|

Monday June 21 | Weekly market update |

| The Federal Reserve is very active at the moment. In addition to keeping rates unchanged and maintaining securities purchases, it hammered home the fact that the surge in inflation is meant to be transitory (3.4% in 2021 and 2.1% in 2022), not justifying a rate hike before 2023. As for the asset repurchase program, it is still too early for tapering and the Fed will give advance warning. Financial markets are showing some signs of feverishness after these announcements, as seen in the clearings on Friday. |

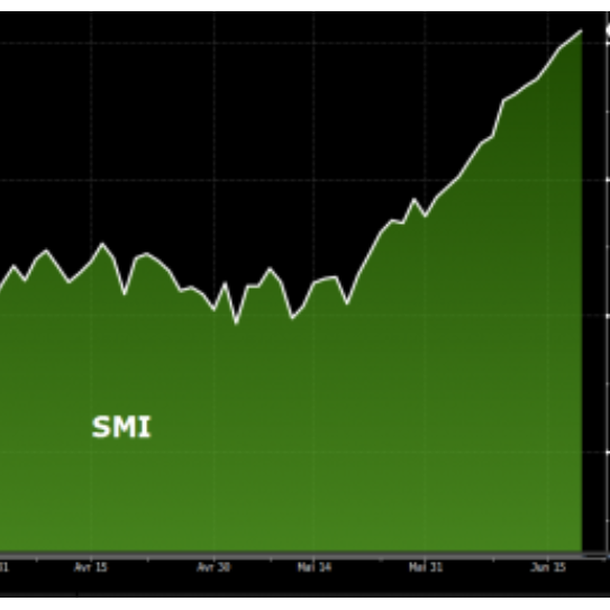

| Indexes In this latest weekly sequence, Asia continues to lag. The Nikkei was stable for the second week in a row, the Hang Seng lost 0.3% and the Shanghai Composite 1.8%. In Europe, the CAC40 ended down 0.5%, thanks in particular to the good performance of the luxury goods sector. Its German counterpart, the DAX, lost 1.6% and the Footsie fell by 1.3%. For the peripheral countries of the euro zone, Spain lost 2.1%, Portugal 1.6% and Italy 1.2%. The SMI is accelerating upwards, with an increase of 1.1% over the last five days, boosted by the return in strength of the three heavyweights of the index: Roche, Nestlé Novartis (see chart). In the United States, the Dow Jones is looking grim, with a weekly decline of 3.2% and the S&P500 is losing 1.5%. Sectoral arbitrage continues to benefit technology stocks, with the Nasdaq100 climbing another 0.7% on the week. Acceleration of the SMI index over the last 6 months  |

| Commodities The price of a barrel of WTI returned to peaks dating back to 2018, before marking a slight consolidation under the effect of the appreciation of the dollar. U.S. crude is trading around $71.5. Brent is trading at $73.5. The Fed, which was the catalyst for the week, showed its optimism. The rise in the dollar has put downward pressure on gold. The yellow metal has lost nearly 5% over the past 5 days. A reaction seen as a bit of an overreaction for some. But with the Federal Reserve's expected rate hikes, the appeal of gold is not likely to improve, as this increases its cost of ownership. Overall, the commodities market continues to depress. Lumber is down 15% as supply chains improve. Grains are also losing ground: upcoming harvests are fueling supply and future weather forecasts are improving. The red metal is not immune either, with China cutting into its industrial metals inventory to curb prices. Copper is down 7.5%. Consolidation of raw materials over 1 month  |

