|

Friday May 8 | Weekly market update |

|

Financial markets have shown nervousness this week, torn between bad statistics confirming the strong impact of Covid-19 on the world economy and hopes of a recovery in activity, with the end of lockdown restrictions in several countries. Despite a slight lull on the trade front due to the resumption of trade agreement talks between Beijing and Washington, all major indices finished the week in scattered order. This is despite a disappointing monthly US employment report, although slightly above expectations. |

| Indexes Over the past week, in Asia, the Nikkei and the Shanghai Composite have done well, recovering 2.8% and 1.2% respectively. Hang Seng, on the other hand, lost 1.5%. In Europe, the main indexes moved in a mixed order. The CAC40 recorded a weekly loss of 0.6%, while the Dax gained 0.3% and the Footsie climbed 3%. For the peripheral countries of the euro zone, red is dominant. Spain lost 2%, Portugal 0.8% and Italy 1.4%. At the time of writing, in New York, the Dow Jones is up 2.1% for the week, the S&P500 is up 3% while the Nasdaq100 is up 5.5%. The technology stocks index has now risen by 5.3% since January 1, confirming its clear outperformance against the other indices (see chart). Index performance since January 1  |

| Commodities The prospect of seeing demand for crude oil rebound in the coming weeks, revived by easing lockdown restrictions, is restoring some comfort to operators. They were also confident about the decline in black gold production, both globally and in the United States. Volatility remained very high this week, with Brent rising by nearly 14% to USD 30.3, while WTI gained 30% to USD 25.85. Precious metals are still doing well. The gold ounce is moving close to its annual high at USD 1719, while silver is back in contact with the USD 15.7. The industrial metals segment recorded a positive weekly sequence, partly supported by the resumption of activities in China. Copper rose to USD 5227 per metric tonne, as did zinc at USD 2000. |

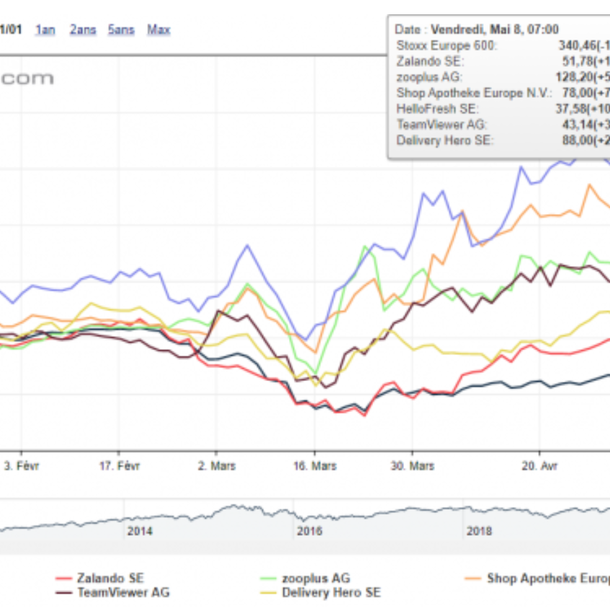

| Equities markets Technology is not all about California It is fashionable to praise the stock market performance of American technology stocks, especially since the start of the Covid-19 crisis.But we should not forget other islands of digital prosperity, such as Germany. The following graph shows the performance of six internet stocks in Germany since January 1. The outperformance compared to the broad STOXX Europe 600 index (-18%) ranges from 33% to 119%. These stocks are online retailers Zalando (shoes, clothing), Zooplus (pet supplies) and Shop Apotheke (pharmaceuticals), the delivery service Delivery Hero, the home cooking supplier HelloFresh and the developer of TeamViewer collaboration software. Apart from the latter, it is mainly retailers who rely on technology to sell their products and/or services. But these are still digital success stories. Performance of 6 internet stocks  |

| Bond market Interest rates stabilised for major European issuers. The French OAT is still trading close to zero yield while the German Bund remains in negative territory at -0.5%. The Swiss 10-year bond followed the same trend at -0.56%. This widens the gap with Italian and Spanish government yields, which are tending to rise. The Spanish 10-year stabilized at 0.83%, while the Italian construction sector remains at the 2% mark. On the other side of the Atlantic, the US 10-year is still proving to be resilient, even though the country's economic statistics are vacillating. The T-bond thus posted a return of 0.64%. |

| Forex market It must be said that the week was not volatile on foreign exchange markets. Overall, the EUR weakened against its major counterparts, weakened by the German Supreme Court's decision regarding the ECB's policy on government debt buybacks. The EUR/USD pair lost a little ground at USD 1.08, a trend that was also observable on the EUR/CHF and EUR/JPY pairs, which moved respectively at CHF 1.05 CHF and JPY 115. In the U.S., the dollar did not suffer particularly badly from the collapse of private sector employment in the country with the destruction of more than 20 million jobs in April. The greenback stabilized against the yen at JPY 106. |

| Economic data In the United States, the ISM Services index exceeded expectations (41.8 vs. 37.5 expected). Industrial orders dropped by 10.3% (consensus -9.2%) and all employment data disappointed. The ADP survey reported 20236K job losses in the private sector (-20500K expected and -149K last month). Weekly jobless registrations came out at 3169K (consensus 3000k). The focus of the week was the monthly employment report. The unemployment rate soared to 14.7% (consensus 16%) and 20500K jobs were destroyed in April, where the market was expecting -22000K (-870K last month). Few European statistics were on the agenda this week. The manufacturing and services PMI indices came out overall in the consensus at 33.4 and 12 respectively (consensus 33.6 and 11.7). In Germany, Industrial Production dropped by 9.2% (-16.2% in France) and German Industrial Orders dropped by 15.6%. Looking ahead to next week, traders will focus their attention on the Euro-Zone Industrial Production, Trade Balance and GDP, which is expected to drop by 3.8%. In China, the positive surprise comes from the 3.5% increase in exports in April (consensus -11%), even though imports fell by 14.2% (-10% expected). The trade balance stands at +45.3B dollars (consensus 9.1B). In the coming sessions, the CPI and PPI indexes, industrial production, retail sales and unemployment rate will be released. |

| Disappointments and hopes The week is ending much better than it started. Markets were in high spirits and suddenly tightened when old demons returned, namely Donald Trump's warlike rhetoric and his favourite bargaining lever towards Beijing: trade retaliation. While the two sides quickly agreed to collaborate, experience shows on the one hand that the market is still unable to acclimatize to the unpredictability of the White House tenant, but above all that the commercial soap opera is not over. In this age of Covid-19 and bruised economies, these commercial oppositions take on a whole new dimension. Let's try to keep this in mind and add it to the equation to the many unknowns of the post-lockdown world. |

By

By