Financial regulator chief Eun Sung-soo said the bond market stabilization fund could be larger than 10 trillion won ($7.75 billion).

Central banks in emerging countries from Brazil to India have stepped in this week to buy bonds, to prevent a jump in borrowing costs and discourage capital outflows. Authorities have also been tightening stock market trading regulations in an attempt to halt the deepening rout.[MKTS/GLOB]

The savage selloff in most markets is being driven by fears that business disruptions caused by the pandemic will plunge the global economy into recession and heavily stress banking systems.

Developed and emerging market bonds are being dumped on worries over deteriorating credit quality and a desperate need for companies and brokers to raise cash and stay liquid.

As Korea's won slid 3 percent against the dollar on Thursday to an 11-year low and stocks plunged more than 9%, its finance minister said crisis funds for both bond and equity markets will be reactivated.

Regulator chief Eun later said local financial institutions will help raise money needed for the fund, which will be used to buy corporate bonds to help companies facing a liquidity crunch.

The exact size of the funds and other details will be decided next week after meetings with head of local banks.

Earlier in the day, Vice finance minister Kim Yong-beom said the spiking cost of U.S. dollars and capital outflows from emerging economies' stock markets could mean the world may be heading for a global credit crunch.

"Global credit market is showing signs of sporadic credit crunch as bond market spread is widening with strengthening U.S. dollar," Kim said.

"(The government) needs to prepare for a possible global credit crunch."

The comments come after the government on Wednesday relaxed one of its capital flow rules to inject more dollars into its banking system to ensure businesses can come through a funding crunch unscathed.

The Bank of Korea was working in tandem, announcing plans to buy 1.5 trillion won worth of government bonds and conducting a 1 trillion won repo auction.

Even so, local shares plunged to a near 11-year low while the won dropped to its weakest since July 2009.

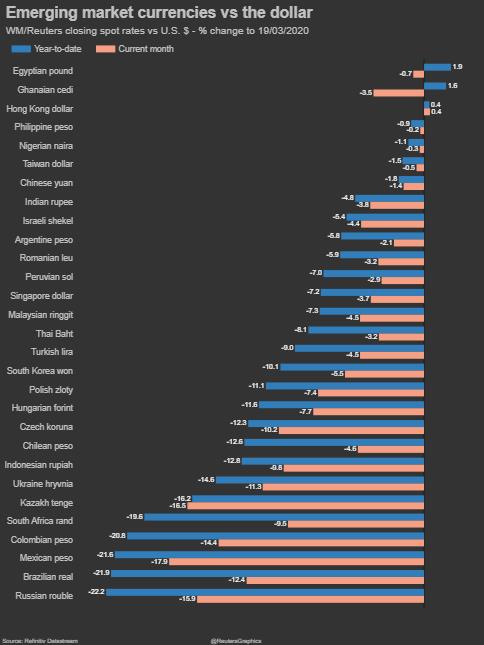

Most other Asian emerging market currencies and bonds have also been hit by the rush to secure dollar funding and the consequent rise in the dollar's value.

The strain on corporate borrowers and rising credit risk has seen yields on the BofA Merrill Lynch Asian high-yield debt index double to 13% in 3 weeks.

(Graphic: Emerging market currencies sink -  )

)

Indonesia, whose high-yielding markets have significant amounts of foreign investment, saw the rupiah sink to its weakest level since 1998 on Thursday as its 10-year yields climbed a full percentage point in less than a month.[EMRG/FRX]

Its central bank has been intervening regularly this month via dollar supplies and bond purchases. It announced on Thursday it would hold further currency auctions to broaden access to dollars in the local market.

The Bank of Korea not only pumped cash into local brokerages but was also suspected of selling dollars on Thursday morning to slow the won's decline..

The Korea Exchange said on Thursday circuit breakers were triggered on the benchmark KOSPI as headed for what could be its sharpest daily fall since at least late 2008.

India's rupee hit a record low on Thursday, and its central bank has pledged to buy a huge amount of bonds on Friday.

The Philippines stock market slumped as much as 24% at one point and has lost more than a third of its value this year.

In Brazil, where the currency has fallen about 20% this year, the central bank cut rates on Wednesday by 50 basis points to a record-low 3.75%.

By Cynthia Kim and Fransiska Nangoy

KOSPI COMPOSITE INDEX

KOSPI COMPOSITE INDEX