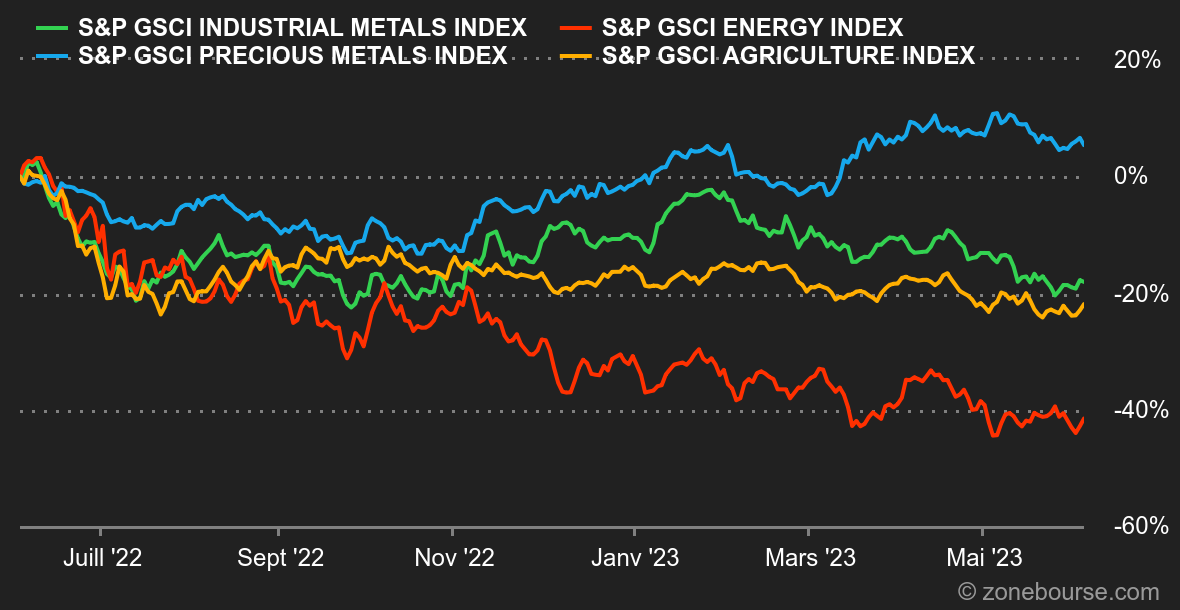

Energy: Tick-tock... Initiatives were limited until last weekend's OPEC+ summit. Given the momentum of oil prices, which have taken a beating in recent weeks, production quotas were the focus of financial attention, with differences between Moscow (which does not want to cut production) and Riyadh, which is in favor of supporting oil prices. Against this backdrop, Saudi Arabia has declared that the Kingdom is committed to unilaterally cutting its supply by 1 million barrels a day from July 1 for a period of one month, renewable if necessary. Saudi Arabia will thus produce around 9 million barrels a day. Still on the subject of OPEC, the cartel's production fell by 0.5 million barrels per day (mbpd), according to Bloomberg, to 28.26 mbpd in May. In terms of prices, North Sea Brent is trading at around USD 77 a barrel, compared with USD 73 for its American counterpart, WTI.

Metals: Base metal prices rebounded last week, thanks to a favorable alignment of planets: The return of risk aversion with the resolution of the US debt problem, a weaker greenback and lower LME inventories all contributed to a rebound in copper, aluminum and tin. The proof is in the pudding, with copper back above the USD 8,000 mark on the LME, now trading at around USD 8,200. Gold has also regained a little height, thanks to falling bond yields. The barbaric relic is trading at around USD 1,950 an ounce.

Agricultural products: Tension continues unabated in the Black Sea, with Ukraine claiming that Moscow is not respecting grain agreements. Also in Ukraine, the latest data from the Ukrainian Ministry of Agriculture shows that, unsurprisingly, wheat and corn sowings have fallen by 38% and 16% respectively year-on-year due to the war. It's clearly not the same story in the USA, where crops are developing well, allowing the USDA (US Department of Agriculture) to bank on prospects for record harvests. On the price front, cereal prices ended May sharply lower. In Chicago, wheat is selling for 610 cents a bushel, compared with 585 cents for corn.

By

By