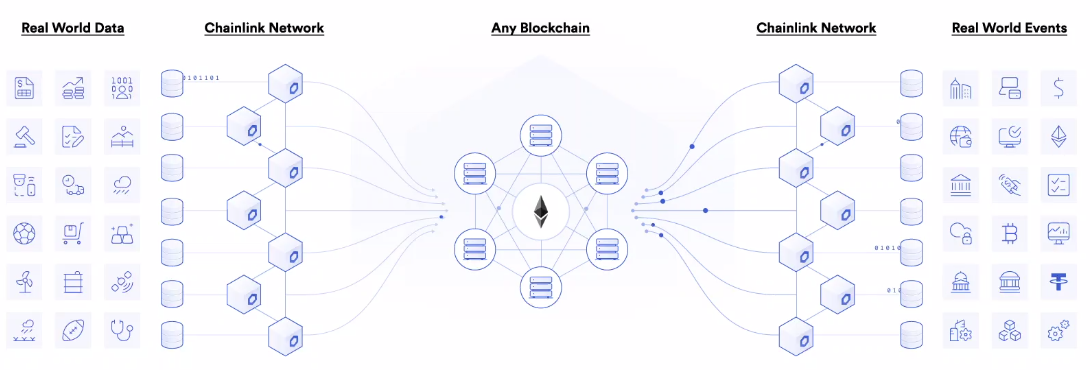

An oracle was considered to be the answer given by a god to a personal question related to the future, in other words, it was a dialogue with a god about his future. Of course, to question Zeus, one had to fulfill certain conditions, follow certain procedures, perform certain rites or pay certain taxes, and very often Zeus' answer came through the mouth of a prophet. By extension and distortion, Chainlink takes on the role of the oracle in the age of the blockchain. That is, the oracle 3.0 connects a smart contract from a blockchain (on-chain), with a reliable external real world data source (off-chain). A data source that is searchable at any time, or rather, the modern day oracle.

Chainlink Network

Source: Chainlink.com

It is essential for Chainlink to have in mind the usefulness of a smart contract, so I'll allow myself a little memory refresh before I jump in. Smart contracts are pre-established agreements on a blockchain that evaluate information and execute automatically when certain conditions are met. Crowdfunding is a good example: if a certain amount of ether (ETH) is deposited into a smart contract by a certain date, the payment will be made to the fundraiser - if not, the payment will be returned to the donors. Because smart contracts exist on a blockchain, they are immutable (they cannot be changed) and verifiable (everyone can see them). This ensures a high level of trust between parties because it garanties that contracts accurately reflect the stated parameters of the agreement and that they will be executed if, and only if, these parameters are met.

Now let's go back to our oracle 3.0, and to fully understand it let's start with a concrete use case:

Match : Yankees vs Mets, Chainlink style

For example, let's suppose that Mike and Jason want to bet on the result of the Yankees vs Mets game within a smart contract. Mike bets 20 dollars on the Yankees and Jason 20 dollars on the Mets, the total of 40 dollars being placed in escrow by the smart contract. At the end of the match, how does the smart contract know whether to give the funds to Mike or Jason? The answer is that it needs an oracle mechanism to retrieve the exact match results and transmit them to the blockchain in a secure and reliable manner. Our oracles are coming.

Indeed, at the moment, a smart contract is unable to go and open a web page to consult the result of the match in order to determine the winner, it is then necessary to resort to an external, reliable and consultable data source at any time. Chainlink retrieves all the data from various available databases to resist manipulation should a site display an incorrect score. In the case of our football match, Chainlink's oracles would retrieve information from Sports Illustrated, ESPN, etc... They would then determine the winner by choosing what the majority of the different sites (external data sources) have defined as the result, and then unlock the smart contract in order to release the rewards to the winning punters. We understand that even if the score coming from "Flash Score" is wrong (wrong result) and all the other sites show a different score (real score) it doesn't matter because the oracles will take into account the result that is the majority. For the result transferred to the blockchain to be false, the majority of the data sources would have to agree on a false score. This is unlikely to happen...

