It has been an important week for Fixed Income investors, and indeed the markets as a whole. The last week of November saw speeches from the FED, new inflation readings throughout Europe, and unemployment data.

Jay Powell’s speech on Nov 30th at the Hutchins Center on Fiscal and Monetary Policy was an overall positive event for the markets, though he outlined the same uncertainties regarding inflation, as in previous communications. There was however one difference, which both equity and fixed income markets picked up on; the slowing pace of rate hikes. With core inflation now forecast at 5%, having come down to its December 2021 level, the Fed believes it is now appropriate to lower the magnitude of future rate hikes, and has all but committed to a 0.5% hike at the next meeting.

Fixed income markets rallied in the days following the comments, with the 10-year treasury yield touching 3.53% on Dec 2nd, the lowest since early September. Likewise, the price of 20-year treasuries has increased by 4.5% since Powell’s comments, as can be observed in the TLT ETF.

Investment grade and high yield bond ETFs also rallied in the days following the speech, with increases of 1.05% and 0.85% respectively, as illustrated by LQD and HYG.

European inflation shows signs of easing but uncertainties about hikes remain

Inflation data for the European Union was also released on Nov 30th and showed moderating inflation in Germany and Spain, echoing comments from the Spanish Economy Minister, Nadia Calvino, who advised Spain’s own inflation situation is quite different from the rest of the EU. The economic fragmentation of the EU zone makes the ECB’s job much tougher, as explored in a previous article which can be read here.

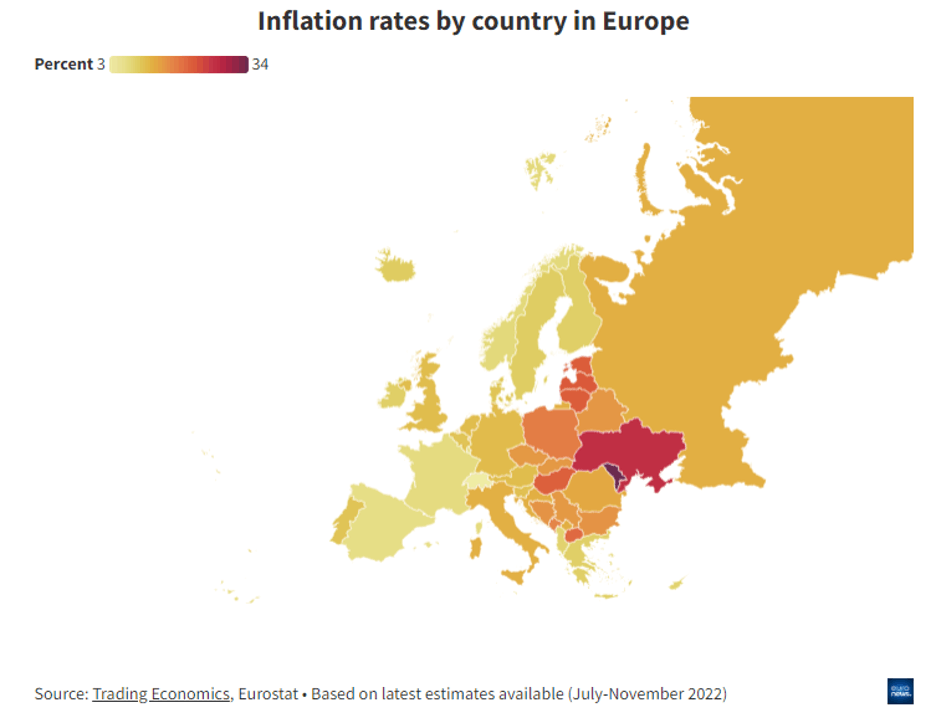

Despite the overall level of inflation across the zone dropping close to 10%, there is a wide divergence in the individual inflation rates experienced by various member states. On the one hand, there are countries like Spain and France, representing 25% of the EU’s GDP, where inflation rates are significantly below the 10% average. On the other, there are countries such as Germany, Austria, Poland and Hungary with Inflation rates far above the 10% average and representing +30% of the EU’s GDP:

All of this leaves the ECB with a dilemma on the forward path of interest hikes, causing even its own top economists to engage in public debates on the topic. The ECB's chief economists, Isabel Schnabel and Philip Lane have sparred over the projections for interest hikes and inflation rates, and have caused even more uncertainty for investors looking to nibble at European equities or fixed income.

One thing is clear, however; the ECB has more work to do than the FED. Whereas the FED is beginning to pump the brakes on the pace of hikes as a result of a clearer downward trend in inflationary pressures, the ECB is still engaged in fiery internal debates on the possible paths forward. European investors will have to exercise patience and caution for a little while longer when considering European fixed income or equity ETFs.

The ECB’s head, Christine Lagarde hinted in September that she expects inflation to remain relatively stable - around the 10% level - for the next quarter, with energy prices remaining elevated across the continent. Economists polled by Reuters, however, see a moderation in prices, with a projected 8.5% inflation by year-end, followed by declines to 6% and 2.3% in 2023 and 2024.

Low-duration fixed income assets may be one way to gain exposure to the European bond market, in order to limit the downside caused by higher future rates. Trackinsight’s ETF screener is an effective way to search and compare funds that meet your specific objectives. Alternatively, the following ETFs provide access to government bonds with maturities between 1-3 years for exposure with lower risk:

- iShares € Govt Bond 1-3yr UCITS ETF (IBGS)

- Lyxor Euro Government Bond 1-3Y (DR) UCITS ETF (MTA)

- Deka iBoxx € Liquid Sovereign Diversified 1-3 UCITS ETF (ETFES13)