There are five times more individual guns in circulation in the United States than in all other countries in the world combined. In American homes alone, that is, not even counting military stocks.

Historically, the industry's business was quite cyclical, as the life of a firearm can easily span several decades. But at the turn of the century, or more precisely over the past 15 years or so, sales have tended to follow a pattern of continuous growth. The two real triggers were the repeal of the Federal Assault Ban (which restricted the sale of assault rifles) and the fear that the rules would become stricter because of the strengthening of the progressive political tide with each mass killing.

A constitutional right

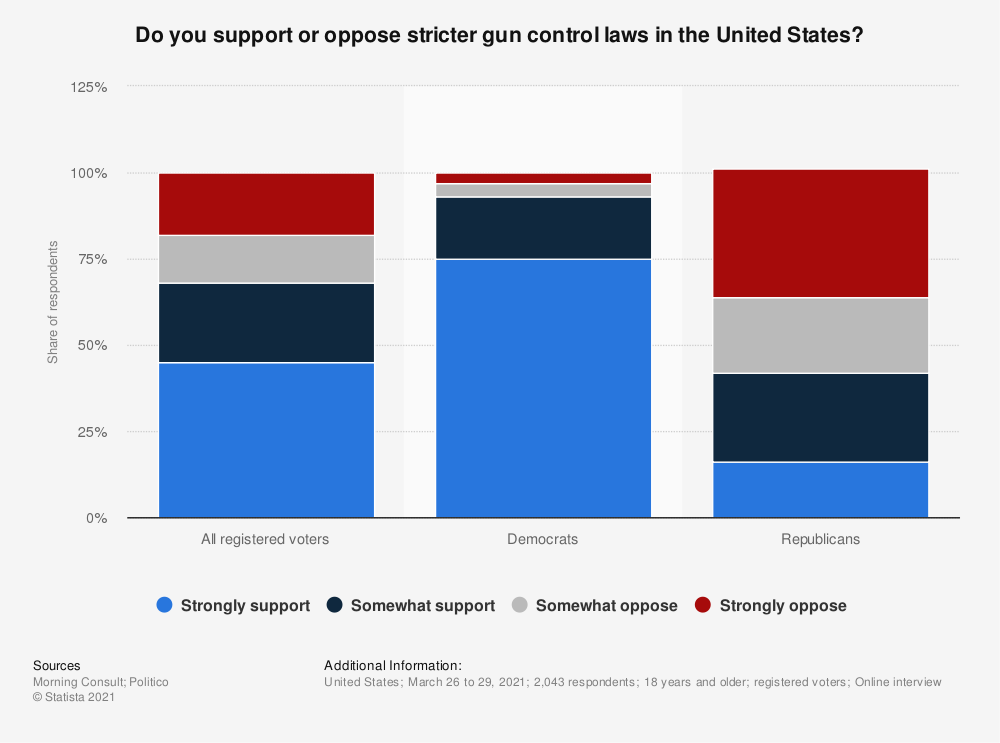

The recent massacre in Uvalde, Texas, has of course reignited the debate. In the Democratic camp, the entire political staff has come out in favor of revising the legislation, joined by some Republican elements and, above all, by an ever-growing share of public opinion. The subject is extremely sensitive because it is constitutional and emblematic of the sanctity of individual liberties in America. The reference text is the second amendment of the United States Constitution, which is part of the ten amendments voted in 1791. It is therefore set in stone and reads: "A well regulated militia being necessary to the security of a free state, the right of the people to keep and bear arms shall not be infringed

.

This ubiquity of firearms is the cause of recurring killings, but also of a certain form of trivialization. A telling anecdote: there were 69 shootings over the first weekend of June in Chicago alone, and more than 350 wounded in the country since Friday. Everywhere else, this would be considered the news of a country at war, but it is "business as usual" in the United States. In any case, for contrarian investors with no ideological preconceptions on the subject, it makes sense to look at the financial and operational dynamics as well as the extraordinarily depressed valuations (due to legislative risk and cyclicality) of the two pure player arms manufacturers listed in the US: Smith & Wesson and Sturm, Ruger & Company.

Both companies have similar profiles: they have focused their activities on the design of handguns and shoulder arms, selling their less lucrative divisions (such as their outdoor textile brands) and concentrating their capital allocation strategy on shareholder remuneration (dividends and share buybacks). This positioning is undoubtedly motivated by the setbacks of the industry, with a multitude of bankruptcies over the last fifty years, as well as by the poor performance of Remington (controlled by the private equity firm Cerberus), which had opted for an ineffective external growth strategy.

Sturm, Ruger & Co (RGR): over the last 15 years (2006-2021), the group's sales have increased more than fourfold, to $731m. Operating margins have risen from the 3-4% range to over 20% in the same period. The number of shares has been reduced by a quarter and the dividend has been increased tenfold. In other words, the company is in better shape in 2021 than it was at the beginning of the century. The financial position is excellent, with cash flow alone covering more than three times total liabilities. Return on equity is stratospheric despite overcapitalization and lack of leverage. As for inventories, their turnover rate is staggering, with inventories turning over fifteen times a year, which is higher than in the retail sector. Smith & Wesson (SWBI): better known than Sturm, although not as large on the stock market, it has had a comparable dynamic for the last fifteen years. Beware, however, of the atypical fiscal year 2021, with an extremely pronounced "post-pandemic" / "return to outdoor" effect. Normalized sales are closer to those of Sturm, as is the normalized margin, since Smith & Wesson left the fold of American Outdoor Brands. On the other hand, the number of shares is up by a fifth, the company has only been paying dividends since this year, and the balance sheet is less impressive, though also solid. Margins are a bit more volatile, while stocks are turning over slower than those of the competitor.

All in all, it is clear that historically SWBI's management was less inspired than RGR's, due to detrimental diversification. But the management has learned its lesson and now promises to rectify the situation. Beyond the controversial activity, RGR's business model is a kind of investor's dream: the operational and financial dynamics are exceptional, the brands are renowned. All this at six times profit in 2021. For SWBI, we are close to a PER of three. But we must also put this into perspective: 2021 was a completely atypical year and the sector was already coming out of a multi-year arms rush, due to social unrest, fears of new restrictive regulations and the disappearance of the aforementioned 2007 Federal Assault Ban.

.

Pressure is mounting on the sector

Going forward, the picture is likely to be less favorable, as the rate of equipment is at record levels and stricter controls on sales are expected after the numerous mass killings in the country. But one should be careful not to believe that the answer to this question is binary, especially with a European reading of the issue. Some mischievous minds could also invoke a fate similar to what has been seen with the tobacco industry, where the more regulations and bans there are, the more the profits of cigarette manufacturers increase thanks to their unparalleled pricing power.

As you can see, these issues are at the heart of the controversy and will not be included in MarketScreener's US portfolio. Interested investors should be careful not to extrapolate the multiples obtained on a previous year that was quite out of the ordinary.

By

By