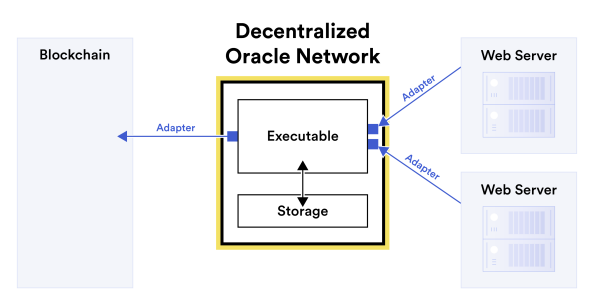

Transmission of information via DON (Decentralized Oracle Contract)

Source : White Paper Chainlink (research.chain.link)

Here we have taken the example of a baseball game, but the field of possibilities is open. The various decentralized applications (Dapps) will need to use real world data to optimize smarts contracts to orders based on the evolution of a stock price, or to alert inhabitants based on weather data, etc. Any decentralized application that needs an extreme source of reliability on external data in order to import it into smart contracts will need a bidirectional oracle system, in other words, a system that can export information from the blockchain to the outside world and vice versa.

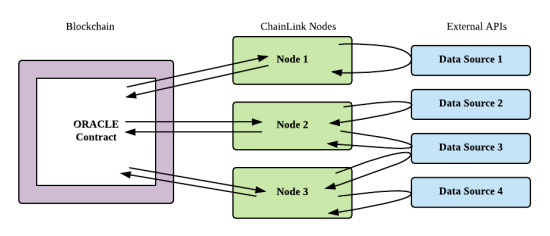

The core of Chainlink's system: decentralized oracles

Blockchain oracle mechanisms using a centralized entity to provide data to a smart contract introduce a single point of failure, which defeats the very purpose of a decentralized blockchain application. If the single oracle is offline, the smart contract will either not have access to the data needed to execute or will execute incorrectly based on stale data.

Even worse, if the single oracle is corrupted, the data provided on the chain can be very incorrect and lead to smart contracts executing very poorly. Moreover, since blockchain transactions are automated and immutable, the outcome of a smart contract based on incorrect data cannot be undone, which means that users' funds may be permanently lost. Therefore, centralized oracles are not a solution for smart contract applications. This is where nodes come to play the role of decentralization.

How decentralised nodes work on Chainlink

Source: Chainlink White Paper

A decentralized oracle network combines multiple independent oracle node operators and multiple trusted data sources to establish end-to-end decentralization.

Let's take our oracle that captures data from football games via different data sources. If there was only one connected computer (blockchain node) to run the oracle in question, then if it were to get hacked or stop working, the data could no longer be transferred to the smart contracts. To avoid this major risk, it is necessary to have several oracles connected to several nodes, so if one oracle provides different answers than all the other oracles, the data will be lost. To avoid this major risk, it is necessary to have several oracles connected to several nodes, so if an oracle provides different answers than all the other oracles, it will be discarded, because it is considered of poor quality and therefore penalized by the network. Thus, several oracles working on several nodes allow to push the decentralization to the maximum in order to tend towards the 0 risk of false information transmitted.

The LINK Token

It should not be forgotten, the Chainlink company relies on the cryptocurrencies ecosystem by connecting blockchains to the real world. Therefore, it has its own digital currency. The: LINK. What is it used for? Mainly to pay for the operating costs of the network. When your Dapps needs to retrieve information from the real world to integrate it into a smart contract, you will call on the oracles who will ask you to pay for "data transformation between the on-chain world and the off-chain world. Remuneration is done in LINK.

For investors, there is another important notion to consider, when the project was launched in 2017, it was agreed that only 35% of the tokens would be sold to the public, with the rest reserved to reward nodes for helping to decentralize the oracles and for the team. Too much concentration of the total tokens issued in the hands of the company increases the risk of price manipulation. One can also imagine the disappointment of early investors, who made the project possible, to have received only one third of the total tokens. Finally, the team does not communicate much about the evolution of the Chainlink project, which may raise doubts among investors. Although Chainlink is the most important decentralized oracle system at the moment, others come to play elbows like Augur, Band Protocol or Tellor. A future article in the columns of MarketScreener for a thorough comparison between competitors.

Price and performance of LINK

The price of the token has evolved by more than 60% since January 1st, with a unit price of $18.16 at the time of writing. With a market cap of over $8 billion, Chainlink boasts a top 25 cryptocurrency position in terms of market cap.

Token price: LINK

Source: CoinMarketCap

The decentralized oracle system is extremely useful in the world of decentralized applications on blockchains. Naturally, it is understood that many of them will need real-world information to function. Whether it's Chainlink or another company, we have a strong feeling that they will have a role to play in the Dapp ecosystem. Still, it will be interesting to see what Eric Schmidt brings to the company from his experience at Google.

By

By