Atmosphere: Are central banks overplaying the threat of rate hikes to avoid having to implement them in full? This is the scenario that investors seem to favor and that fueled the rebound earlier this week. But the fear of a recession and its consequences remains at the top of the risk pile. In the weeks to come, the strength of the U.S. consumer will need to be closely monitored. The consumer is part of the Fed's current bet: if he can keep spending until rate hikes - or threats of rate hikes, you guessed it - have calmed inflation, the bet for a soft landing could be won. Still a lot of conditional in there.

Interest rates: The mood change is confirmed on US bond rates, with a big slide in yields on 5 and 10-year maturities. The 10-year T-Bond is yielding 2.91% versus 3.10% a week ago. Fears of recession have pushed the 6-month maturity up to 2.48%. In Europe, easing is also on the cards with the German Bund yielding 1.26% on 10 years compared to 1.48% last week. The French OAT went from 2% to 1.83%. The signatures of southern Europe are also experiencing significant embellishments.

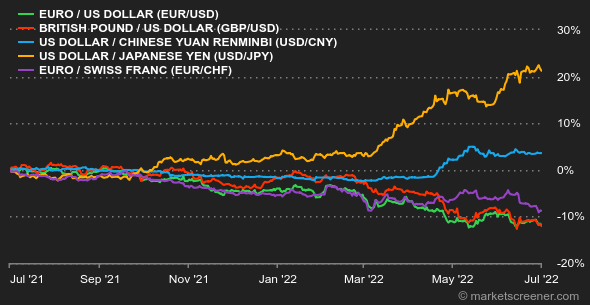

Currencies: The U.S. dollar showed its strength over the past week, with gains against the British pound, the euro and the Australian dollar. The current picture is "very nervous and fragile, as fears of a global recession grow and the dollar could still benefit from its safe-haven status," Unicredit traders said. During the first half of the year, the most notable movements were the sharp strengthening of the dollar against the yen, at JPY 135.40 to the USD, and the slide of the British pound against the dollar (USD 1.1999 to the GBP). And the surprise strengthening of the ruble, which is trading at 54.87 RUB for 1 USD, a slide of more than 30% for the greenback. As for the EUR/USD pair, it is around 1.04 USD for 1 EUR, a return to the lows hit twice this year for the single currency, mid-May and mid-June.

Cryptocurrencies: Bitcoin, meanwhile, just closed June with a -37% underperformance, recording its worst quarter since 2011. The digital currency continues its fall that began in November 2021 and is now sailing at the $19,000 level as of this writing. Bitcoin is still not out of the woods in this still very deteriorated macroeconomic environment and may yet put the nerves of crypto-investors to the test during this summer season.

Calendar: The EU will publish its new economic forecasts on July 6, the same day as the minutes of the last Fed meeting. In the US, the June employment figures will be the focus of attention on Friday July 8. Until then, American investors will enjoy a weekend extended by the national holiday of July 4, Monday.

|

By

By