The American company, which specializes in technological equipment, especially for the aeronautics industry, is offering a price of 800 pence per share. It said the two groups are complementary and the deal will allow it to significantly strengthen its aerospace business.

But this is a sensitive case, since Meggit has signed many contracts with the British government, particularly in the defense sector. The government could see this as a potential risk and decide to block the deal. To reassure authorities, the American group pledged to keep Meggitt's technology, plants and headquarters in the country. It added that most of Meggitt's Board of Directors will be British nationals.

This is the latest episode in a series of takeovers of British companies by foreign groups, since they are considered cheap. Just a few days ago, equipment manufacturer Ultra Electronics was the target of a takeover bid by defense group Cobham. The takeover of chip designer Arm by US chip company Nvidia is also scrutinized by the government.

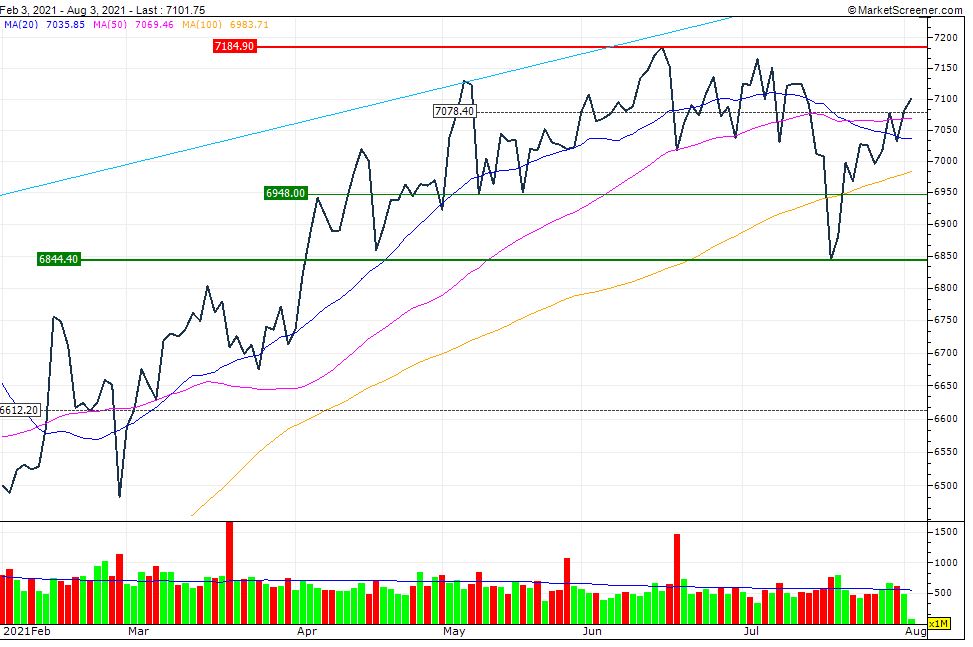

The FTSE 100 is up 0.3% this morning, led by energy giant BP and lender Standard Chartered after they both reported good results.

FTSE 100 over 6 months

Things to read:

China’s young ‘lie flat’ instead of accepting stress (Financial Times)

By

By