By Mai Nguyen

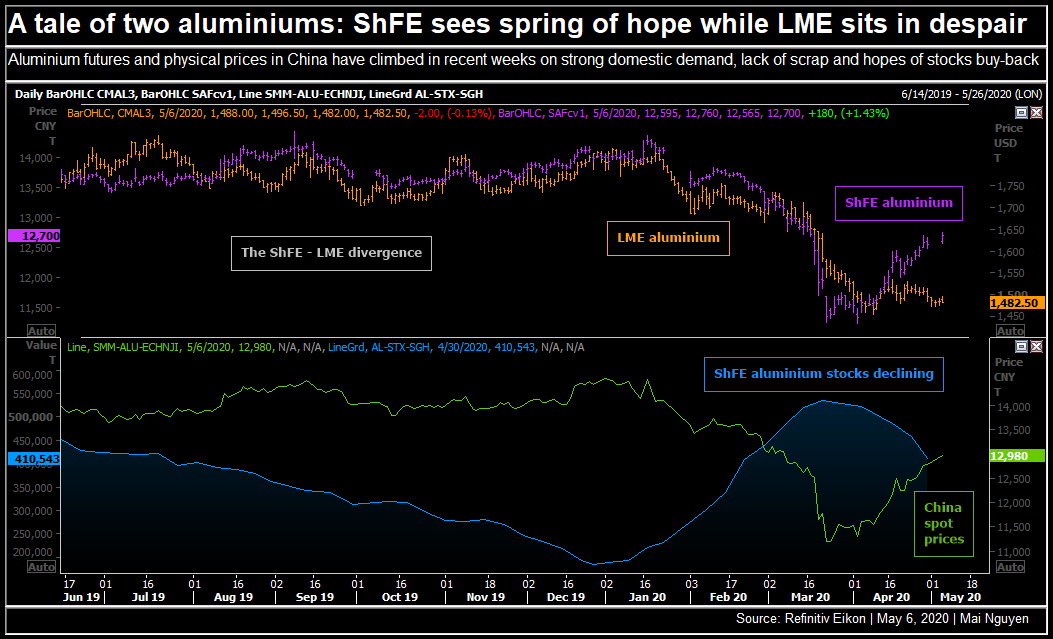

A robust recovery in aluminium demand in China has boosted prices in the world's top consumer and producer of the metal by more than 10% in a month, but traders say weak demand for Chinese exports could soon take the shine off the market.

Shanghai Futures Exchange's (ShFE) most-active aluminium contract hit a seven-week high on Wednesday of 12,760 yuan ($1,799.67) a tonne, after rising 10.2% over the last four weeks, Refinitiv data showed.

A Singapore-based trader, speaking on condition of anonymity, said buyers considered prices so low, they were increasing inventory levels "more than normal".

"The re-stocking in reality is faster than expected," said another metals trader, adding that plans for government-subsidised stocking programmes also lent support.

The devastation wrought by the coronavirus pandemic sent ShFE aluminium to a four-year low in April, forcing some smelters to cut capacity.

But the economic slowdown also led to less scrap metal production, which helped to fuel the rebound in refined metal prices as industrial activity recovered.

Spot aluminium prices in the processing hub of Jiangsu

Graphic: A tale of two aluminiums: ShFE sees spring of hope while LME sits in despair -

China's Yunnan province said it would help businesses stockpile 800,000 tonnes of metal, while Gansu province is also considering a commercial stockpile plan.

Underscoring the stronger sentiment, ShFE aluminium net speculative short-positioning fell to 20.4% of total open interest as of April 30, from 52.7% on April 2, data from brokerage Marex Spectron showed.

Graphic: Aluminium positioning on LME vs SHFE -

Outside China, the picture is different.

Three-month aluminium on the London Metal Exchange (LME) has fallen every month this year and 18% year-to-date - the weakest performance of all base metals.

