When cement goes green too

LATEST

Cementir has announced a €100m additional green investment, and cost-cutting strategies in the ‘Industrial Plan 2022’ during the 9M 2019 results. To promote profitable sustainability, the investment is aimed at increasing Belgian plant efficiency, expanding the district heating in Denmark, developing waste heat recovery systems in Turkey and Denmark, and improving R&D. It has also introduced a digitalisation plan to streamline the group’s operations. Our visit to the Gaurain plant confirms that the group is progressing well towards its sustainability targets for 2030.

FACT

To step beyond numbers, AlphaValue’s Construction & Building Materials research team grabbed their muddy boots and donned their hard hats to reconnoitre at the Gaurain plant in Belgium.

ANALYSIS

Plateaued growth in global demand for construction material, piggy-backed with tightened regulations by policymakers meant to reduce carbon emissions, poses a big challenge over the next few years for cement companies. The cement industry is expected to be heavily impacted by the increasing carbon certificate prices and reducing carbon allowance in Phase IV (2021-2030) of the EU Emission Trading System (ETS) which allows companies to trade freely excess emission rights. These will drastically increase the production cost. The cement industry is a capital-intensive industry with low price elasticity. Hence, cost-cutting and efficiency will be key drivers for profitability, while revolving around sustainability.

Along with its 9M 2019 results, Cementir provided Sustainability Targets 2030, in which it aims to reduce carbon emissions by 30% by 2030, thanks to alternative fuels, clinker content reduction, product innovation, heat consumption reduction and heat recovery. To achieve this target, the group has announced ‘industrial plan 2022’ and a €100m additional green investment over 2020-22. This shows that the company is ready with a “green” armour to face both environmental and market-related challenges. Indeed, feeding two birds with the same seed!

The €100m capex will be spent mainly on the following initiatives:

Augmenting alternate energy and upgrading district heating in Aalborg

The group intends to invest in a windmill capacity that will enable it to cover up to 80% of the electricity needs with renewable resources. This would save ~25,000 CO2 t/year. The group also plans to increase the outreach of district heating from 36,000 to 50,000 households in Aalborg. This will be enough to fulfill 40% of the municipality needs.

Increasing capacity and reducing traditional fuels in CCB

Confirmed during our recent visit to the CCB plant in Belgium, the plant is one of the largest plant in EU and operates two kilns at ~100% utilisation rate. The plant’s contribution to EBITDA (23%) is higher than its contribution to sales (19%), thanks to operational efficiency achieved through state-of-the-art logistics and prominent projects such as Grand Paris, Summer Olympics 2024, etc. THe following are the highlights of the plant’s logistics:

- CCB has an agreement with Calcia to use a railway terminal strategically built near the plant for exports. Due to high volume-to-price ratio of grey cement, it is less profitable to transport cement via roadways beyond a 100km radius. However, the railways allow this radius to expand almost double while keeping the per ton transportation cost the same. CCB also makes use of sea-borne transportation.

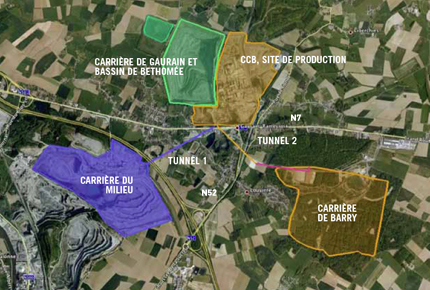

- The plant has all three quarries in close proximity. Currently, the plant is supplied by the Gaurain quarry which is operated by SCT – a 65% subsidiary of LafargeHolcim and CCB. This enables CCB to enjoy economies of scale and simultaneously postpone the exploitation of the Barry quarry which can fulfill the plant’s requirements for 80-90 years more.

- The plant shuts for about 5 weeks every year during the winter (when the construction activities are at their lowest due to the weather) for preventive repair and maintenance. This reduces the requirement of shutting the plant at other times of the year and thus reduces the need to cool and reheat the kilns frequently.

In our opinion, the group has strategically allocated about 30-40% of the green capex to CCB plant in order to make the plant more profitable. It will increase the production capacity of the plant by upgrading the newer kiln and shutting down the older one, thus improving the overall efficiency of the plant simultaneously. This upgradation will also be accompanied by an increase in alternate fuel consumption (from 40% at present to 80%) which will promote further CO2 reduction. The interest of the company will be in line with its environmental goals because the proposed alternative fuels (especially waste fuels) are generally cheaper than traditional fuels.

