While many factories in China are gradually cranking back up as the virus outbreak there eases, widespread closures are spreading elsewhere in the world, including at the world's biggest automaker, Volkswagen Group.

Sales of cars, a key source of demand for steel, are expected in the U.S. to plummet 80% or more in states with lockdowns.

(Graphic: European Factory Activity Slides; U.S. Car Sales Weaken IMAGE, https://fingfx.thomsonreuters.com/gfx/mkt/azgpomyopdx/European%20Factory%20Activity%20Slides%20-%20U.S.%20Car%20Sales%20Weaken.png)

That has created a precarious position for Europe, with many operating blast furnaces, which are more inflexible than the electric arc facilities that dominate the United States.

"Europe's steelmakers have got a big problem. It was a pretty bad year in 2019 and cash reserves have been depleted over the past six months," said James Campbell, principal analyst at consultancy CRU.

The current situation is a big contrast to the years ahead of the global financial crisis, when the European steel sector enjoyed fat profits and were able to pile up some cash, he added.

(Graphic: European Steel Industry Profitability Lags Other Regions IMAGE, https://fingfx.thomsonreuters.com/gfx/mkt/rlgvdwgkpoj/European%20Steel%20Industry%20Profitability%20Lags%20Other%20Regions.png)

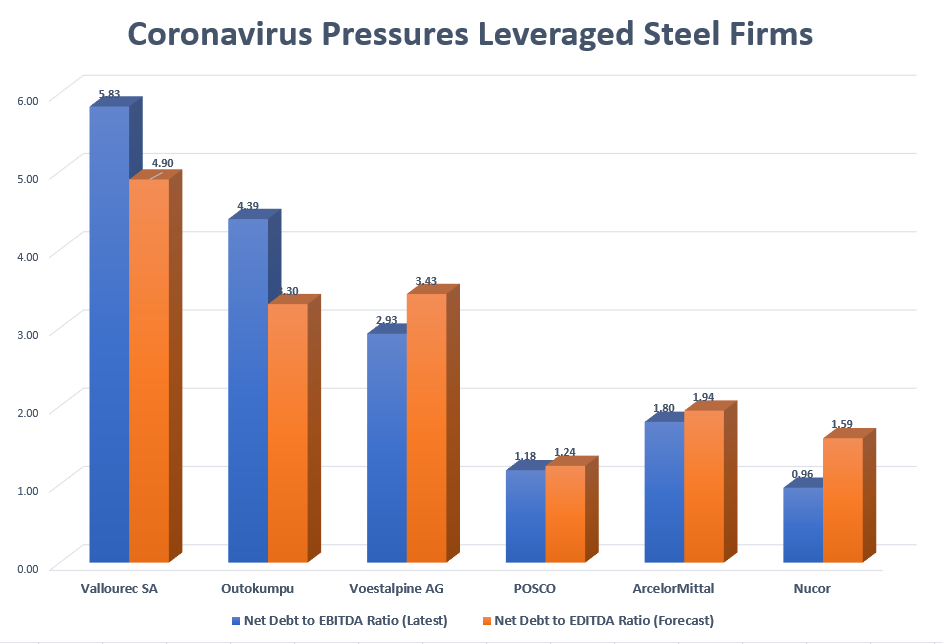

"Leveraged companies are at risk if the downturn is

protracted," analyst Myles Allsop at UBS said in a note.

Companies with robust balance sheets include the world's biggest steelmaker ArcelorMittal, South Korea's POSCO and Hong Kong-listed China Oriental, Allsop added.

In Europe, stainless steel group Outokumpu would be worst positioned in a scenario where earnings slide to 33% below 2009 lows, Alan Spence at Jefferies said in a note.

Voestalpine reported its first nine-month loss in years last month and posted net debt of 3.65 billion euros.

(Graphic: Coronavirus Pressures Leveraged Steel Firms IMAGE,  )

)

While steel output has continued to rise year-on-year so far in 2020, the outlook is due to shift in the short term.

"The virus has taken what was already set to be a dismal year for steel production, and turned it into a catastrophe," said Kieran Clancy, assistant commodities economist at Capital Economics.

"In the near term, the pain will almost certainly be most acute outside of China."

Global steel production is likely to fall in 2020 for the first time since 2015, he added.

(Graphic: Global, European, Chinese Steel Production IMAGE,  )

)

In Europe, nine blast furnaces with total annual capacity of about 19 million tonnes have already idled and others are at reduced capacity, while a total of 6 million tonnes have been temporarily shut in the United States, according to CRU.

Europe will have a greater problem in balancing the collapse in demand with reduced production because it is not easy to turn off blast furnaces, which account for nearly 60% of EU steel output, compared to about a third in the United States.

In China, global steel production continued to grow as the virus spread in January and February as state-owned enterprises kept pumping out metal, resulting in big piles of inventory.

Inventories of major steel products in Chinese marketplaces have nearly tripled, surging to 24.72 million tonnes by March 27 from 8.88 million in early January, according to consultancy SteelHome.

(Graphic: Chinese Steel Inventories Surge Amid Coronavirus IMAGE, https://fingfx.thomsonreuters.com/gfx/mkt/rlgpdlmepoj/Chinese%20Steel%20Inventories%20Surge%20Amid%20Coronavirus.png)

Steel prices in China slumped after the delayed return from the Chinese New Year holiday and levels in Europe and the United States are due to be pressured by weak demand and excess production.

U.S. hot rolled coil prices shed nearly 7% to $548 a tonne over the past two weeks and are forecast to drop to $525 in the second half of the year, David Gagliano at BMO Capital said in a note.

(Graphic: Chinese Steel Prices Fall Sharply with Country in Lockdown IMAGE, https://fingfx.thomsonreuters.com/gfx/mkt/ygdvzwympwa/Chinese%20Steel%20Prices%20Fall%20Sharply%20with%20Country%20in%20Lockdown.png)

(Reporting by Eric Onstad;Editing by Elaine Hardcastle)

By Eric Onstad