Cameco has this week begun to reopen its uranium conversion facilities after virus lockdown while the US government has outlined plans for the purchase of domestically produced uranium

-Cameco reopens two processing plants

-US government outlines Strategic Reserve plans

-Uranium market activity again subdued

On Monday, Cameco announced it would resume production at its Port Hope conversion facility (UF6) and its Blind River refinery (U3O8) in Ontario. On April 8, the company had placed the two plants in lockdown in accordance with government directives.

While the provinces and communities in which Cameco operates are not out of the virus woods, management noted, the company will remain vigilant and is now confident of maintaining the required roster of qualified operators at the two aforementioned plants.

Cameco's globally significant Cigar Lake uranium mine will however remain in lockdown, with operations having been suspended in March for an indefinite period. Because Cigar Lake is in a more remote location, in northern Saskatchewan, the risk is greater to the small communities nearby from which many of the mine's workers are employed.

So it's not a case of returning to normal just yet, but the first steps have been taken.

Strategic Rescue

In line with President Trump's Nuclear Fuel Working Group review, released on April 23, the US Department of Energy issued a follow-up communication last week entitled "Building a Uranium Reserve: The First Step in Preserving the US Nuclear Fuel Cycle," which provides brief details on how it plans to launch a Strategic Uranium Reserve.

While stockpiling uranium to ensure a secure nuclear fuel, and thus electricity, supply during times of crisis makes perfect sense, the actual trigger for the SUR plan were complaints from US uranium producers that they could not compete with foreign imports, threatening a loss of domestic production altogether. Rather than force already uncommercial US nuclear utilities to buy locally at a higher price, or impose further tariffs when the push was on to end the trade war, the Trump Administration has chosen to go down the SUR path.

Ironically, during the Obama Administration the DoE was selling off stockpiles of uranium into as market already impacted by low post-Fukushima uranium prices, drawing complaints from producers back then as well.

The DoE's Office of Nuclear Energy will initiate a competitive procurement process for establishing the Uranium Reserve program within the next year, industry consultant TradeTech reports. Additional support will be considered over a ten-year period as market conditions evolve, including consideration of enrichment needs after first addressing the very near-term pressure on the uranium mining and conversion sub-sectors of the nuclear fuel market.

The estimated cost would be US$150m per year over the ten-year period.

But there's a catch. The cost is included in the Trump Administration's proposed fiscal 2021 budget, and that proposal is yet to be passed by Congress. Right now, Congress is distracted by other matters, leading the Democrat-led House to propose a second fiscal relief package worth US$3trn, greater than the US$2.6bn spent on the first package.

While the Republican-led Senate has already dismissed the proposal out of hand, the Administration is still intent on delivering a second package in some form. The question is as to whether the mounting cost to the US government and the debt required to fund fiscal relief has grown so large as to render the thought of another US$150bn a year as beyond the pale, or whether the numbers are just so big now a bit more makes little difference.

After all, we have now emphatically entered a Modern Money Theory universe.

No Response

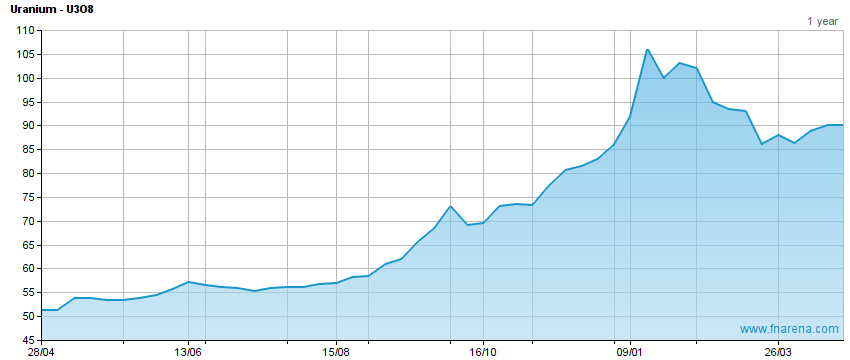

The response in the actual uranium market to the two above developments was muted at best. TradeTech reports eleven transactions concluded in the spot market last week totalling 1.3mlbs U3O8 equivalent, up from the week prior's volumes but lower than those seen in the weeks of frenzy that sparked a significant spot price rally.

That rally has now stalled, with TradeTech's weekly spot price indicator falling -US10c for the second week running, to US$33.70/lb.

There were no transactions reported in term markets. TradeTech's term price indicators remain at US$37.50/lb (mid) and US$39.00/lb (long).

FNArena is proud about its track record and past achievements: Ten Years On

All material published by FN Arena is the copyright of the publisher, unless otherwise stated. Reproduction in whole or in part is not permitted without written permission of the publisher.

© 2020 Acquisdata Pty Ltd., source FN Arena