VanEck Semiconductor ETF (SMH):

The SMH is an exchange-traded fund designed to closely track the performance of the "MVIS US Listed Semiconductor 25 Net Total Return Index." It offers investors physical exposure to the semiconductor industry by allowing them to own shares of the ETF, which generate returns through both capital appreciation and dividend distributions. It consists of a carefully selected basket of 25 companies, with 15 of them accounting for 79.69% of the total weight. Notably, Nvidia holds the largest position in SMH, representing 11.49% of the portfolio. This is advantageous for the ETF as Nvidia exhibits a strong financial foundation, with an increasing market capitalization, EBITDA, and return on assets (ROA).

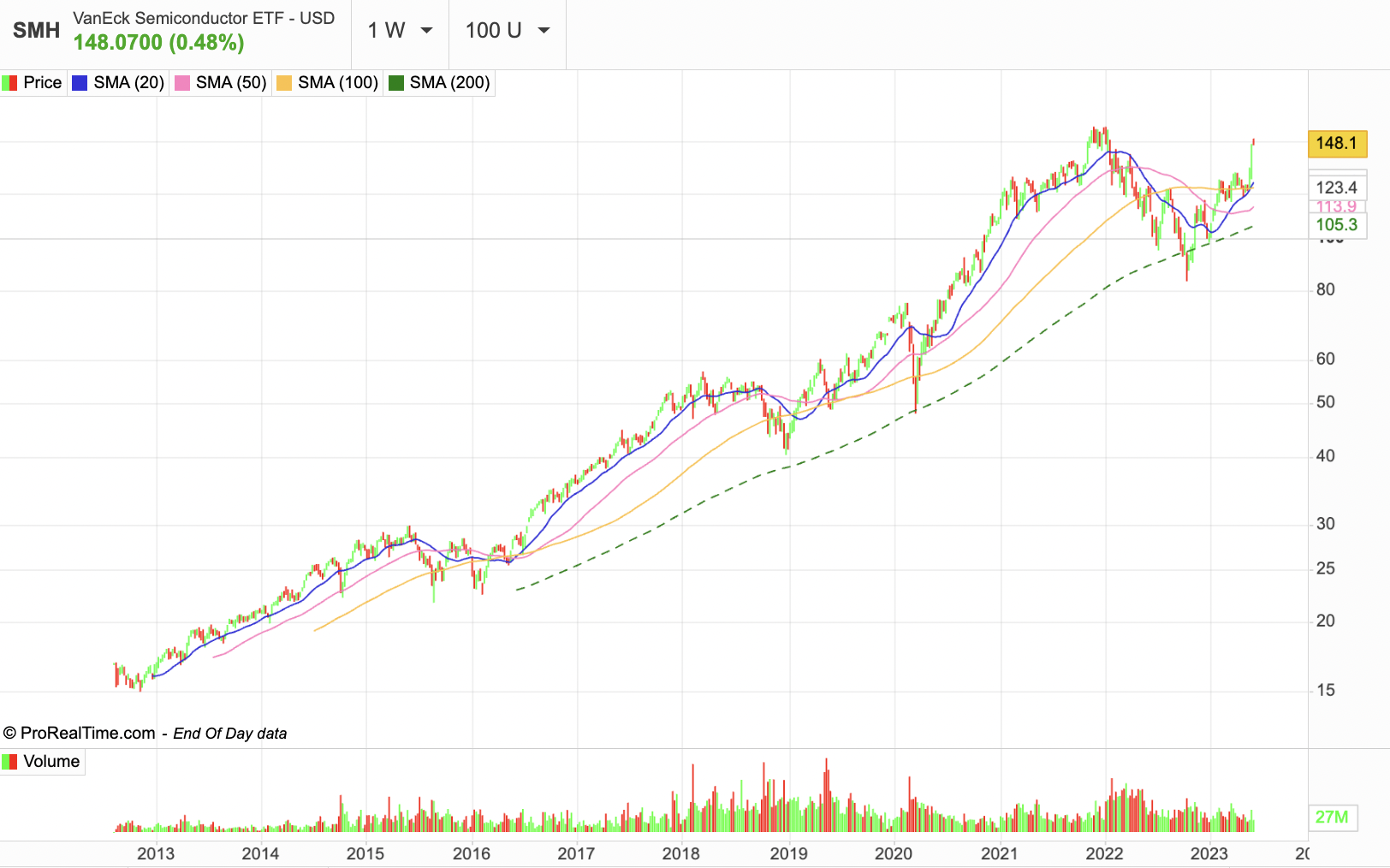

Furthermore, the geographical allocation of the ETF is diversified, with the United States accounting for 77.9%, followed by Taiwan (10.8%), the Netherlands (8.5%), and other regions (2.8%). From a sector perspective, the fund primarily focuses on Information Technology, which comprises 97.2% of the portfolio, while the remaining 2.8% is allocated to other sectors. Since January 2023, the ETF has demonstrated exceptional performance (+45.92%), driven by the growing enthusiasm surrounding artificial intelligence (AI) technologies.

The semiconductor industry is a vital component of today's evolving economies, driven by emerging markets, technological advancements, sustainability initiatives, and shifting consumer preferences. This industry encompasses various sectors that heavily rely on semiconductors, including automotive, artificial intelligence (AI), Internet of Things (IoT), and 5G technology. In addition to addressing challenges faced by the automotive sector, such as improved electric charging infrastructure and consumer demands for affordable technological enhancements, the semiconductor industry is experiencing a significant surge in demand in these other areas.

