Its shares soared as much as 15% after the results before retreating to trade 6.7% up by 1350 GMT. It was the second best-performing stock on the FTSE 100 Index.

(GRAPHIC: Antofagasta shares -  )

)

"We think the positive dividend surprise management reported this morning will be taken as a positive signal of confidence in the Antofagasta assets," said Peel Hunt analyst Peter Mallin-Jones, adding debt was "materially lower than expected".

Antofagasta cut its dividend by 22% to 34.1 cents, but this still beat analysts' expectations of 28 cents, according to Refinitiv Smart Estimates. Net debt for the company fell 5.5% to $563.4 million.

The company, which operates four mines in the country, said it expects capital expenditure in 2020 to be in the range of $1.3-1.5 billion compared to $1.5 billion previously announced.

CEO Iván Arriagada said some of the cuts to spending could come from buying equipment locally, a weaker peso currency and deferring spending on certain projects.

"We have moved the organisation into a very strict operating and capital expenditure screening mode to ensure that we keep our cash flow in a lower price environment and protect our margins," he told analysts following the release of full-year results.

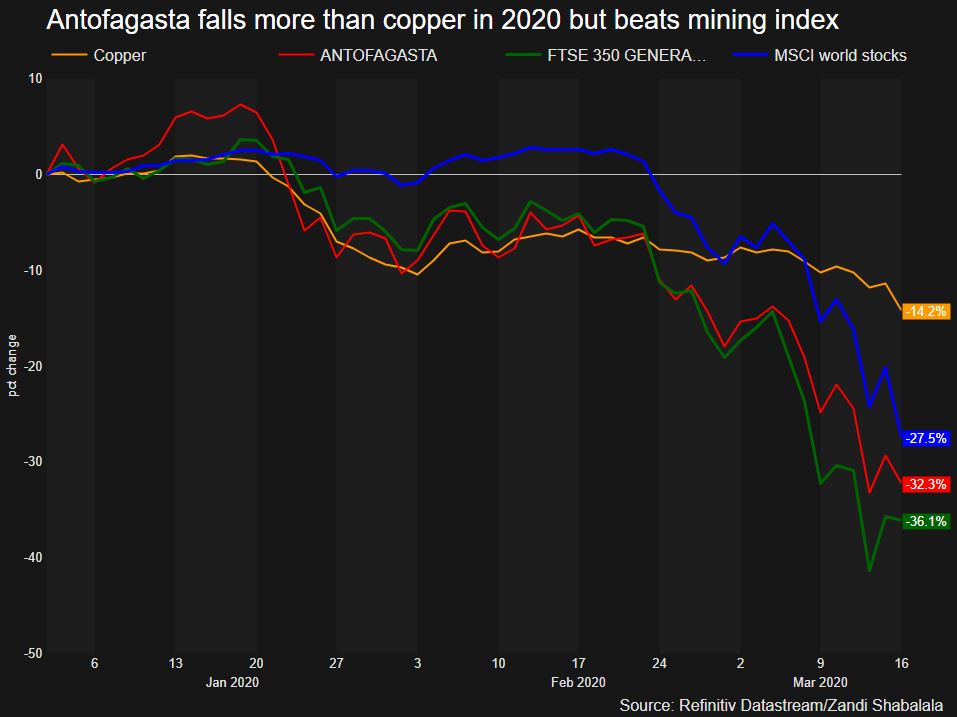

(GRAPHIC: Antofagasta versus other securities -  )

)

Antofagasta said it would stockpile supplies of fuel, acid and spare parts and equipment to increase the autonomy of its mines in Chile as coronavirus threatened to disrupt operations.

Others in the industry are taking similar action and have seen an impact on projects. Barrick Gold said it would stockpile key commodities while Rio Tinto said operations at a mine in Mongolia were slowed by government curbs to curtail the spread of the virus.

Anglo American said on Tuesday it would temporarily slow down the construction of its Quellaveco copper project in Peru after the government announced a 15-day national quarantine.

Chile, the world's top copper producer, cut interest rates to cushion its economy against the impact of the coronavirus and said it would close its borders from Wednesday.

Antofagasta said the virus has not yet affected its employees, supplies or sales.

It is expected to complete the expansion of its Los Pelambres mine in 2022 and will make a decision on whether to build a second $2.7 billion concentrator at Centinela 2021.

Arriagada said it was trying to reduce the number of employees on site due to the virus at Pelambres and that equipment for Centinela was not at significant risk in the short term.

Copper production in 2019 rose 6.2% to 770,000 tonnes and it kept its 2020 target at a range of 725,000-755,000 tonnes.

(This story has been refiled to fix company identifier in first paragraph)

(Reporting by Zandi Shabalala, editing by Jason Neely and Emelia Sithole-Matarise)

By Zandi Shabalala

FTSE 100

FTSE 100