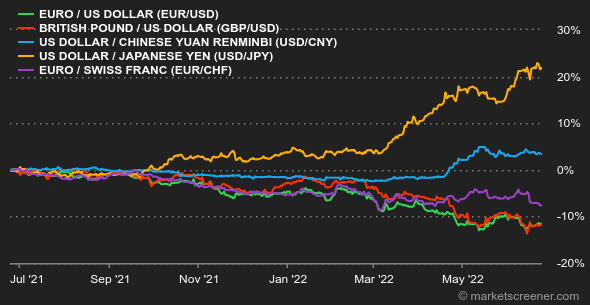

Atmosphere: Two rooms, two atmospheres. Macroeconomic statistics are not necessarily in line with the clear rebound of stock market indexes this week. The Flash PMI indicators, the barometer of corporate purchasing managers, are in clear decline between May and June in Germany, France and the United States especially. This week, investors have stopped panicking at every offensive statement from central banks. They have regained the taste of risk, on hopes of cheap buybacks mixed with bets on a less punishing rate hike trajectory than expected. A fragile stock market rebound that gained strength throughout the week. Interest rates: The yield on U.S. government bonds continued to fall, returning to around 3.10%. In other words, investors believe that the Fed will not have to raise rates as high as they feared ten days ago. An optimistic reading is because the central bank is winning its battle against inflation. A more cynical view might be that the upcoming recession will force the Fed to take its foot off the brake anyway. Traders are more nervous, the 5-year yield is still a little higher than the 10-year. In Europe, the German Bund has eased to 1.48% compared to last week, although it is in a bit of a recovery phase at the end of the week. The French OAT is paying 2.02% and the Italian signature is at 3.48%, a spread that is up 200 points with Germany. Currencies: The EUR/USD pair is hardly moving at USD 1.0551. The Swiss franc continued to rise against the euro, reaching CHF 1.0075 for EUR 1. This was due to the aftermath of the Swiss National Bank's somewhat unexpected double rate hike the week before. Last week, UBS expected a return to parity within a few weeks. "The SNB has a more convincing tightening strategy than the ECB," the bank said. Both currencies continue to slide against the ruble, which is about 30% above its levels of the beginning of the year against them. Vladimir Putin's gamble to force Westerners to pay their energy bills in rubles is paying off for now. Cryptocurrencies: For its part, bitcoin is just about even on a week, around $21,000 at the time of writing. After losing nearly 35% of its capitalization since the beginning of June, the digital currency is back gravitating to a price area that represents the peak of the 2017 bull market. In a macroeconomic environment that remains unfavorable for risky assets, crypto-investors may still be in for a scare before they see bitcoin reverse its downward trend. Calendar: Top central bankers are attending an ECB event in Portugal on Wednesday. A discussion will even mix Christine Lagarde, Andrew Baley and Jerome Powell that day at 3:30 pm. The US consumer confidence index will be published on Tuesday and German inflation for June on Wednesday (to see how the ECB will be eating us up in the coming weeks). On Thursday, we'll be looking at PCE inflation in the United States, an indicator that the Fed closely follows in order to conduct its monetary policy. |

By

By