|

|

| This week's gainers and losers |

| Gainers: Super Micro Computer (+26%): The US server and storage specialist is on a roll. Like the other stocks associated with AI, which promises to revolutionize the economy, it is currently benefiting from a powerful buyer flow. The Group is also unveiling a new liquid cooling technology for data centers, as well as a cloud partnership with Applied Digital Corporation. Finally, Loop Capital recommends the stock as Buy, with its price target raised to USD 200. Abercrombie & Fitch (+25%): Despite economic uncertainties, the American fashion brand posted solid quarterly results. Over the past period, the group reported a surprise profit, as well as sales (+3%) and operating margin ahead of expectations. Abercrombie also reported significantly reduced inventory levels compared to 2022. Management has therefore raised its annual sales growth and operating margin forecasts. Cricut (+25%): While the American group, which provides technologies for creative DIY projects, reported lower-than-expected quarterly results, with a 26% drop in sales, it announced the payment of a special dividend to investors of record on July 3, 2023. With user volumes up 19% in the quarter, management is confident in its ability to generate profitability, finance growth and reduce inventory levels. This should boost the share price. Nvidia (+21%): Nvidia exploded this week after publishing exceptional quarterly results, better than expected, and flamboyant forecasts for the coming quarter, again ahead of expectations. The American chipmaker is unsurprisingly buoyed by growing demand from businesses for graphics processors dedicated to artificial intelligence projects, which require significant computing power. Palo Alto (+10%): The cybersecurity specialist also exceeded market expectations for its fiscal third quarter, thanks to higher IT security spending by major corporations, and strong subscription and support sales. While the group has been profitable since the start of the year, it has raised its annual targets: it is now targeting an increase in revenues of between 23 and 24%, compared with 22% to 23% previously. Losers: Petco (-17%): The retailer specialized in pet products disappointed investors. It reported quarterly sales up 5.4%, but lower margins and a loss of 1 cent per share. Pet owners are concentrating their spending on essential products to the detriment of discretionary purchases. With rising interest rates, the market is also concerned about the group's heavy debt burden. But while the company has reaffirmed its forecasts for the year, investor reaction seems a little excessive. SnowFlake (-16%): Snowflake did not disappoint. The software maker reported better-than-expected quarterly results, with revenues up 48%, but once again cut its full-year forecasts, notably for product revenue growth to 34%, compared with 44% to 45% previously. The company , which markets analytics and data management tools for cloud platforms, is suffering from the timid outlook of its partners against the backdrop of a slowing US economy. Dollar Tree (-15%): Under the impact of inflationary pressures, demand is also slowing down at Dollar Tree, which has consequently revised its annual profit and sales forecasts downwards. The discount retailer posted mixed quarterly results: revenues were up 6.1% on a reported basis and 4.8% on a comparable basis, better than expected, but profits were down. The company is counting on lower freight rates this year, and on the measures deployed to boost productivity, to brighten its outlook. Pets at home (-9%): Despite a record year, with sales up 7.9% on a like-for-like basis, the British pet products retailer is on a downward trend. The company reported an 18% fall in annual profits, weighed down by a reduction in discretionary sales. Investors believe that the group is mature in its market, and that it will need growth drivers. With this in mind, Pets at home has announced the opening of 40 new sales outlets. |

