1/ALL TOGETHER NOW

In 1971, ex-U.S. Treasury Secretary John Connally bluntly informed his fellow finance ministers: "The dollar is our currency, but it's your problem." Half a century on, that still holds true: desperate companies and banks around the world have been stumping up big premia in recent days in their rush to buy greenbacks -- for trade, debt repayments, or just to hold.

The liquidity squeeze that saw the financial markets' plumbing creak prompted the Fed into action: The world's top central bank said on Friday it would enhance the dollar liquidity swap line arrangements it has with the Bank of Canada, Bank of England, Bank of Japan, European Central Bank and Swiss National Bank.

To see if that does the trick, watch for the dollar to stabilise - not just in exchange rates but also in forward swaps that essentially show how much of a premium people are willing to pay for dollars. In euro-dollar for instance, the Fed's gigantic cash injections have narrowed the spread to minus 10-15 basis points from a whopping 120 bps earlier in the week. Similar on other currency pairs.

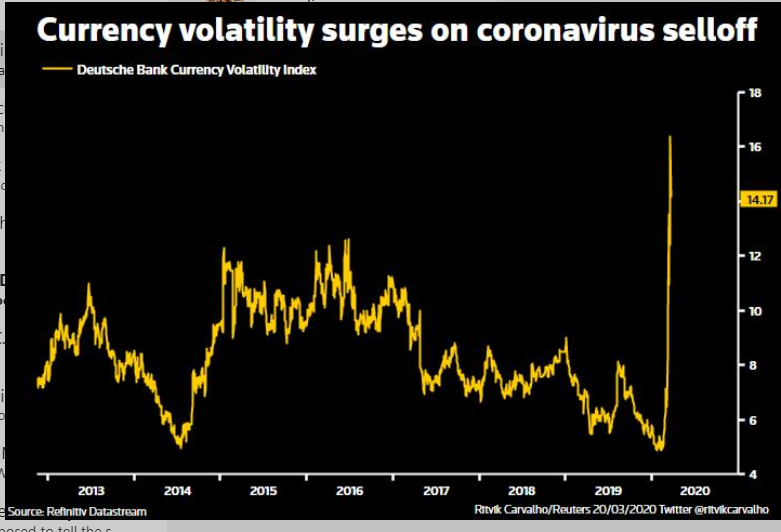

If that continues, it should calm down currency markets overall. Implied volatility, a gauge of expected price swings, surged above 15% this week but has since eased to around 12%. (A reminder: vol was below 4% earlier this month). That's crucial and not just in currencies because few investors will venture back in when asset prices are volatile.

-Fed increases frequency of swap line operations with other major central banks

-INSTANT VIEW-Global cbanks in decisive joint move to enhance dollar liquidity

-WRAPUP 2-Dollar rampage spurs FX interventions, talk of big G7 move

(GRAPHIC: Volatility surge -  )

)

2/BADLY HIT

Few doubt that the coronavirus will tip the world economy into recession as countries around the globe go into lockdown to contain the outbreak. The forward-looking purchasing managers' index due out in coming days in Europe and the United States will provide an early reading of the scale of the hit financial markets have already been bracing for.

The PMI surveys are typically conducted in the second half of a month and the data in the "flash" survey is usually collected in the week or so before the data is released, so economists reckon next week's PMIs will provide the most comprehensive overview so far of the coronavirus impact.

It might make for ugly reading. Deutsche Bank now expects Germany to contract between 4%-5% in 2020; JPMorgan forecasts emerging markets ex-China to slip into recession in the first half and BofA sees global GDP growth dropping to zero this year, matching the major recessions of 1982 and 2009.

Of course recent days have seen governments and central banks ramp up aggressive easing and fiscal stimulus to buffer their economies - that may provide a silver lining to what is surely set to be a period of dire economic data.

-POLL-Global economy already in recession on coronaries devastation

-U.S. Senate will seek deal on $1 trillion coronavirus economic aid package

-German manufacturing expectations record fastest-ever plunge

(GRAPHIC: World economy braces for severe hit -  )

)

3/STOCKS - CHEAP OR CONFUSING?

