The blue-chip index rose 2.9% on Thursday, ending a holiday-shortened week with a gain of nearly 8%.

The U.S. central bank announced measures worth $2.3 trillion in aid for local governments and small and mid-sized businesses to keep the U.S. economy intact.

Meanwhile, the Bank of England agreed to temporarily lend the British government money if needed to help finance its massive coronavirus-related spending plans.

The measures, along with signs of new coronavirus cases levelling off in the U.S. hotspot of New York and receding in hard-hit regions of Europe saw global stock markets gain.

"The mood in markets continues to improve, but it's patchy," said Jasper Lawler, head of research at London Capital Group.

Travel stocks surged across Europe, lifting cruise line Carnival Corp 9.2%, while Just Eat Takeaway jumped 14% to the top of the FTSE 100 index after it said total orders jumped 50% in the first quarter.

Shares in BP and Royal Dutch Shell

Among midcap stocks, homebuilder Redrow rose 9.6% after getting approval for the Bank of England's coronavirus emergency financing scheme and saying talks with six banks to secure additional funds were progressing well.

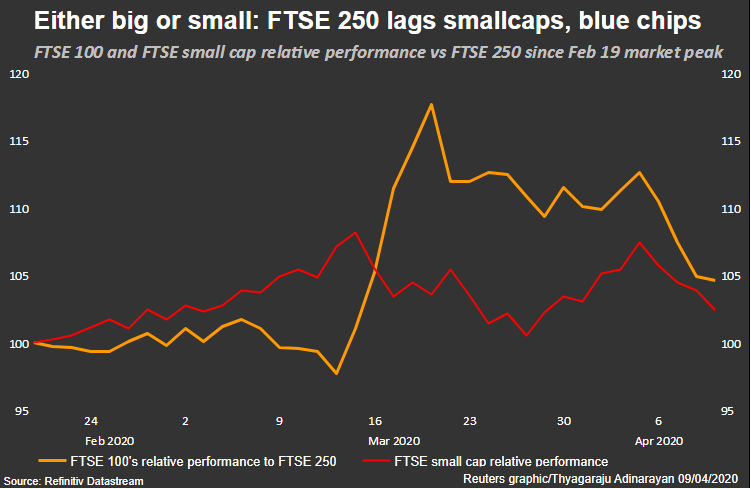

The FTSE Mid 250 index, which has underperformed the blue-chip and small cap companies since the rout started in February, added 3.4%, posting its best weekly performance.

GRAPHIC: Either big or small - FTSE 250 lags smallcaps, blue chips -

Diageo Plc, the world's largest spirits maker, rose 4.4% after it maintained its plan to pay an interim dividend even as it withdrew its earnings outlook and suspended a share buyback programme in response to the pandemic.

Rail and coach ticketing company Trainline rose 2.2% after saying it would cut costs and capital spending to help weather an extended downturn.

By Devik Jain and Sruthi Shankar

FTSE 100

FTSE 100