By Mei Mei Chu and Krishna N. Das

When Shell engineer Incham Serdin quit his job four years ago to start a small palm plantation in his native Malaysia, prices of the fleshy fruit bunches used to make the world's most-consumed vegetable oil were bubbling near their peak.

But prices have since halved for smallholders like Incham, falling 30% this year alone as the COVID-19 pandemic slashes demand and wipes out profits for many farmers with 100 acres (40 hectares) of land or less.

To survive, smallholders in Malaysia and neighbouring Indonesia -- which together account for 85% of global palm oil production -- are cutting back on spending, particularly on expensive fertilisers and replanting old trees.

With small farmers making up a third of output, the cuts are set to hit production, not just in 2020 but also next year when demand for the oil used in everything from noodles to lipstick is expected to rebound as the health crisis eases, farmers and analysts said.

"What you get currently is just enough to pay the workers," Incham, 59, said by phone from Sarawak, Malaysia's biggest palm producing state by cultivation area where he has a 100-acre plantation.

"For those people with landholdings of 10 acres or so, there's barely enough to put food on the table."

Fertiliser makes up 30%-50% of the cost of production for smallholders and any lower application of the nutrients typically shows in output six months to a year later. Incham said his yields could fall by 20%-40% as he halves fertiliser usage to 1.5 kg (3.3 lb) per tree per quarter.

With the price of fresh fruit bunches (FFB) now at about 330 ringgit ($73.63) a tonne, Malaysia's biodiesel association has estimated palm oil output this year will fall 10% to about 18 million tonnes. It has yet to give an estimate for next year.

"A lot of people are facing credit crunch and cash flow issues," said Malaysian Palm Oil Association Chief Executive Nageeb Wahab.

GRAPHIC: Malaysian palm oil output growth mainly due to increases in area rather than yield -

In Indonesia, farmers are using the minimum recommended dosage of fertiliser, said Gulat Manurung, chairman of the Palm Farmers Association, likely cutting output to 1.4 tonnes per hectare per month from the usual 1.5 tonnes.

Some farmers, however, are facing a worse dilemma.

Yusro Fadli, a smallholder in Rokan Hulu in Riau province, said the fresh fruit price has dropped below 1,000 rupiah per kilogram ($67.80 a tonne) in his region.

"Whether there is a pandemic or not, if the fresh fruit bunch price is below 1,000 rupiah per kilogram, forget about fertiliser. Farmers will choose to buy rice instead of fertiliser," he said.

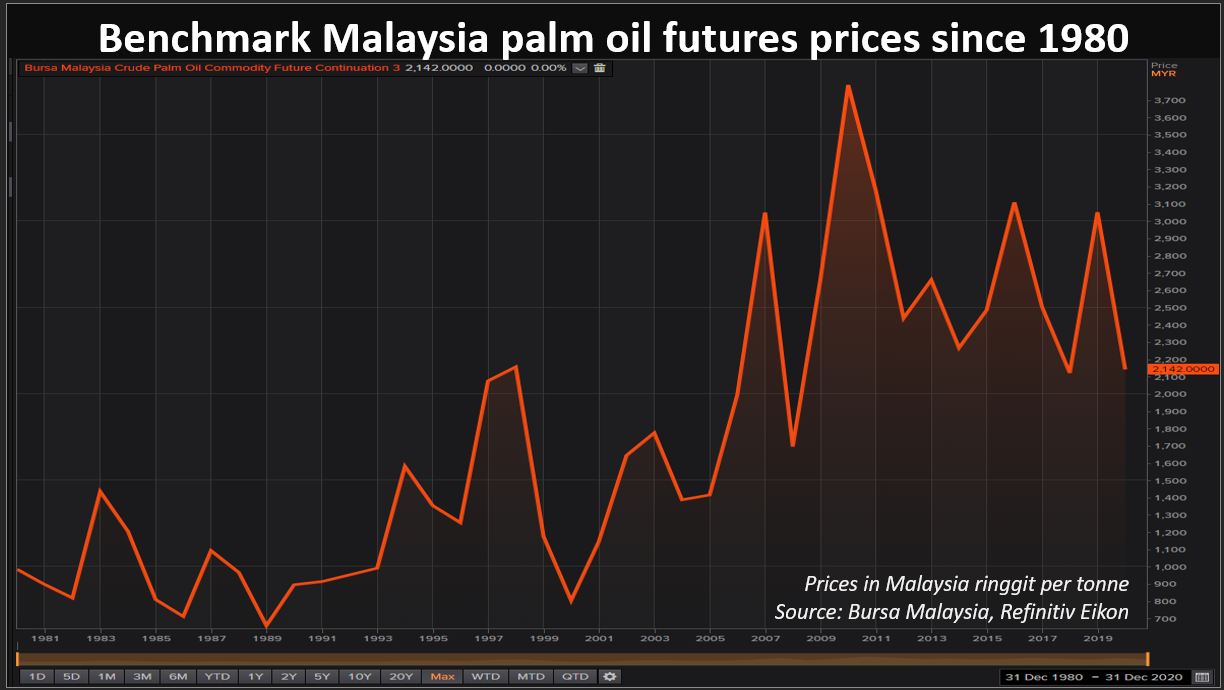

GRAPHIC: Benchmark Malaysia palm oil futures prices since 1980 -

SURVIVAL MODE

Bigger companies like Malaysia's Sime Darby Oils have also warned of "painful cost cuts" in the industry, but are reducing overhead expenses instead of production inputs.

Lower nitrogen, phosphate and potassium use by many planters is already showing in overall fertiliser sales.

Sales in Malaysia by German agrochemical supplier Behn Meyer AgriCare fell 30% over January to April from a year earlier, and local Managing Director Teo Tee Seng expects more order cancellations in coming weeks.

Smallholders are also delaying replanting old trees. Demand for seedlings in the first four months of the year fell 29% from last year, according to Malaysian Palm Oil Board data.

Other growers like Adzmi Hassan, vice president of Malaysia's National Association of Smallholders, are dipping into their own savings to keep going.

"For me, it's okay as long as I can pay my costs because I have a government pension to help me survive. I'm spending my own money to keep my palm growing, and hopefully palm prices will go up next year."

(Reporting by Mei Mei Chu and Krishna N. Das in Kuala Lumpur; Additional reporting by Fransiska Nangoy and Bernadette Christina in Jakarta; Editing by Richard Pullin)