While the global automotive semiconductor market is projected to grow substantially, reaching $101 billion by 2026 with a compound annual growth rate (CAGR) of 17.3%, other sectors are also driving the industry forward. The increasing adoption of AI, for instance, necessitates powerful chips to support the training and implementation of AI models. The heightened demand for semiconductors is driven by enterprises upgrading their hardware infrastructure, as exemplified by Nvidia's impressive $11 billion guidance for the current quarter and their announcement of the DGX GH200 super-computer, which underscores the company's commitment to meeting the increasing demand in the AI industry. Moreover, the rapid expansion of IoT and the ongoing deployment of 5G networks require advanced semiconductor technologies to enable seamless connectivity and enable the development of smart devices and systems.

Considering this multifaceted growth potential, the SMH ETF becomes an intriguing investment opportunity for diversification within the semiconductor industry. It allows investors to capitalize on the upward trends in various sectors, while mitigating risks associated with individual company exposure. The expanding demand in these areas, driven by technological advancements and market dynamics, positions the semiconductor industry favorably for future growth.

First Trust Nasdaq Cybersecurity ETF (CIBR):

The CIBR ETF has been specifically designed to track the Nasdaq CTA Cybersecurity Index, offering investors physical exposure to the cybersecurity industry. This share class generates a consistent stream of income through dividend distributions. Despite being a smaller ETF with 34 holdings, the top 15 companies account for a substantial 65.61% of the total weight, with Fortinet and Palo Alto Networks occupying the first and second largest positions, respectively.

The increasing importance of cybersecurity is undeniable in our technologically reliant society, with no indication of this trend slowing down. This ETF has demonstrated impressive performance, with a notable return of +41.76% over the past three years and +13.10% since the beginning of the year. These strong performance figures further highlight the growing demand and significance of cybersecurity in the market.

The CIBR ETF provides investors with an opportunity to gain exposure to the cybersecurity industry, which is becoming increasingly crucial in our interconnected world. As technology continues to advance, the need for robust cybersecurity measures becomes paramount in safeguarding sensitive data from malicious hackers seeking to exploit it for nefarious purposes. The importance of cybersecurity extends across various sectors, including governments, military, institutions, hospitals, and businesses, as they store vast amounts of data that are vital for the functioning of our society.

To address this growing challenge, the cybersecurity industry relies on a combination of advanced technologies and policy frameworks. Artificial intelligence (AI) plays a significant role in bolstering cybersecurity defenses by enhancing threat detection, response capabilities, and risk mitigation. AI-powered systems can analyze vast amounts of data in real-time, identify patterns, and detect anomalies that may indicate potential cyber threats. By leveraging machine learning algorithms, cybersecurity professionals can proactively identify and address vulnerabilities, preventing potential breaches before they occur.

Looking ahead, the future of cybersecurity holds great potential. As technology continues to evolve, so do the threats and risks associated with it. The cybersecurity industry will need to stay ahead of these challenges by adopting innovative approaches, such as integrating AI and machine learning into their defense strategies. The use of AI in cybersecurity will enable more proactive and adaptive defenses, capable of swiftly responding to emerging threats and continuously learning from evolving attack patterns. Additionally, advancements in areas like quantum computing and secure communication protocols will further shape the future of cybersecurity, creating new opportunities and challenges that the industry will need to navigate.

The Communication Services SPDR Fund ETF (XLC):

The XLC ETF is meticulously designed to closely track the performance of the Communication Services Select Sector Index, providing investors with a strategic avenue to gain exposure to the dynamic communication services industry. By offering physical exposure, investors have the opportunity to own shares and potentially benefit from the returns generated by the underlying securities. The ETF encompasses a carefully curated selection of 25 companies operating across various segments of the communication services sector, including media, entertainment, interactive media, and telecommunications. Notably, Meta holds the largest position within the XLC portfolio, representing a significant 19.71% weight.

From a sector perspective, the XLC ETF offers a diversified allocation, with a primary focus on Information Technology, accounting for 50% of the portfolio. Additionally, the Consumer Discretionary sector comprises 24.2%, Telecommunication holds 17.1%, and the remaining 8.7% is allocated to other sectors. Since the beginning of the year, the XLC ETF has demonstrated a notable performance of +29.53%.

The communication services industry is a crucial component of our interconnected world, providing essential services such as internet access, mobile communication, streaming platforms, social media, and content creation. The XLC offers investors exposure to this industry by including major players that shape the communication services landscape. Its performance is influenced by factors such as industry growth and innovation, changes in consumer behavior and media consumption patterns, regulatory developments, and broader market trends.

Looking ahead, the future of the communication services industry holds immense potential as technology continues to advance. The emergence of transformative technologies like 5G networks, artificial intelligence, and virtual reality is expected to revolutionize communication and media consumption patterns. These advancements will drive further growth and innovation within the sector, presenting opportunities for companies involved in streaming, digital advertising, cloud computing, and telecommunications.

Despite the challenges faced during the complicated economic environment of 2022, Meta has demonstrated impressive growth. After navigating through the economic downturn, the company has positioned itself for success, leveraging its vast user base and expanding its reach into various communication services and digital platforms. Meta's resilience and adaptability make it a notable player in the communication services industry, contributing to the overall growth potential of the XLC.

By

By