By Elizabeth Howcroft

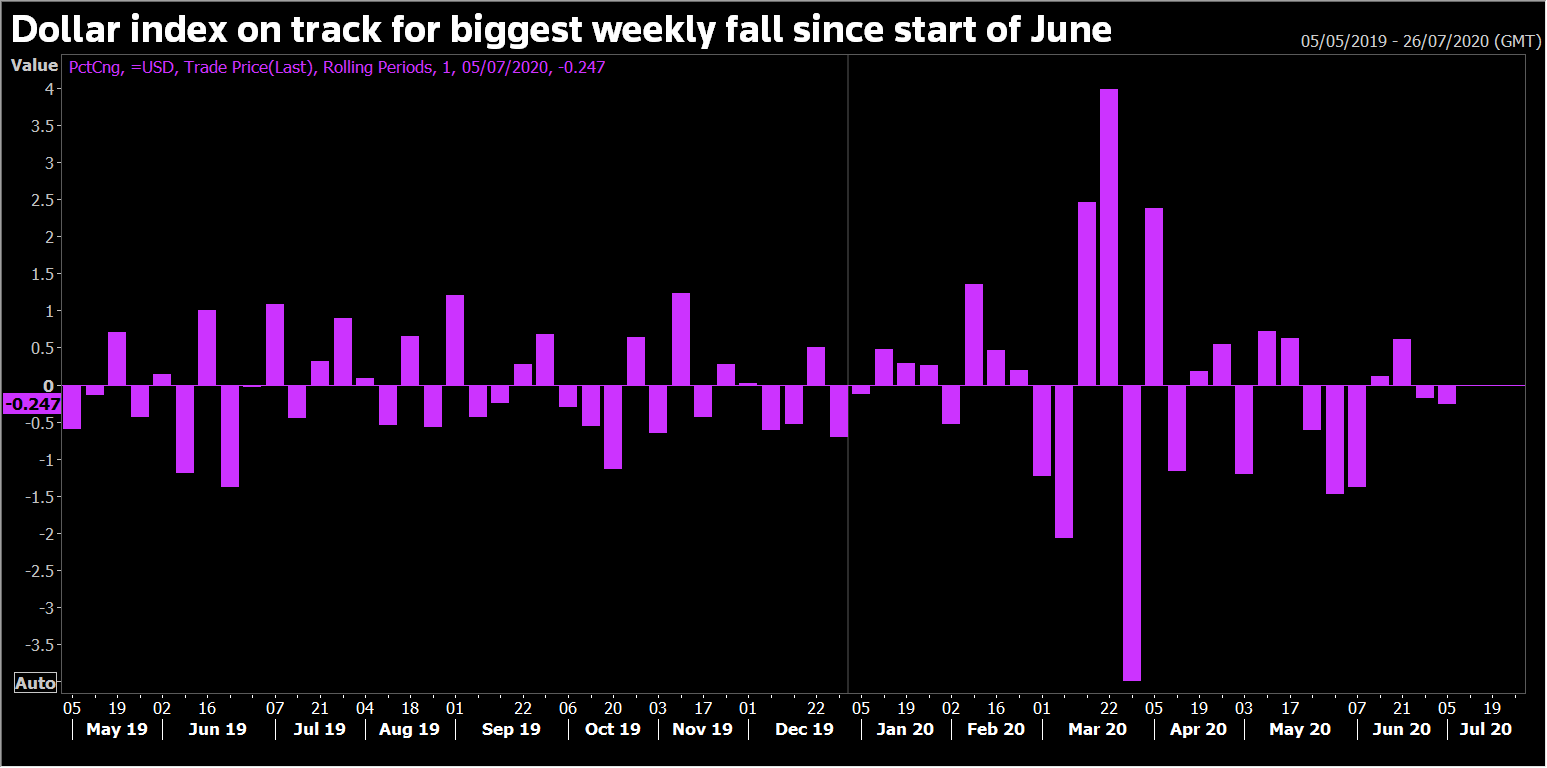

The dollar edged up on Friday but was set for its biggest weekly fall since the start of June, as a sentiment boost from better-than-expected jobs data in the United States was tempered by surging coronavirus cases.

The U.S. Labor Department said on Thursday that payrolls surged in June but the reaction in currencies was limited. Even after two months of job recovery from May, the U.S. economy has regained just over a third of an historic plunge of 20.787 million jobs lost in April.

Broader market sentiment improved as Asian shares rallied to a four-month high overnight following a brisk pickup in Chinese service sector activity.

Against a basket of currencies, the dollar rose less than 0.1%, to 97.249 at 1353 GMT <=USD>. Friday saw its biggest daily gains this week but it is still on track for its biggest weekly fall since the first week of June.

(Graphic: Dollar -  )

)

"In a week characterized by dropping FX volatility, the dollar looks to be re-establishing a gentle bear-trend as equities keep showing complacency to grim contagion news," FX strategists at ING wrote in a note to clients.

"Such complacency still indicates the short-term outlook for risk assets is not lacking hurdles, but there is still a material chance we have seen the peak in the dollar," they added.

Riskier currencies edged up, with the New Zealand dollar up 0.3% at 0.6528 versus the U.S. dollar

The Norwegian crown rose around 0.5% versus the dollar, at 9.487, on track for its best week since the first week of June

The euro was little changed against the dollar, at 1.1237

Traders have been balancing hopes for an economic recovery with surging coronavirus infections, particularly in the United States, where infections are rising in the majority of states.

"We are surprised about an emerging consensus that a much-faster-than-expected recovery justifies support for risk assets. What we see in the latest data is just base effects, as economies exit the lockdown," Bank of America FX strategists Michalis Rousakis and Rohit Garg said in note.

"We would expect global output to stabilize soon to well below pre-crisis levels. This is not a V," they added.

U.S. states have delayed and in some cases reversed plans to let stores reopen and activities resume.

"The chances have risen that risk aversion will rise again over the coming days due to the negative news flow, allowing the dollar to appreciate, rather than optimism making further ground," wrote Antje Praefcke, FX analyst at Commerzbank.

"The downside in EUR-USD still seems to be the weaker side currently," she added.

Relations between the United States and China are also in focus over China's strategy in Hong Kong.

The U.S. Senate unanimously approved legislation on Thursday to penalise banks doing business with Chinese officials who help implement Beijing's new national security law for Hong Kong.

With U.S. markets are closed for a public holiday.

(Reporting by Elizabeth Howcroft; Editing by Elaine Hardcastle, Emelia Sithole-Matarise and Chizu Nomiyama)