|

Monday June 1 | Weekly market update |

| Despite some profit-taking on Friday, amid tensions between Beijing and Washington, last week was particularly good for financial markets, with traders hoping for a rapid resumption of economic activity. Banking stocks and cyclicals, which have so far been neglected, made a significant contribution to markets' recovery, even though all sectors made overall gains. |

| Indexes Over the past week, in Asia, the Nikkei gained 7.3%, the Shanghai Composite 1.3% while the Hang Seng grabbed only 0.2% (-3.7% last week), still weighed down by new national security laws in Hong Kong. In Europe, the CAC40 recorded a weekly performance of 6.1%, the Dax performed 5.1% and the Footsie 2.2%. For the peripheral countries of the euro zone, Portugal gained 2.4%, Spain 6.2% and Italy 5.6%. In New York, the Dow Jones is up 3.5%, the S&P500 is up 2.5% and once again, the Nasdaq100 underperformed, gaining only 0.5% over the week. |

| Commodities Despite still significant daily variations, oil ended the week close to equilibrium. Traders prefer to see the glass half full, betting on a gradual recovery in demand, leaving aside the rise in US inventories and the deterioration in Sino-US relations. Brent Crude remained at USD 35 a barrel, while the US benchmark is trading at USD 33. Silver gained 2.80% over the last five days. As for gold, it is trading at USD 1,730. As for base metals, zinc is once again down to USD 1918, while tin, copper and aluminium are up to USD 15590, 5300 and 1500 respectively. |

| Equities markets Swedish Match specialises in the manufacture and marketing of tobacco products: snuff (50%), cigars (38%), matches and lighters (8%). Thanks to strong national brands, the United States accounts for 57% of its turnover compared to 35% in Scandinavia. The Stockholm-based company has excellent Surperformance ratings that highlights fundamental qualities such as strong profitability with high net margins (29%) and positive sales estimate revisions. 2019 has been a year of change for Swedish Match. In addition to record sales (USD 1.5 billion) and operating profit, the company has become the undisputed market leader for nicotine products in the United States. The company sells alternatives to traditional cigarettes. The Swedish stock is the leading performer in the Scandinavian (Denmark-Sweden-Finland) OMX Nordic 40 index, with 31.7% year-to-date growth, highlighting the resilience of its business. Swedish Match's surge  |

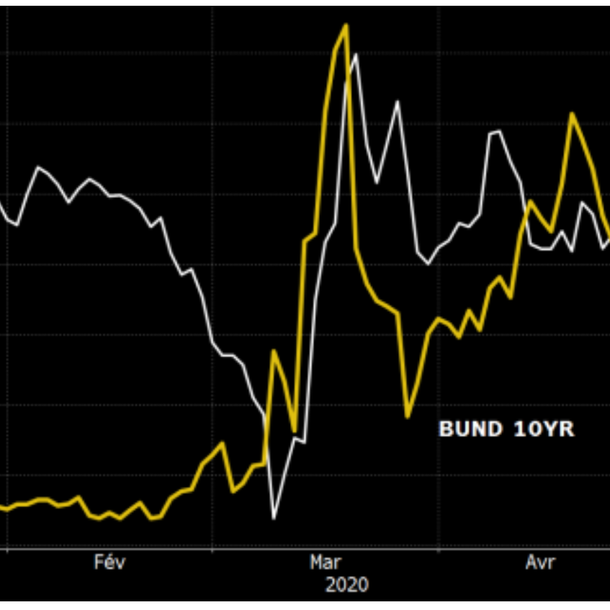

| Bond market Bond markets showed a relatively mixed trend throughout the weekly sequence. The Bund's lower-yielding trend reduced spreads against securities issued by the southern periphery of the euro area. Germany's 10-year yield rose to -0.44% while Italy's fell 16 basis points to 1.43% (see chart), as did Spain's at 0.56%. These divergent trajectories are rooted in the recovery plan presented by the European Commission with a €750 billion fund. Italy could be the main beneficiary of this continental project. In France, the OAT stabilises at -0.07%. The Treasury came on the bond market to raise funds over 20 years. Anxious investors, in the current market context, rushed to this new auction. As a result, the EUR 7 billion offer was oversubscribed thanks to an overall demand of EUR 58 billion. In the United States, the T-Bond was little impacted by the rising tensions of the Sino-American conflict and stabilised at 0.65%. It is still on the Swiss side that investors find the most reassuring ten-year bonds, but also the least profitable (-0.54%). The spread narrows between the Bund and the Italian 10-year maturity  |

| Forex market In Europe, the announcement of a EUR 750 billion recovery plan has boosted the single currency, even if this project is opposed by northern countries, which are more in favor of budgetary restraint and controlling deficits. The major parity (EUR/USD at 1.1140) is progressing towards a zone of resistance. This upturn was also seen against other safe haven currencies, particularly against the Swiss franc at CHF 1.07. The SNB should be satisfied with this pause. The balance between the strong monetary values is being verified, as is the case with the USD/JPY at 107.80 and the USD/CHF at 0.965. Despite everything, the dollar index fell back significantly over the week (see graph), a negative path driven by the secondary currencies as shown by the USD/RUB which is trading at 71 Russian units for one dollar while at the worst moment of the oil crisis the greenback was trading at RUB 81. In the southern hemisphere, the AUD (Australian dollar) and the NZD (New Zealand dollar) continue their advance, with the reopening of the economies. The former is trading at USD 0.66 and the latter at USD 0.62 (+200 basis points for each pair). Dollar index decline  |

| Economic data European statistics were mixed last week. In Germany, the IFO (79.5) and Retail Sales (-5.3% vs. -12% expected) beat the consensus, while import prices fell slightly more than expected to -1.8%. For France, the CPI index was stable, household consumption fell by 20.2% (consensus -14.5%) and GDP declined by 5.3%. For the euro zone, the CPI was in line with expectations at 0.1%. In Asia, pending further measures to support the economy, Japanese industrial production fell by 9.1%, retail sales by 13.7% while housing starts dropped by 12.9%. The unemployment rate came out at 2.6%. In the U.S., GDP fell 5% in the first quarter, orders for durable goods dropped by 17.2% and housing sales pledges fell by 21.8%. Household spending fell by 13.6% while household income rose by 10.5 (consensus -7%). This week, the focus will be on the PMI manufacturing and services indexes on both sides of the Atlantic, but also on employment data from the United States, with the ADP survey and the monthly report on Friday. |

| Easing lockdown restrictions boost indices The context is improving thanks to positive health and economic indicators. After very selective buying during the crisis, investors moved throughout the weekly sequence towards a more neutral sector allocation. Indeed, arbitrage benefited the neglected stocks and sectors that were bound to take part in the bull rally one day or another. In addition, the TINA (There In No Alternative) concept, which highlights the lack of profitable support, is a technical advantage for equities. The reopening of the economy is being boosted by huge stimulus plans, which are proactive economic policy tools, and, on the monetary front, by accommodating measures from central banks. This global coordination is a real breath of fresh air for indexes. The upward trajectories of equities signals a synchronised economic rebound. However, some obstacles to recovery could still manifest, such as the resurgence of tensions between China and the United States or a sharp deterioration in the US labour market. |

By

By