Let's have a look at the performance of three large supermarkets chains over the last ten fiscal years: Britain's Tesco, France's Carrefour and America's Walmart.

Tesco and Carrefour have comparable valuations, around €30 billion, including debt. Both have a similar capital structure (debt/equity ratio), although Tesco has slightly less debt.

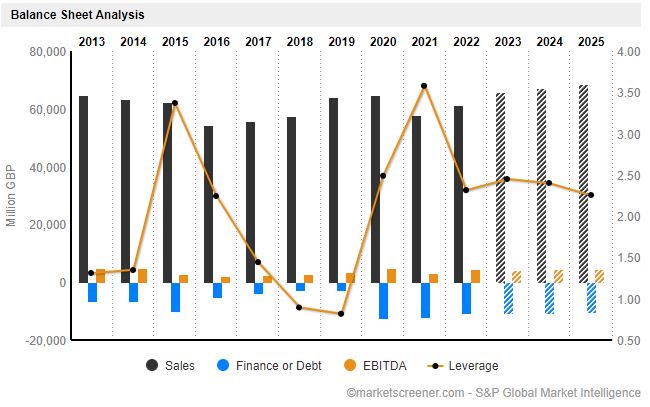

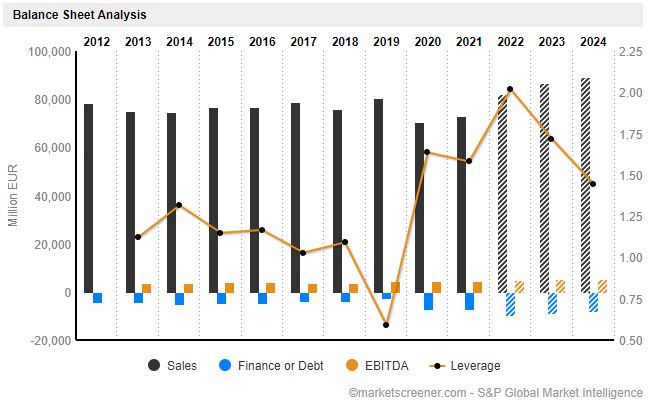

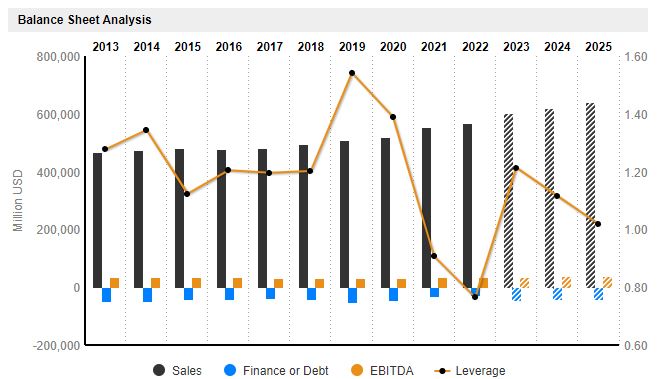

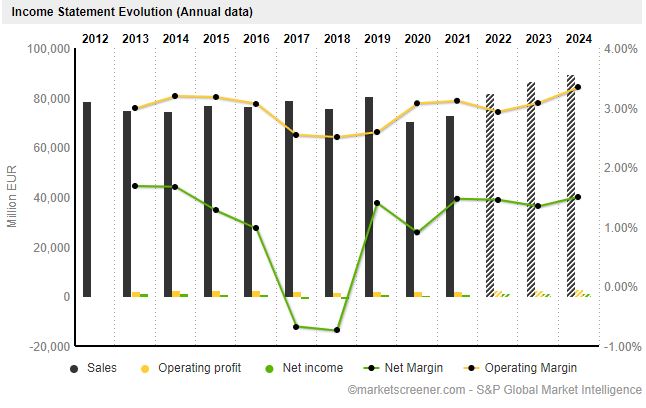

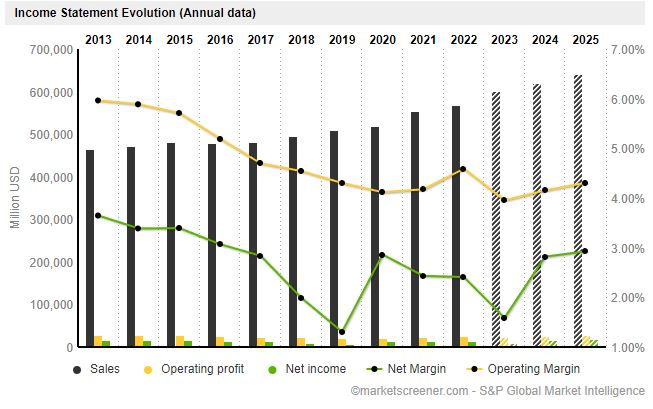

The British supermarket chain has gone from £63B to £60 over the decade, while Carrefour went from €75B to €72B. The evolution is therefore comparable and can be explained, among other things, by increased competition and a rationalization of the geographical footprint of the two retailers. We are therefore faced with mature companies that are in slight decline. Walmart does not have this problem, as its sales have gone from $446B to $573B!