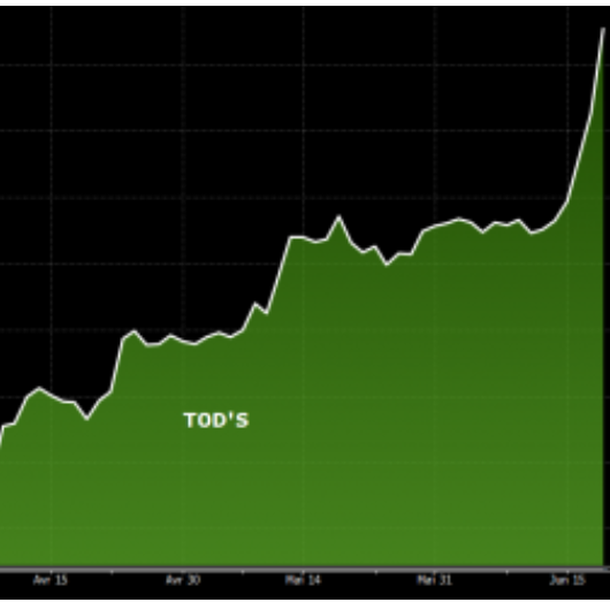

| Equity markets Tod's is an Italian specialist in footwear, leather goods and luxury apparel. The company, valued at 1.8 billion euros, is present in all world markets with more than 400 stores and four recognized brands: Tod's, Roger Vivier, Hogan and Fay. The Italian midcap has soared this week. A rally that has allowed it to gain nearly 30% since the close of last Friday ... without apparent justification. Investors are still enthusiastic about the prospects of the luxury industry. Add to that speculation about a potential takeover of Tod's, which seems to be the perfect target for the giant LVMH. Bernard Arnaud's group recently increased its stake from 3.5% to 10% to support the shareholder family. At this stage, Tod's is keen on its independence - both parties have reiterated this - but in the medium term, everything remains possible. The share price has almost doubled since the beginning of the year (+98%). The company is highly valued, despite a negative net result in 2020. The estimated P/E for 2023 is 90. But when the speculative flavor gets involved... Tod's stock soars  |

| Bond market The consequences of the Fed's decision are everywhere. Even on the bond market, of course. But paradoxically, these announcements did not cause the rise in yields that some had feared, with the US 10-year moving around 1.5%. "After a turbulent week, we expect the next few days to be marked by a modest rise in US real rates, to which EGB yields should remain fairly immune," says Unicredit. In Europe, the German Bund remains in negative territory at -0.2% and the French OAT stands at 0.15%. The 10-year debt of southern European countries was little changed, ranging from 0.41% in Portugal to 0.83% for Italy. |

| Foreign exchange market Investors were unsure of where they stood with the U.S. central bank's June meeting. Finally, the Fed tightened its timetable for monetary policy changes. In response to solid growth and robust inflation, it told the market that it will begin raising rates in 2023 rather than 2024. This will give the dollar some strength against the euro. The greenback has moved out of the 1.21/1.22 area and back up to USD 1.188 per 1 EUR. We find this strength against most major currencies. A few words on the Swiss franc after the SNB meeting on Thursday. The central bank removed the prospect of a rate hike, leaving the CHF down against the Chinese (at CHF 0.14241 per CNY 1) and US (at CHF 0.91739 per USD 1) currencies. In contrast, the EUR/CHF pair was little changed at CHF 1.09344. |

| Economic calendar Statistics were scarce in the Eurozone last week. Industrial production rose by 0.8% and the CPI by 2% (+1% excluding food and energy). For France and Germany, the CPI was in line with expectations, at +0.3% and +0.5% respectively. In the US, most figures disappointed. The PPI index rose by 0.8%, import prices by 1.1%, retail sales fell by 1.3%, building permits and housing starts were below expectations, and weekly jobless claims rose to 412K. On the other hand, industrial production climbed 0.8% (0.1% last month) and the Phillyfed index beat the consensus at 30.7 (even though it was previously at 31.5). |

| An enigmatic scenario The Fed's announcement that it will raise rates in 2023 caused markets to sway slightly. This was not enough to upset indexes, some of which set new records last week (Nasdaq-100, CAC40). However, this news was greeted with a great deal of uncertainty from traders, who are hesitating about which sectors to focus on to protect themselves from inflation on the one hand and to anticipate the rise in rates on the other. This surprise may make for a more turbulent summer with a possible decrease in asset buybacks that could come sooner than expected. |

By

By