Pioneer in R&D

About ?rds of the total CO2 emissions while producing cement is generated due to the chemical reaction which is carried out to produce clinker. Hence, reducing the clinker ratio in cement will drastically reduce CO2 emissions. Cementir has proved to be a pioneer in research and development as it has successfully tested its patent cement FUTURECEM and the recent investment in rolling out this technology along with others such as Aalborg Extreme, Aalborg Excel, etc. would enable the group to reduce clinker usage by 30% and, ergo, contribute significantly in the 2030 sustainability target.

Waste heat recovery in Turkey and Denmark

The group will build a waste heat recovery plant in Izmir that would bring down the internal electricity consumption in the plant to just 40%. A similar implementation will be seen in Denmark.

These investments may contribute around €25m from H2 22 onwards.

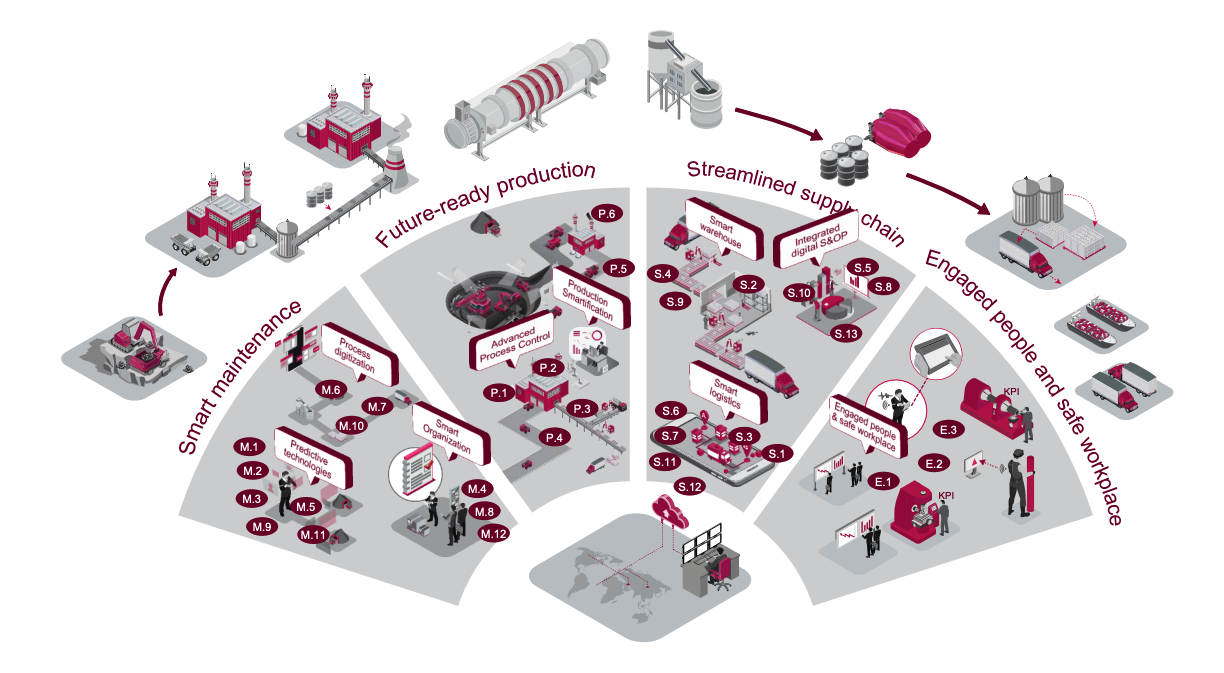

Cementir 4.0 programme aims to digitalise the processes from procurement to storage. This digitalisation programme will focus on four areas of manufacturing: production, maintenance, supply chain and workplace safety. It will streamline operations and will translate into an annual cost saving of €15m from 2022 onwards when it will be rolled out completely (cost savings of €2m – €3m can be expected in 2020 due to partial implementation).

IMPACT

In our opinion, Cementir’s focus on sustainable organic growth over inorganic growth may enable it to shield its EBITDA margins from the effect of the reducing allowance (the overall number of emission allowances will decrease at an annual rate of 2.2% from 2021 onwards, compared to 1.74% in the period 2013-20) and increasing carbon certificate prices. Even after the additional €100m investment, the group continues to have a positive FCF, making it lucrative in the present as well.