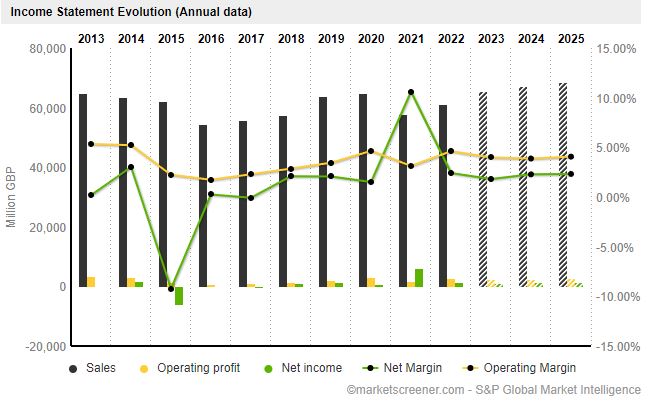

When it comes to operating margins, Tesco is doing almost as well as Wal-Mart, at 4-5% on average, while Carrefour remains at 3%. However, the French retail market is exceptionally competitive, much more so than the UK market. Wal-Mart, on the other hand, has the advantage of an uncommon scale in the world's largest consumer market... As well as a dominant position in several Southern and Midwestern states.

Tesco's share capital increased from 6.3 billion to 7.7 billion over the period, while Carrefour's share capital rose from 659 million to 791 million. The evolution is therefore similar, more or less +20%. On the other hand, Wal-Mart is a "cannibal" that aggressively buys back its shares and therefore saw its number of shares in circulation decrease from 3.6 billion to 2.8 billion.

The impact of share buybacks

Tesco's earnings per share are erratic, but the increase in the number of shares coupled with a fall in operating margins over the cycle gives an average EPS of £0.1 and an aggregate of £1.16 over the ten years combined. At Carrefour, we have an average EPS of €0.95 and aggregate of €10. If we relate these averages to their current prices, Tesco shares trade at nearly x25 their average EPS over the last cycle, vs. x16 for Carrefour. WalMart's average EPS of $4.4 over the cycle, at the current share price, is x33!

Walmart manages to maintain a somewhat constant EPS thanks to share buybacks, because its operating margins are decreasing over the cycle due to a competitive pressure that has increased in the US over the last ten years with the emergence of the "premium groceries" segment and Target's very intelligent development strategy in the suburban areas. We can see here how, in a mature business, share buybacks can serve as a "crutch".

In terms of balance sheets, Tesco and Carrefour are about equal, with roughly €12 billion of net debt each and €30-35 billion of tangible assets. For the rest, Tesco's net debt represents 4 years of operating profit (EBIT), Carrefour's 5 or 6 years, so the advantage here goes to Tesco. At Walmart we are on a net debt/EBIT ratio of 2.

The average ROE at Tesco is 8% over the cycle, which is slightly higher than Carrefour despite a lower leverage. So here again, the British chain wins. And once again Walmart is in another sphere with an ROE firmly anchored at 18% on average.

Walmart in a league of its own

But it's also important to look at cash flows, what do they tell us? Tesco generates a total of £13B in FCF over the past decade, or £1.3B per year on average. It paid out 2/3 of this in dividends. For its part, Carrefour generated €11.2B, or €1.1B on average per fiscal year. All in all, this is quite similar. The French group, on the other hand, has only been able to pay €2.7B in dividends to its shareholders, as it has mainly focused on reducing its debt, which had reached a critical level about ten years ago. WalMart generated $180B in FCF over the cycle, or $18B per year on average. Of this amount, $130B was returned to shareholders, half in dividends and half in share buybacks.

Looking back is good, as it allows us to know where we came from and what the dynamics were, but looking forward is essential, so let's have a look at the rich free forward data available via MarketScreener, and talk about valuations! Tesco has a dividend yield of 4.3% and a going forward PER of x13. Carrefour has a yield of 3.5% and a going forward PER of x12. WalMart is again in another league, with a forward P/E two to three times higher (adjusted for exceptional items in the current year) and a yield of 1.56%.

Overall, these supermarkets might not be the best place to invest right now. Inflation has hit their profit hard last year, with Tesco showing an operating profit down 10% when it unveiled its interim results for 2022. However, Tesco remains significantly more interesting than Carrefour, even though both face strong headwinds, have low profitability and still a lot of debt. As for Wall Mart, although it is the largest company in the world when it comes to revenues, from a value perspective, it remains too expensive.

By

By