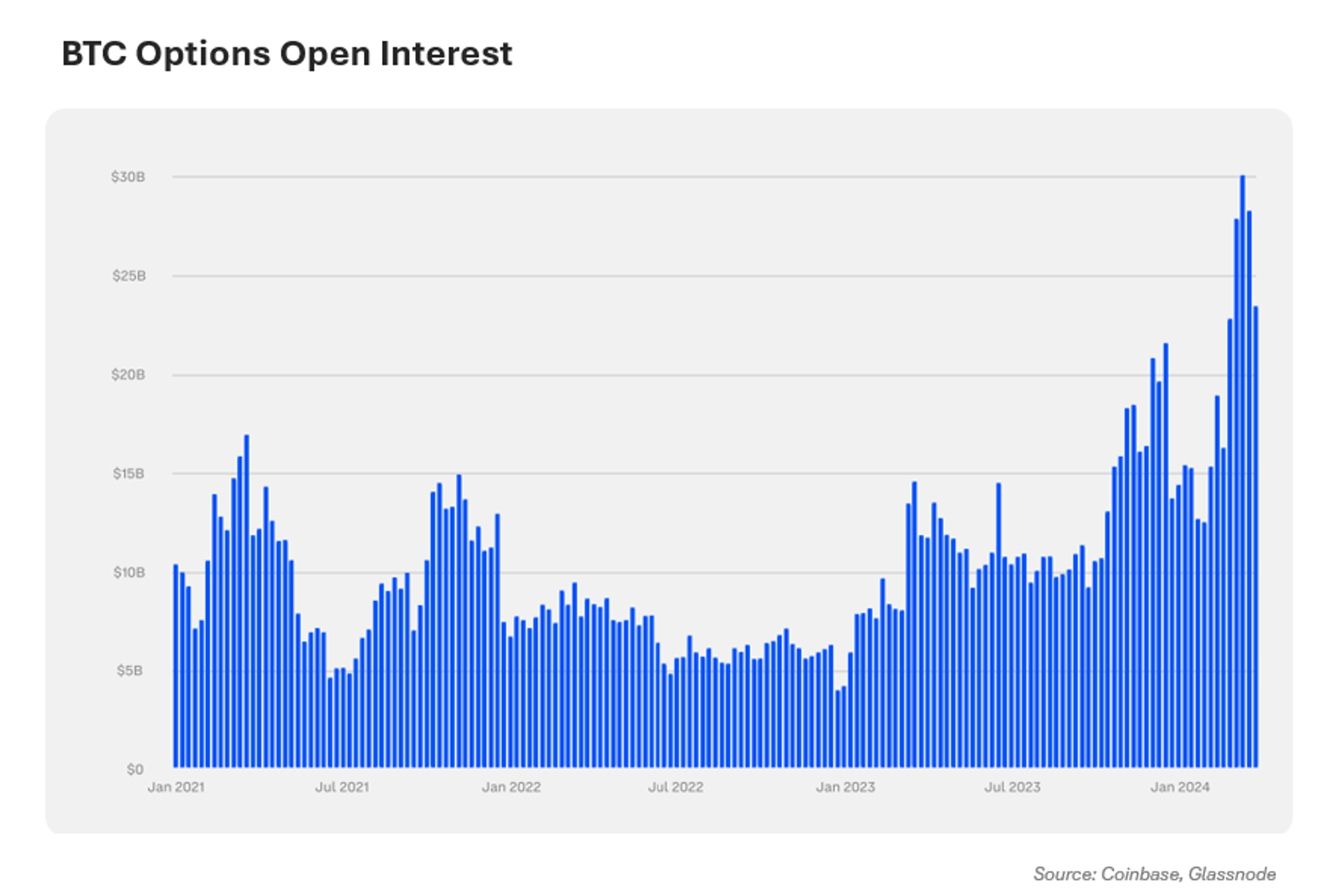

Options are a popular hedging tool, because, in contrast to futures, an investor is not obligated to buy or sell an asset at the contract expiry date if they decide otherwise. For instance, if the price of Bitcoin falls, an investor might choose not to buy at the contract price because that’s now higher than the actual value of the crypto.

Bitcoin options open interest increased 74% in the first quarter to a new all-time high above $30B. This increase is a sign of the deepening of derivatives markets, which now allow traders to put on more sophisticated positions, as well as for actors like miners to hedge their income exposure.

Although several crypto exchanges now offer BTC options trading, the biggest platform with the best liquidity is still Deribit, a pioneer in this derivative type.

As bitcoin matures into a recognized investment vehicle, its market increasingly adopts traditional financial practices and methodologies, reflecting its growing acceptance among institutional investors. The rise of bitcoin derivatives exemplifies this shift.

By

By