|

|

| This week's gainers and losers |

| Gainers: Software AG (+55%): The German software developer received a takeover bid this week from Silver Lake Management. The American private equity firm, which acquired 9% of the company's capital in 2022, is offering shareholders EUR 30 per share, valuing the company at EUR 2.2 billion. The offer was welcomed by shareholders. In the meantime, Elliott Investment Management and other investors have increased their positions in the group. Hasbro (+14%): The toy and game group reported better-than-expected quarterly results. Sales (-14%) and operating profit (-85%) were down, but surprised the consensus. Sales were supported by the strength of the role-playing games, digital games and the "Magic: The Gathering" card franchise (+16%). The manufacturer, which is working to reduce costs and inventory levels, confirmed its annual sales and profit forecasts. Chipotle (+13%): The fast food chain specializing in Tex-Mex cuisine also beat market estimates. It benefited from inflation and the attraction of low-income customers to report a 17% increase in quarterly sales and 84% growth in net profit. The company also opened 41 new shops this year. This is a great comeback for the group, which had been the victim of a wave of foodborne illness outbreaks in 2016 and 2017. Meta Platforms (+12%): The parent company of Facebook and Instagram is back in the black, reporting a better-than-expected quarter after its disappointment in the previous period. The company was able to capitalise on a year-on-year increase in the number of Facebook users and presented a better-than-expected revenue outlook for the current quarter. These good results supported investor sentiment. Losers: First Republic (-56%): The San Francisco-based bank remains the weakest link in the US sector. There are whispers that US regulators, politicians and investors are looking for ways to stem the bleeding and avoid a repeat of the domino effect in the sector. First Republic, which was trading at over USD 120 two months ago, is now trading at less than 7% and is proving unable to restore confidence. Compass (-27%): Some headwinds for the real estate brokerage specialist. The group missed estimates for the current quarter, and delivered a bleak outlook for the next. With the property market contracting, the group's turnover dropped by 31% over the period. Its cost-cutting efforts were not enough to compensate for this decline. Enphase Energy (-26%): The solar energy technology group saw its share price fall sharply this week after publishing its quarterly results. While profits for the period were better than expected, sales, although up 60%, and forecasts for the second quarter were disappointing. Since the beginning of the year, the manufacturer has been suffering from the lack of confidence in the economy and rising interest rates. However, let's remember that it has had a remarkable stock market performance over the past five years. Activision Blizzard (-9%): We were expecting it, but it's official. The CMA, the British competition authority, has finally opposed Microsoft's $69 billion takeover of the video game publisher. The tech giant's promises and commitments were not enough to convince the institution that the merger was well founded. The buyer has announced that it is appealing the decision, Activision says it remains optimistic that the deal will go through, and analysts remain positive about the case. |

