The Fed's most recent move to reduce risk and loosen up tight markets, especially trading for Treasury securities, helped lift the dollar to a fresh three-year high against a basket of major currencies <=USD> and push bond yields lower.

The Fed increased access to dollars for central banks in nine countries so contracts can be taken out in key commodities and other goods that are made in the U.S. currency.

The U.S. central bank said swaps, in which the Fed accepts other currencies as collateral in exchange for dollars, will be in place for at least the next six months.

The swaps will allow the central banks of Australia, Brazil, South Korea, Mexico, Singapore, Sweden, Denmark, Norway and New Zealand to tap a combined total of up to $450 billion to help ensure the world's dollar-dependent financial system functions.

The collateral to purchase crude oil, for example, is U.S. Treasury debt and to buy those securities requires dollars, said Michael Skordeles, U.S. macro strategist at Truist/Suntrust Advisory Services in Atlanta.

"All these things kind of happening at once causes a lot of dominoes to fall, and as the dominoes fall, it creates more demand, pushing people toward the dollar," Skordeles said.

"This (the dollar swap lines) is going to help, but it's not a silver bullet," he said. "Because there's a flow of capital into dollar-denominated assets, in particular U.S. Treasuries, it's starving these countries of liquidity and making the dollar appreciate."

U.S. oil prices surged about 25%, recouping some losses from a sell-off that drove prices to near 20-year lows over the past month, but analysts saw the rebound as a brief reprieve from the economic tsunami the virus is expected to cause.

Stocks responded, rebounding from initial declines, as investors held out hope the latest policymaker efforts will stop the freefall in equity markets and reduce the selling of bonds. But stocks on Wall Street pared some gains at the close.

The aggressive moves by both central banks and governments have been met with a muted market response and have failed to boost overall sentiment, said Candice Bangsund, a global asset allocation strategist at Fiera Capital in Montreal.

"Investors remain intensely focused on the progression of the fast-spreading pandemic and its implications for the global economy," she said.

MSCI's gauge of stocks across the globe <.MIWD00000PUS> gained 0.22% and emerging market stocks lost 2.41%.

On Wall Street, the Dow Jones Industrial Average rose 188.27 points, or 0.95%, to 20,087.19. The S&P 500 gained 11.29 points, or 0.47%, to 2,409.39 and the Nasdaq Composite added 160.73 points, or 2.3%, to 7,150.58.

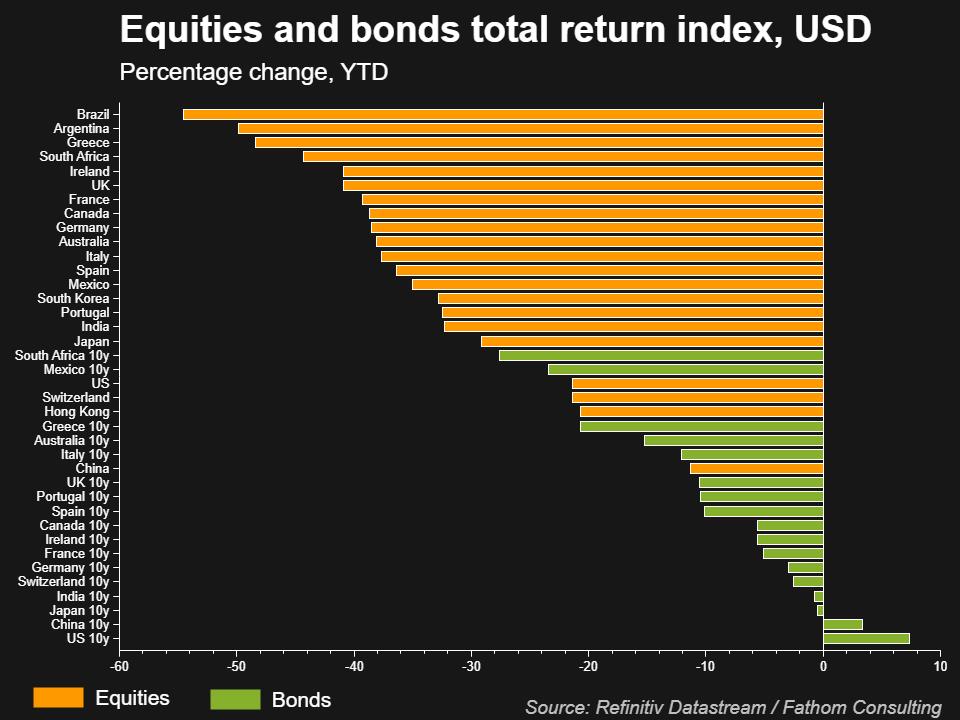

The meltdown in markets had pushed Wall Street's three main indexes down about 30% as of Wednesday from their record closing highs last month.