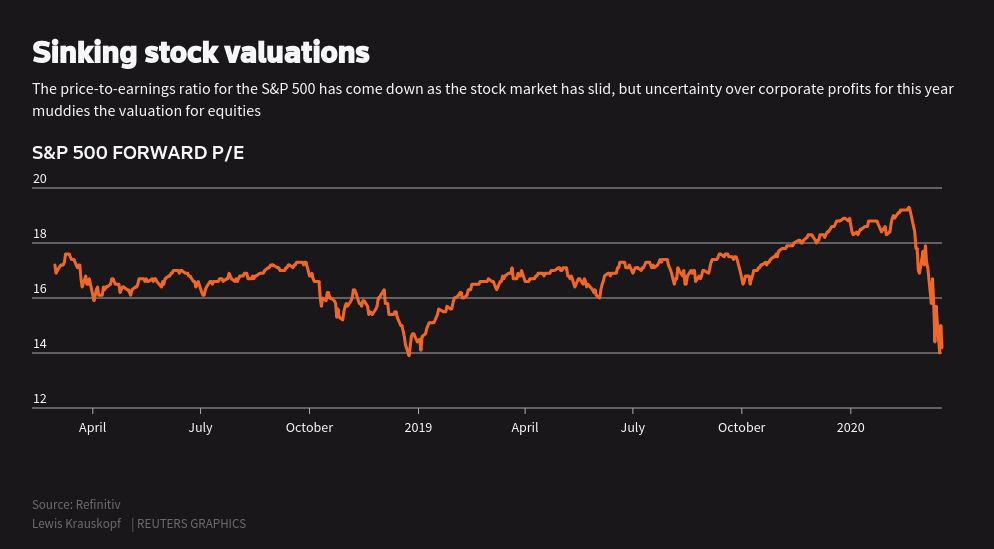

As the U.S. stock market has tumbled, valuations have also come down sharply.

The S&P 500's price-to-earnings ratio, based on earnings estimates for the next year, has dropped from over 19 times in late February to 14.2 times as of Wednesday, according to Refinitiv data. This takes the valuation below its historical average.

But the picture is muddied by the fact that earnings estimates may have not come down enough to account for the coronavirus fallout. Just on Thursday, BofA Global Research cut its S&P 500 profit forecast and now projects 2020 earnings to fall 15%.

The picture may become clearer in the coming weeks, as the first quarter comes to an end and companies start preparing their results. This week, FedEx and Marriott walked away from their 2020 forecasts because of the uncertainty.

Nike, Micron Technology and KB Home are among the U.S. companies due to report results next week.

(GRAPHIC: Sinking stock valuations -  )

)

4/BIG IN JAPAN

In Japan, the land where unconventional monetary policy and yield-curve control were born, all eyes are on the Olympic trail. The torch has landed and many fingers are crossed that the games proceed in July, but fears that the event may be postponed are growing.

A distracted government is still mulling fiscal measures to support the economy, and the Bank of Japan is the only G3 central bank that hasn?t brought out the monetary bazooka so far. All it has done is to increase some asset purchases.

Part of the reason may be that it's been there and done that - with little success. Short-term yen rates are negative, longer yields are anchored and the BOJ would not cut them further so banks' profits are protected.

