|

Monday September 28 | Weekly market update |

|

Risk aversion clearly made a comeback last week, with an increase in the number of Covid-19 contaminations in Europe, raising fears of new health restrictions and a marked impact on the economy. Financial markets have been heavily cleared, with the latest macroeconomic data pointing to a slowdown in the recovery. Nervousness remains palpable, all the more so with uncertainties surrounding Brexit and the US stimulus plan, and this as the earnings season and the US presidential elections loom. |

| Indexes Over the past week, all indices have lost ground. In Asia, the Nikkei is resisting, with a weekly loss of 0.67%. The Hang Seng fell by 5% and the Shanghai composite by 3.7%. In Europe, the CAC40 lost 5.3% over the week, the DAX 5.2% and the Footsie 3%. For the peripheral countries of the eurozone, Italy is down 4.3%, Spain 4.9% and Portugal 6%. In the United States, technology stocks are still nervous but the Nasdaq100 index manages to limit the damage, with a weekly gain of 0.3%. The Dow Jones fell by 3% and the S&P500 by 2.1%. The Nasdaq100 is making great strides on hinge areas  |

| Commodities The wait-and-see attitude is palpable across oil markets, torn between the decline in U.S. inventories and concerns about demand. The resumption of Libyan production and exports also weighed on the trend. US and European references are down, at USD 40 for WTI and USD 41.8 for Brent. The strength of the dollar and the recovery of real yields on US bonds are shaking the gold compartment. The gold metal recorded its worst week since August, falling by nearly 4% in five days to USD 1858. This decline is even more violent on silver, whose price dropped 13% over the week to USD 22.7. The time has come to correct the prices of the base metals compartment. Copper consolidates around USD 6538 per metric ton, nickel corrects to USD 14179, while aluminum plunges to USD 1697. Money comes back on an important support (38% Fibonacci retracement).  |

| Equities markets Snowflake Here is the story of two French entrepreneurs who have pulled the biggest IPO in history for a software company. If the adventure begins in 2012, it is on September 16 that Snowflake is listed on the stock exchange at the price of 120 dollars. After one week of listing on the NYSE, the digital storage and data processing specialist weighs 61 billion dollars. Such is the excitement for the company that Salesforce and Berkshire Hathaway will each invest $250 million in private placements at IPO prices. This is significant because Warren Buffett's company is not known for investing in young listed companies, especially in the technology sector. Probably because Snowflake is enjoying triple-digit growth. According to the SEC registration document, Snowflake's revenues increased from $104 million in the first half of 2019 to $242 million in H1 2020, an increase of 132.6%. To date, it has 3,117 customers with well-known brands such as Axa, Abode, Logitech and Asics... Nevertheless, the company has not yet recorded a quarter with a positive net result, due to significant development costs. |

| Bond market Some risk aversion has crept into the European bond market. Following the relatively disappointing results of the IFO index and the persistent fall in stock market indices, the yield of the ten-year Bund fell to -0.51% while that of the French OAT stabilized at -0.23%. Debt instruments issued by the southern periphery of the euro zone recorded slightly lower results than their core counterparts. Italy nevertheless maintained good ten-year borrowing conditions, with a rate of 0.87%, following the local elections. Outside the euro zone and still very much in demand, Swiss debt is treated on a -0.53% interest rate basis. In the United States, the Tbond strengthened slightly to 0.66%, as a consequence of the CBO's (Congressional Budget Office) assumptions on the negative evolution of the American debt. |

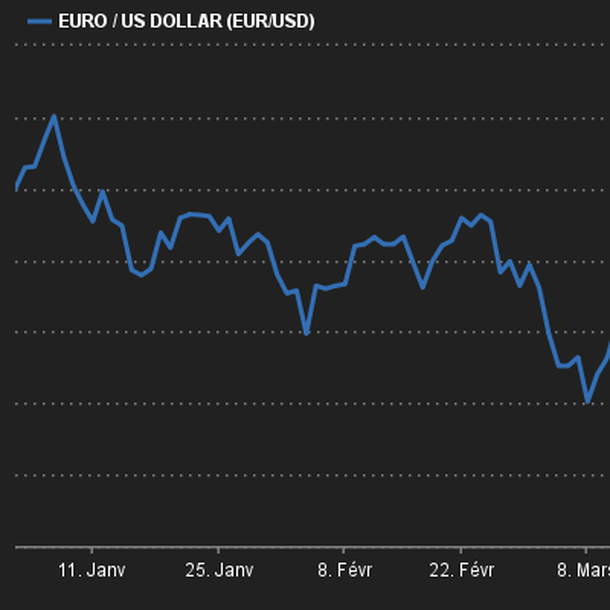

| Forex market The return to caution is largely benefiting safe-haven currencies, like the dollar, which is regaining ground against the single currency (+300 basis points) at USD 1,1660. The yen is one of the supports also sought after by forex traders, allowing the Japanese currency to appreciate by 250 basis points against the euro (JPY 122.75). The Japanese currency also flies against the Swiss franc at 0.875 CHF. The pound sterling, on the other hand, continues to suffer. The expected new restrictions for the UK, fears of a failure of Brexit negotiations and the prospect of a negative key interest rate weighed on the currency. The GBP/JPY pair lost 400 basis points to trade at JPY 134. The cable follows the same trend to trade at USD 1.27 from USD 1.30 a week earlier. On the Southern Hemisphere side, New Zealand's central bank announcements had no noticeable impact as the currency continued to fall. The monetary establishment left its monetary policy unchanged, its main policy rate remaining at 0.25%. The NZD traded at USD 0.65 against the greenback, a loss of 250 points. Rebound of the greenback against the euro  |

| Economic data U.S. statistics were mixed last week, with existing home sales below expectations while new home sales were better than expected (1011K). Weekly jobless listings were up to 870K (845K expected) while the manufacturing and services PMI indexes slightly beat the consensus at 53.5 and 54.6 respectively. In the euro zone, manufacturing activity continued to expand, with the PMI index at 53.7 (51.5 expected and 51.7 last month). By contrast, activity in services declined (47.6 against 50.5 last month). This week will be much busier, with U.S. growth, the ISM manufacturing ISM, industrial orders, and especially the monthly report on U.S. employment. |

| Back to reality The new trading month starts in a stressful climate where equity indices are more correlated with reality. This sudden shift towards risk aversion is partly rooted in fears of a further deterioration in the health crisis.On the economic front, signs of a slowdown in the recovery, like the latest highly contrasting SMIs, are adding to concerns about potential restrictions for citizens. Market players will probably continue to focus on these complex issues in the coming days. In such a context, it is not surprising to see that sovereign bond yields continue to fall, confirming shifts towards safe havens. Exogenous stimuli will therefore be needed to trigger a break with this trend, but this will inevitably take time, an argument that is not acceptable to market players who react more in the short term. |

By

By