|

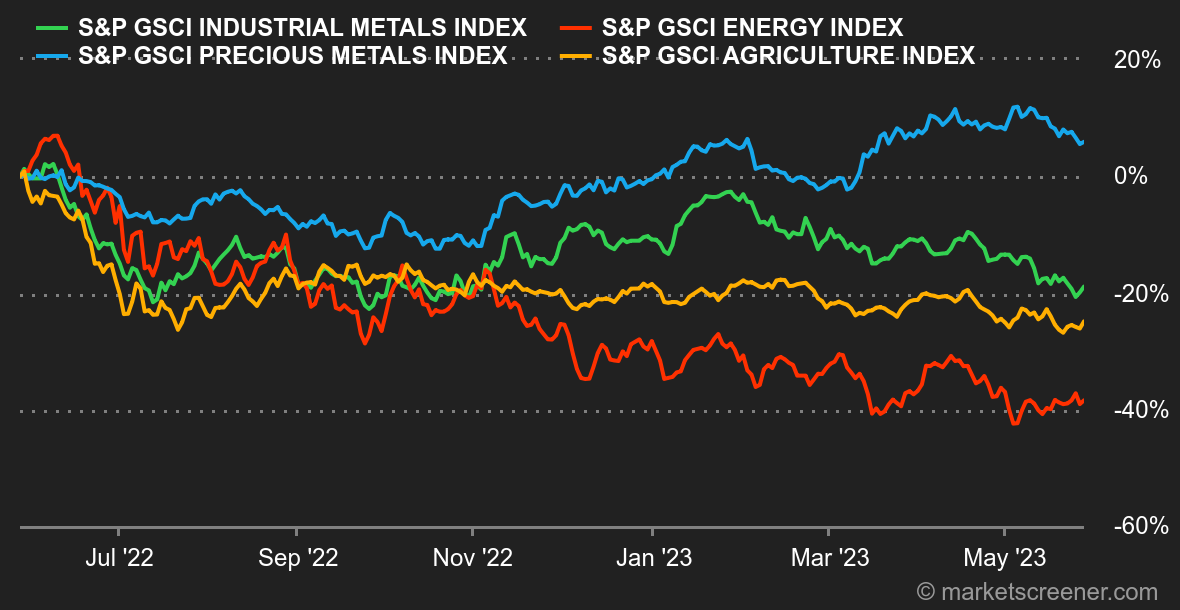

| Commodities |

| Energy: The rebound in oil prices continued this week, albeit without any overzealousness. European Brent crude edged up to USD 76, while its American counterpart WTI traded at around USD 72 a barrel. Although the general mood remains relatively negative on the risky asset front, oil has nonetheless benefited from some good news, particularly in the United States. Oil inventories fell significantly this week, by around... 12.5 million barrels, whereas economists were expecting an increase of 1.9 million barrels! In addition, the latest drilling data from the USA confirms the slowdown in the number of rigs in operation. US producers are thus opting for caution in the medium term, while observers are expecting a tighter oil market in the second half of the year. Metals: Beware, slippery ground! It's hard to reverse the downward spiral that is hitting the industrial metals segment with full force. The cause: mixed economic data from China, a rising greenback and the return of risk aversion. Copper is now trading at USD 7,900 per metric ton on the LME, compared with just over USD 9,000 a little over a month ago. Zinc, which has plunged to USD 2,222. Nickel (USD 21,000) and tin (USD 2,452) are experiencing similar dynamics. Gold, weighed down by the rising US dollar, has been unable to regain ground. The barbaric relic nevertheless stabilized at USD 1950. Agricultural products: The US Department of Agriculture (USDA) has released its initial forecasts for US grain production in 2023/2024. The trend is clear: harvests will be abundant. The USDA expects record corn production of 15.3 billion bushels, an increase of around 10% year-on-year! The outlook for wheat is less prolific, with US supply expected to stabilize at around 1.65 billion bushels. At the same time, Russia is threatening not to extend the agreement on Ukrainian grain exports if its demands for grain and fertilizer exports are not met. In Chicago, wheat prices stabilized at around 610 cents a bushel. In corn, despite the latest USDA report, prices rose to 590 cents a bushel. |

