|

|

| This week's gainers and losers |

|

|

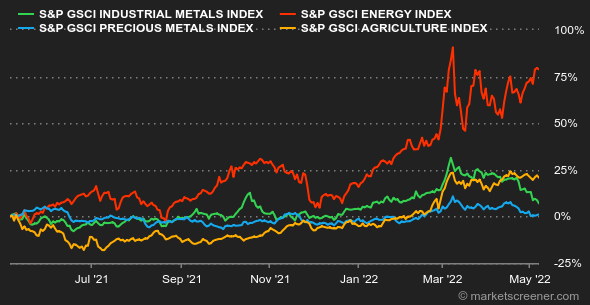

| Commodities |

|

Buying excitement remains intact in the oil markets, still supported by a potential Russian oil embargo in Europe despite opposition from a handful of EU members, such as Hungary. In parallel, OPEC+ has once again decided to stick to its roadmap, which consists of slightly increasing its production, a choice supported by the many risks weighing on demand. The enlarged cartel is expected to increase its supply by 432,000 barrels per day starting in June, a target that will probably not be met since OPEC+ is already struggling to meet its production quotas. In terms of prices, Brent crude is trading near USD 110 per barrel while the US benchmark, WTI, is trading around USD 109. A bearish weekly sequence for industrial metals, whose prices are still sensitive to blockages related to the coronavirus in China. In this regard, the sharp contraction in China's manufacturing PMI in April reinforced concerns about the demand dynamics of the world's largest consumer of metals. As a result, copper is trading lower at USD 9540, as is aluminum at USD 2916. Nickel is also losing ground at USD 30190 per tonne. Despite the clear rise in risk aversion, prices of the barbarian relic are struggling to gain traction. Gold prices are still trading below USD 1900 per ounce. Grain prices remain generally well oriented. The lack of rain in Europe could have an impact on the development of crops, especially wheat and corn. In Chicago, the price of wheat recovered to 1110 cents per bushel. On the other hand, corn lost some ground at 780 cents. |

|

| Macroeconomics |

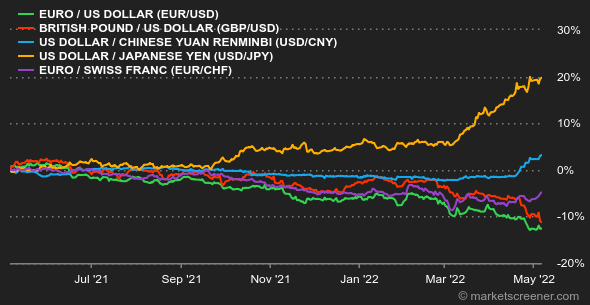

| Atmosphere: It said it, it did it. The U.S. central bank raised rates by 50 basis points at its May meeting, effectively recognizing the need to aggressively fight inflation. The Fed will continue to tighten, but does not plan to accelerate further to the 75 basis point pace at the June meeting. Investors interpreted this as a rather positive signal... but the joy was short-lived. They were quickly overtaken by the fear of the consequences on the economy of a forced monetary normalization, especially since the Fed will also start reducing its balance sheet in early July. Interest rates: This time, bond yields have well integrated the trajectory of US monetary policy. The 10-year T-Bond is paying 3.12%, up from 2.86% a week ago. The rise also continues in Europe: on 10 years, the German Bund pays 1.11%, the French OAT 1.63% and the British Gilt almost 2%. Italian debt has a yield of 3.12%. The Bank of England raised its rates on Thursday, as expected. As for the ECB, the debate is raging between those who think it should rush to do the same, and those who fear that it could cause an economic exit. Currencies: The British pound suffered this week as the Bank of England, while raising rates, openly expressed fears of recession. The euro remains under pressure at USD 1.0565, although slightly higher than last week's level. Cryptocurrencies: In this economic slump, bitcoin, considered a risk asset, is obviously not spared from market nervousness. In the wake of the leading US indices, especially the Nasdaq with which it is highly correlated, the price of the digital currency is falling by more than 5% this week and is back to hovering around the $36,000 level at the time of writing. After six consecutive weeks of decline, bitcoiners are having a tough time. Calendar: The inflation drama continues next week with the April US consumer (Wednesday) and producer (Thursday) prices. While the market hasn't completely ruled out a massive 0.75% Fed rate hike in June, these numbers will have a strong influence on investors. |

|

|

| Things to read this week | ||

|

|

*The weekly movements of indexes and stocks displayed on the dashboard are related to the period ranging from the open on Monday to the sending time of this newsletter on Friday. The weekly movements of commodities, precious metals and currencies displayed on the dashboard are related to a 7-day rolling period from Friday to Friday, until the sending time of this newsletter. These assets continue to quote on weekends. |

By

By