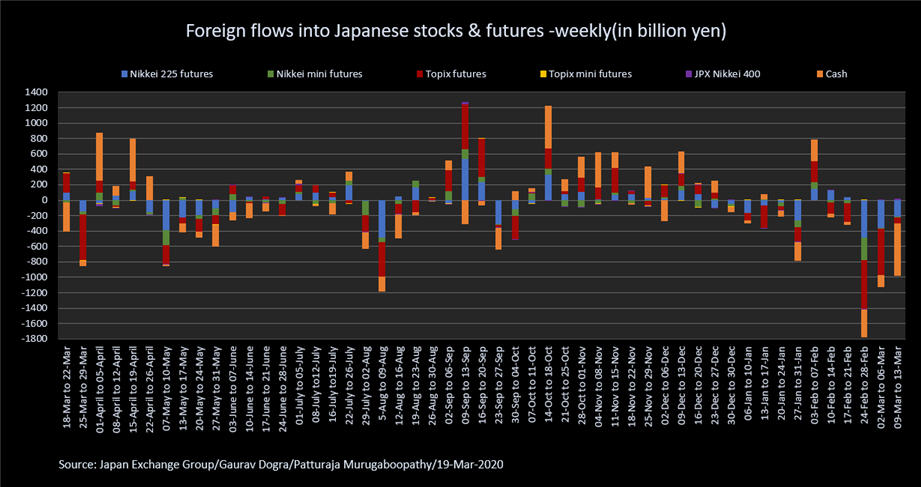

The other reason might be the yen, which has been weakening sharply as the pandemic has spurred global investors into hoarding dollars.

Theoretically, Japan should be celebrating yen weakness: It is an exporter, it is the world's biggest creditor with $3 trillion of net external assets, half its government bond market is in the safe hands of the BOJ, and even the trillions of dollars Japanese investors have parked overseas should be coming back home in such a crisis. But Japan also takes no chances. With an eye on the yen, the rate cuts will come slowly, slowly.

-ANALYSIS-Business spending plans may hold key to Bank of Japan's next move

-Dollar rampage spurs FX interventions, speculation of big G7 move-

-Japan sales tax cut emerging as option as Abe govt battles coronavirus fallout ?

-BOJ eases policy further, ramps up buying of risky assets ?

(GRAPHIC: Foreign flows into Japanese stocks -  )

)

5/THAT SINKING FEELING, AGAIN

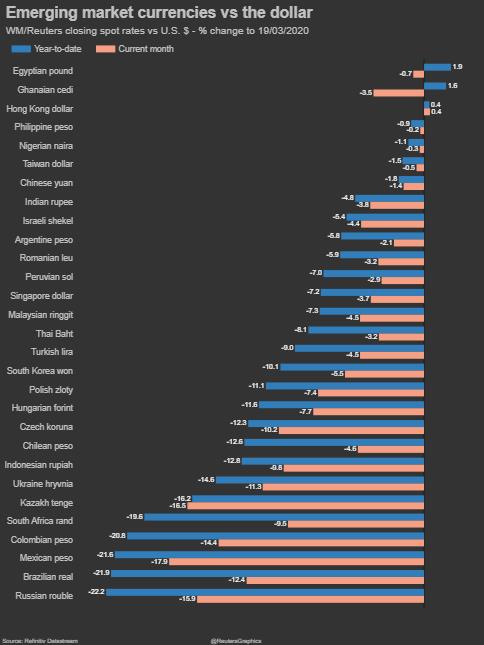

It's been a rough week for markets, but some emerging market assets have found themselves careering towards the abyss as currencies tumble to fresh record lows, bonds get hammered and stocks are down nearly 10% over the week.

A multitude of pressures has contributed to the pummelling: The strong dollar, a dire global economic outlook, tumbling oil prices thanks to waning demand and a Russia/Saudi Arabia production spat as well as rising borrowing costs.

Investors piling into the greenback have seen enduring stresses in dollar funding markets, with hurried swap lines between central banks earlier in the week doing little to alleviate the credit strains at the heart of the problem.

Central banks in the United States, the euro zone, Canada, Britain, Japan and Switzerland stepped in again on Friday, agreeing to increase the frequency of their one-week U.S. dollar credit facility.

In emerging markets, policymakers that lack the firepower to support currencies or face challenges to cut rates, will be keeping their fingers crossed that steps taken by major central banks will be enough to end the financial doom loop.

-U.S. Federal Reserve increasing frequency of swap line operations with other major central banks

-UPDATE 1-Swap lines no fix for emerging markets trounced by strong dollar

-UPDATE 2-Fed opens dollar swap lines for 9 additional foreign central banks

(GRAPHIC: Emerging market currencies sink -  )

)

(Reporting by Lewis Krauskopf in New York, Vidya Ranganathan in Singapore, Dhara Ranasinghe, Sujata Rao and Karin Strohecker in London; Editing by Hugh Lawson)