|

| Macroeconomics |

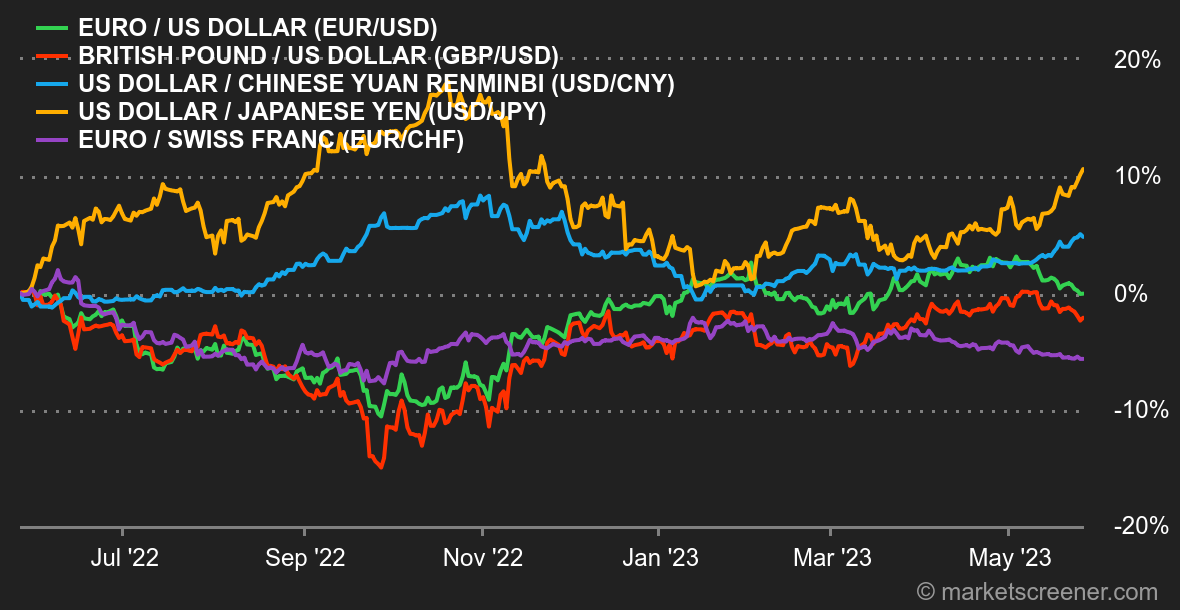

| Atmosphere: The focus is on the negotiations between US President Joe Biden and the conservative Speaker of the US House of Representatives, Kevin McCarthy. While they are well underway on how to raise the debt ceiling, investors are beginning to worry, to the point of taking CDSs (Credit Default Swaps) on US debt to levels higher than in 2011 (the latest example of bitter negotiations on the debt ceiling). The Fitch rating agency has already placed the USA's triple-A rating on negative watch, while Treasury Secretary Janet Yellen is stepping up her efforts to urge the two protagonists to reach an agreement quickly and avoid the risk of default. Such a situation would be like a bombshell in the financial world, the implications of which are difficult to estimate. On the indexes, the time has come to be more selective than ever. Thursday's session was a perfect illustration of this. While the S&P 500 gained 0.88% over the session, 65% of stocks and almost 70% of volumes traded on the NYSE were down. Special mention should be made of Nvidia, which jumped by nearly 25%, but that's just the tip of the iceberg. Such a lack of participation is suspicious and can only invite caution. Currencies: The dollar continues to rise against the euro and most other currencies this week. A rate hike is now the preferred scenario for investors. CME's FedWatch tool now shows a 53.9% probability of a quarter-point rate hike at the Fed's next meeting in June. On the other hand, the news that Germany has entered recession in the first quarter did not help the European currency. Finally, negotiations on US debt are progressing, and optimism is focused on raising the ceiling. As a result, the EUR/USD is trading close to 1.07. Against the yen, the dollar broke through the JPY 140 mark, last seen in November 2022. In the UK, inflation remained very high, at 8.7% in April 2023, which also pushed the currency down against the dollar. As you can see, the dollar is gaining in popularity in the current context, outperforming all currencies this week. Rates. In terms of macroeconomic news, the Fed's minutes highlighted the divergences between committee members, with those in favor of continuing the rate hike cycle on the one hand, and those in favor of a pause, or even monetary easing, on the other, while the consequences of tightening on inflation, banks and, by extension, the economy are assessed. Friday's release of the PCE Core report provided further support for the "Hawks". Slightly higher than expected in monthly (+0.4% vs. 0.3% expected) and annual (+4.7% vs. +4.6%) terms, it corroborates the poor UK inflation data published earlier in the week. The battle against inflation therefore seems far from won. In fact, the US 10-year yield broke out of its horizontal accumulation channel by breaking above 3.64%, paving the way for further upward momentum towards 4-4.10%. Cryptocurrencies: Bitcoin continues to suffer, falling for the fourth week running and hovering around the $26500 mark at the time of writing. Ether, on the other hand, is holding up better than the market leader, gaining just over 1% and hovering above $1800. The cryptocurrency market is still not benefiting from the surge in US technology stocks, with which it has been correlated until now. The lack of regulatory clarity for the crypto-asset industry in the US weighs on crypto-investors' ability to project themselves, resulting in this market's inability to resume positive momentum. |

|

|

| Things to read this week | ||||||

|

|

*The weekly movements of indexes and stocks displayed on the dashboard are related to the period ranging from the open on Monday to the sending time of this newsletter on Friday. The weekly movements of commodities, precious metals and currencies displayed on the dashboard are related to a 7-day rolling period from Friday to Friday, until the sending time of this newsletter. These assets continue to quote on weekends. |

By

By