Reliance, led by Asia's richest man Mukesh Ambani, has in recent years built large telecom and retail businesses as it taps into India's consumer boom, but the company's energy units still make up the bulk of its business.

"The severe demand destruction due to global lockdowns impacted our hydrocarbons business," Reliance Chairman Ambani said in a statement on Thursday.

The company's revenue from operations fell nearly 44% to 912.38 billion rupees (9.39 billion pounds) as the COVID-19 pandemic destroyed demand for refined oil products such as gasoline, diesel and jet fuel due to global travel and business disruptions.

Reliance, India's biggest company by market value, said consolidated profit climbed 31% to 132.33 billion rupees in the three months to June 30.

Earnings were boosted by a gain of 49.66 billion rupees from British oil major BP's investment last year in a fuel retailing joint venture with Reliance.

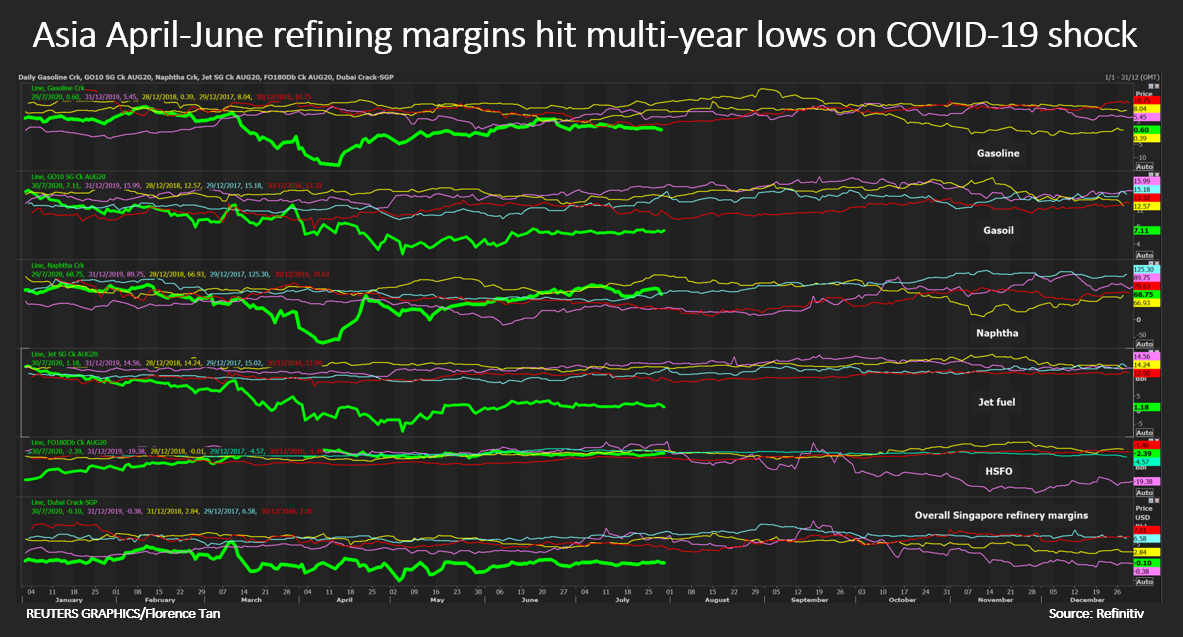

Its gross refining margin - the profit earned on each barrel of crude oil processed - slumped to $6.3 per barrel, the lowest level since 2009. However, Reliance said it maintained a significant premium of $7.2 per barrel over the regional benchmark margin.

Graphic: Asia April-June refining margins hit multi-year lows on COVID-19 shock -  Meanwhile, Reliance's telecom unit Jio Infocomm - India's largest by subscribers - continued to remain a bright spot, adding 9.9 million subscribers on a net basis.

Meanwhile, Reliance's telecom unit Jio Infocomm - India's largest by subscribers - continued to remain a bright spot, adding 9.9 million subscribers on a net basis.

Jio is part of Reliance's digital arm, which has raised more than $20 billion since April, with about half coming from Facebook and Google.

Reliance's retail division, which runs 10,000 stores selling groceries, consumer electronics and apparel, suffered a 17% drop in revenue as many shoppers stayed indoors.

(Reporting by Sachin Ravikumar in Bengaluru, and Nidhi Verma and Sankalp Phartiyal in New Delhi; Editing by Aditya Soni and Anil D'Silva)

By Sachin Ravikumar