Atmosphere: Investors are clinging to two main strands, looser monetary policies on the one hand and the hope of an upturn in China on the other. This is not stopping central bankers in Europe and the US from trying to calm down the prevailing optimism. The market is not listening much, either on the equity or bond side. For the time being, the renewed confidence in China is mainly fueled by investors' intuition rather than by tangible signals, apart from the mechanical improvement of the situation caused by the end of the zero-covid policy.

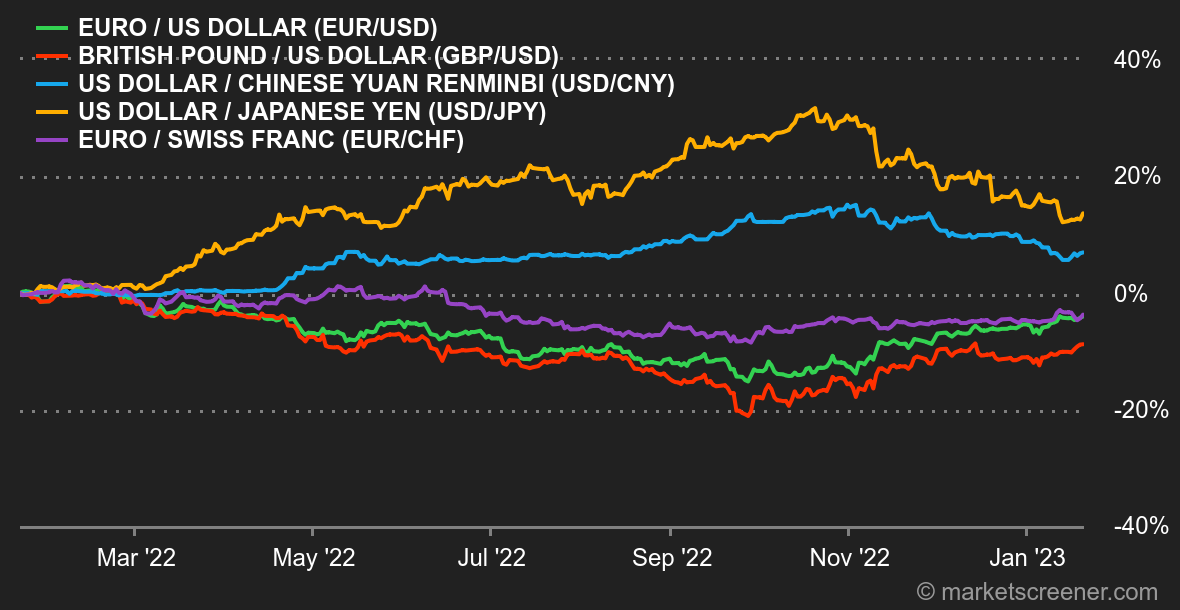

Currencies: The maintenance of the status quo on Japanese monetary policy has weighed on the yen, which is trading at JPY 129 per USD 1, whereas it was closer to JPY 128 at the beginning of the week. There was no violent movement, however. On the weekly sequence, it is the British pound that stands out. Cable has rallied to 1.2360 USD per GBP as the market anticipates the Bank of England to maintain a tight policy stance where it sees the Fed and ECB wavering on what to do. Wage growth in the UK is higher than elsewhere, raising fears of an inflationary spiral. The euro, meanwhile, is trading at USD 1.0848 and CHF 0.9963.

Rates: At the end of a shortened week in the United States due to Martin Luther King Day last Monday and in the absence of major macroeconomic data, the bond markets continued their decline. After stumbling on 3.90% at the beginning of the month, the US 10-year yield tested its December lows around 3.40/3.35%. This support zone, which also corresponds to the bottom of the ascending channel that has been in place since March 2022, will be the main focus for the next few weeks. For its part, the yield on the German 10-year bond came close to 1.93% without reaching it, at least for the time being, and is once again in contact with its 34-day moving average, a stopper around 2.16%. Next week will be marked by the publication of the U.S. GDP for the fourth quarter as well as household spending. Watch this space.

Cryptocurrencies: Bitcoin has had its best start to the year since 2015, regaining more than 28% since January 1. After experiencing a real explosion the week before, the digital currency is stabilizing by clawing back 1% this week, and is hovering around $21,000 as of this writing. For its part, the overall capitalization of the crypto-currency market is slowly approaching $1,000 billion. On the other hand, although the recent rebound is cheering up crypto-investors, the market is still far from turning things around after a disastrous 2022.

Calendar: In Asia, the week will be marked by the Lunar New Year: mainland Chinese stock markets are closed all week, while Hong Kong will only open on Thursday and Friday. The first Western PMI indicators of the year 2023 are expected on Tuesday. In Germany, the Ifo confidence index for January will be published on Wednesday. The weekend will be dedicated to the United States: first estimate of Q4 2022 GDP and durable goods orders on Thursday, then PCE inflation and second reading of the University of Michigan confidence index on Friday.

|

By

By