Investors choose ESG funds when they want to support sustainable businesses. However, those same investors still need a long-term return that allows them to reach their financial goals.

This might prompt some investors to ask, “just how long does it take for the financial benefits of sustainable business practices to be reflected in share price returns?” This question is important because research published in Business Strategy and the Environment shows that “causality between environmental performance and financial performance depends on the time horizon.”

The idea that ESG practices drive long-term financial performance is supported by the Porter Hypothesis which posits that environmental regulation spurs efficiency and innovation as firms strive to find new practices and technologies to reduce harm to the environment.

Importantly, this theory argues that this financial outperformance more than covers the cost of those innovations. The problem is that this process takes time and investors - even long-term ones - can only wait so long.

How long does it take for ESG practices to yield financial benefits?

Research from the Institute of Materials Resource Management shows that an increased commitment to corporate environmental performance leads to financial benefits after 2 years. Moreover, the analysis shows that this effect holds over longer periods like 3 years and 5 years.

Additional Research from the Journal of Sustainable Finance & Investment found that “strong CSR [corporate social responsibility] significantly outperform firms with weak CSR in the mid and long run in certain areas. Firm returns increase up to 3.8% with respect to a one-standard-deviation increase of the CSR rating.”

The research also shows that the primary link between a commitment to corporate social responsibility and stock returns is additional cash flow. When the researchers broke down how each aspect of ESG performed they concluded that:

- Environment activities yield positive mid-term and long-term abnormal returns amounting to a 3.03% over years three to five years

- Social activities yield positive abnormal returns amounting to a 2.53% over years one, two, and five

- Governance activities yield negative abnormal returns in the years one to three

Do markets value companies with long term commitments?

The strong performance of ESG companies over the long-term is about more than generating additional cash flow and achieving operational efficiency.

Strong performance among ESG companies is also due to the simple fact that the market generally values companies that have this kind of long-term approach to management.

Consider research from the Journal of Applied Corporate Finance showing that “long-term plans are associated with abnormal market reactions for both stock prices and trading volumes.”

These findings illustrate an important point for investors: benefitting from the potential outperformance of ESG means having the willingness to wait for the rewards. The effective business practices of most ESG companies requires time to be reflected in revenues and earnings.

How has ESG performed against non-ESG competitors over the long term?

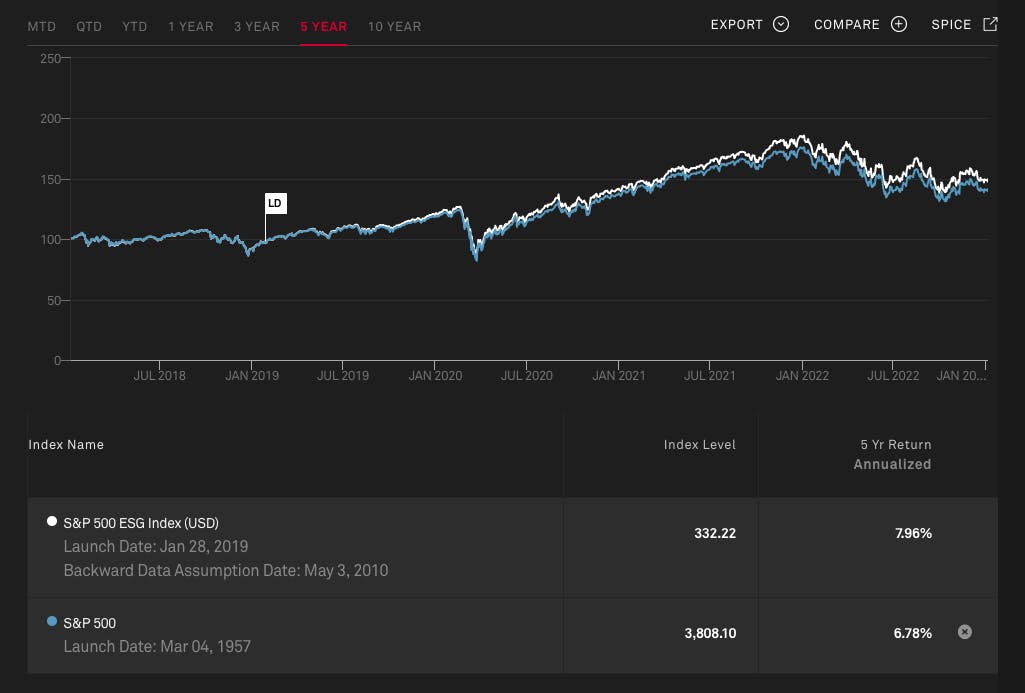

The below chart shows the slight, but noticeable, gradual divergence in performance between the S&P 500 ESG Index and the S&P 500.

Starting from its launch date (“LD”) of Jan 28, 2019, the S&P 500 ESG Index appears to start showing slight outperformance around the end of July 2019.

Source: S&P Global

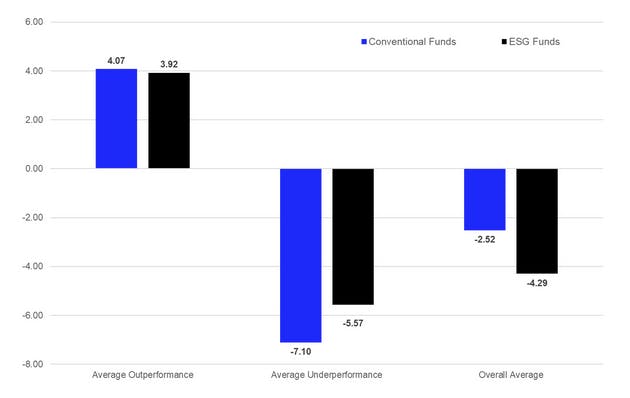

Additional research shows that while down years are worse for sustainable funds relative to non-ESG funds, up years generate better performance relative to those same benchmarks.

The potential for strong long-term returns from ESG investments might explain why a Russell Investments survey of asset managers determined that 82% of U.S.-based respondents incorporate ESG information in their investment process. The same survey found that this percentage gets close to 100% in the UK and Europe.

An analysis of 24,207 conventional (non-ESG) and 7,022 ESG-related equity funds shows that the ESG funds experienced lower downside performance in comparison to their conventional peers.

This performance spans the turbulent first six months of 2022 when the S&P 500 fell approximately 20%.

Source: Seeking Alpha

Financial performance, however, is only one reason managers are focusing on ESG funds for their clients. They are also targeting these holdings because clients increasingly want to see their values reflected in their portfolios. Nearly three-quarters (73%) of US investors state that their personal values influence their investment decisions according to a 2022 survey from Charles Schwab.

The younger the group surveyed, the more respondents cited that their values guided their asset choices. The highest percentage (82%) was among Gen Z, followed by 70% for Millennials, 70% for Gen X, and 64% for Baby Boomers.

The bottom line: ESG investing is here to stay. As younger generations age into their prime investing years they will continue to gravitate towards ESG funds. With a longer time horizon, these younger generations will likely be more willing to allow these investments the time they need to deliver on their full value potential.

Please note this article is for information purposes only and does not in any way constitute investment advice. It is essential that you seek advice from a registered financial professional prior to making any investment decision.