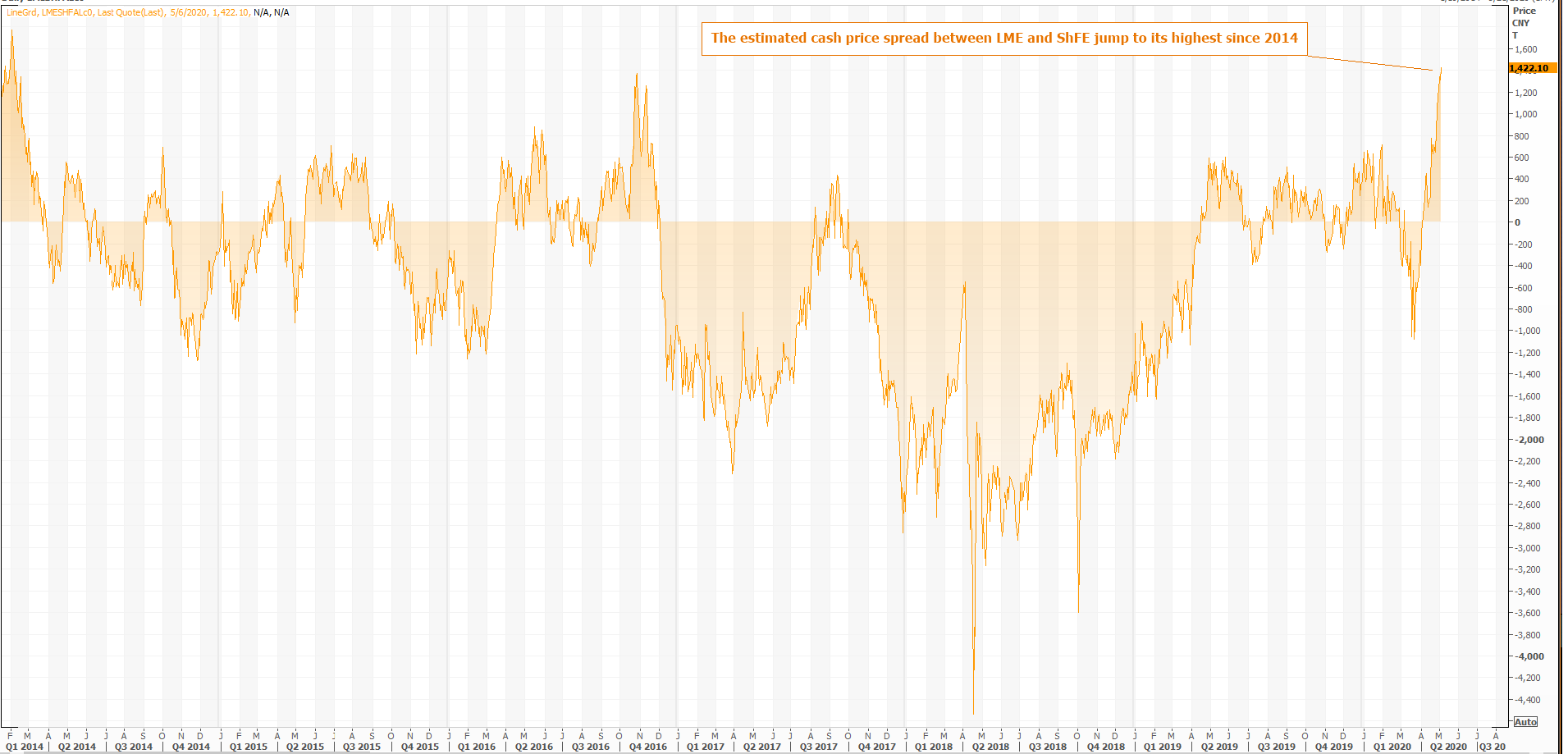

That divergence has opened a rare arbitrage window for traders who can bring aluminium into China - or buy LME and sell ShFE contracts simultaneously - with one trader estimating a $10 per tonne profit on Wednesday for June delivery.

Graphic: The estimated cash price spread between LME and ShFE jump to its highest since 2014 -

However, trade sources and analysts expect the China price strength to be short-lived because of weak global economic growth.

"This month will be critical for aluminium as we wait and see if China's market can continue its recovery, and whether demand growth from the rest of the world finds a bottom," ING analyst Wenyu Yao said, estimating a 1.5-million-tonne surplus for aluminium globally in 2020.

"I don't expect the rally to last long. There is plenty of aluminium, more than enough, I would say, to feed the world," the second trader said.

Graphic: ShFE aluminium prices seen falling every month until December -

(Reporting by Mai Nguyen; additional reporting by Tom Daly in Beijing; editing by Barbara Lewis)

S&P GSCI ALUMINUM INDEX

S&P GSCI ALUMINUM INDEX