(Graphic: Equities and bonds total return,  )

)

TREASURY YIELDS FALL IN VOLATILE TRADE

Global bond prices gyrated, with desperate investors dumping government bonds and hoarding cash in markets gripped by pandemic fears that have forced central banks to step up support for debt.

U.S. Treasury yields largely fell in volatile trading, a sign the Fed's efforts were working.

Benchmark 10-year notes last rose 28/32 in price to yield 1.1667%.

The dollar rallied further as investors rushed to secure liquidity. The British pound

Bond markets stabilized somewhat after the European Central Bank pledged late Wednesday to buy 750 billion euros ($820 billion) in sovereign debt through 2020. That brought the ECB's planned purchases for this year to 1.1 trillion euros.

The dollar index <=USD> rose 1.846% and the Japanese yen weakened 2.26% versus the greenback at 110.58 per dollar.

Government bond yields in Italy and across the euro zone dropped after the ECB's emergency measures, though European stocks fell back into negative territory after arresting their rout in early trading.

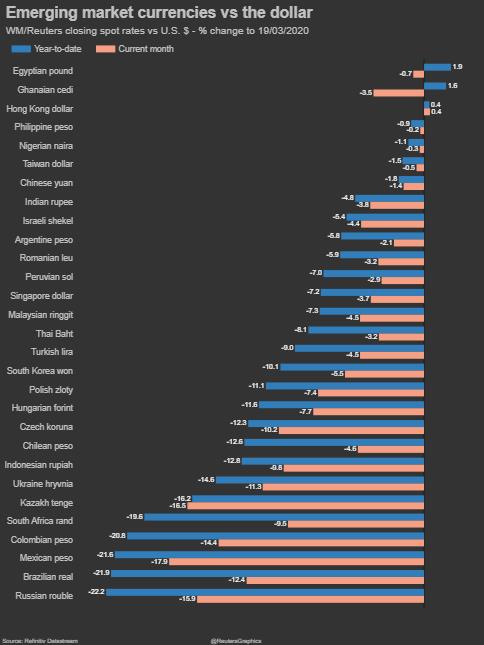

Expected price swings for some of the world's biggest currencies rocketed to multiyear highs as the demand for dollars forced traders to dump currencies across the board.

For the British pound versus the dollar, expected volatility gauges leapt to 24.4%, their highest level since before the 2016 Brexit vote.

"One unresolved and really critical issue is what's going on in volatility," said Andrew Sheets, chief cross-asset strategist at Morgan Stanley. "I think that volatility needs to stabilise before the broader market can heal."

Italy, which has seen its borrowing costs jump in recent days, led the drop in yields after the ECB move.

The gap over the safer German Bund's yields tightened.

The U.S. Fed earlier promised a liquidity facility for money market mutual funds, and Australia's central bank slashed interest rates to a record low of 0.25%.

Traders reported huge strains in bond markets, however, as distressed funds sold any liquid asset to cover equity losses and investor redemptions.

Benchmark 10-year sovereign bond yields in New Zealand, Malaysia, Korea, Singapore and Thailand surged as prices fell, and U.S. 10-year Treasuries rose 10 basis points through the session.

The coronavirus pandemic has killed more than 9,700 people globally, infected more than 236,000 and prompted widespread emergency lockdowns.

Gold fell and, like other assets, was buffeted by volatility. Copper, a gauge of global economic health, hit its down-limit in Shanghai, and London futures traded in London fell to their lowest since 2016.[MET/L]

U.S. gold futures settled up 0.1% at $1,479.30 an ounce.

(Graphic: Emerging market currencies sink,  )

)

(Reporting by Tom Wilson in London and Chris Prentice in Washington; Additional reporting by Herbert Lash in New York, Tom Westbrook in Singapore and Sujata Rao in London; Editing by Nick Zieminski and Bernadette Baum)

By Chris Prentice and Tom Wilson