|

| Commodities |

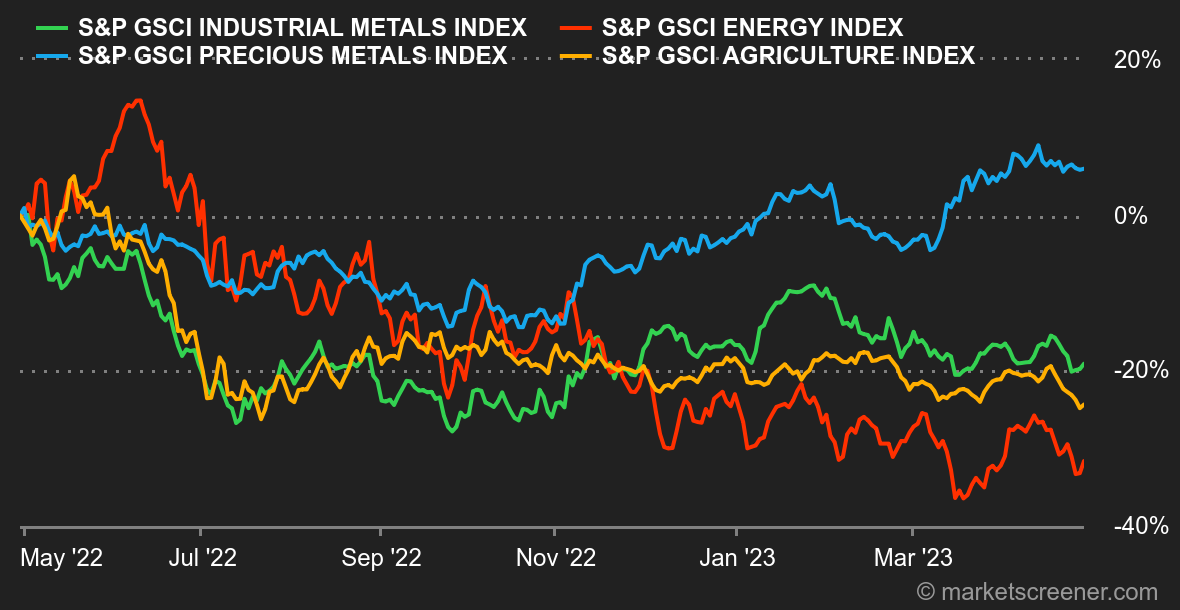

| Energy: Oil prices have fallen this week, hurt by fears of a recession and its impact on oil demand. The economic data from America is mixed and weighs on the price of crude. Financials have thus relegated to the background the strong decline in weekly inventories in the United States, of the order of 5.1 million barrels while the consensus was for -1.3 million. In terms of prices, Northern European Brent and US WTI prices consequently recorded a second weekly downward sequence at USD 78 and 74 per barrel respectively. Metals: After losing momentum throughout the week, base metal prices continue to be penalised by a strong dollar and mixed economic data. Copper is trading at around USD 8500 per metric ton, compared to USD 2300 for aluminium. Mining companies continue to report results to their shareholders. Anglo American increased its copper production by 9% in the first quarter (year-on-year), while iron ore shipments from Australia's Fortescue Metals were flat in its third fiscal quarter. In precious metals, gold is stabilising below USD 2,000 per ounce, as is silver at USD 24.80. Agricultural products: Canada is expecting a significant increase in wheat production as the area planted to this crop has increased by 6.2% compared to the previous year. Against this backdrop, grain prices have continued to decline in Chicago. A bushel of corn is trading at around 625 cents, while the price of wheat has reached its lowest level since July 2021 at 628 cents. |

|

| Macroeconomics |

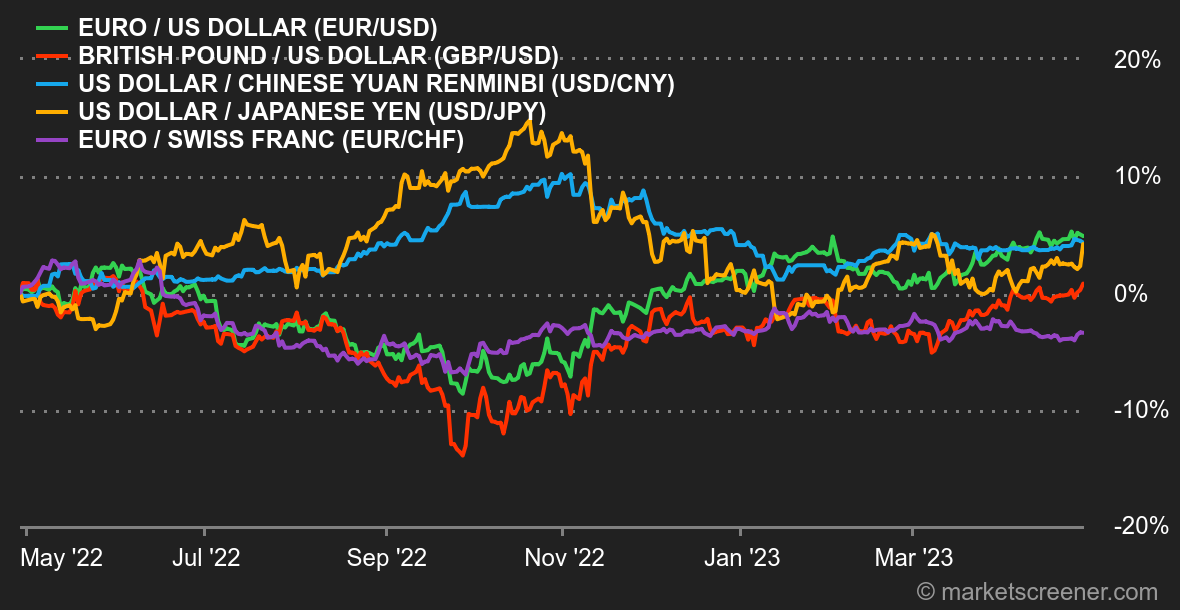

Atmosphere: US statistics are still blowing hot and cold. April consumer confidence, Q1 GDP and March housing sales disappointed. In contrast, durable goods orders were much stronger than expected. At the end of the week, PCE inflation was more or less in line with expectations. All eyes are now on the Fed's policy decision on Wednesday 3 May. What will it do with all these statistics? And what about the rekindled fears about the strength of the banking sector? For the time being, more than 80% of the market is predicting a 25 basis point rate hike. The Fed will be followed on May 4 by the ECB, which should make the same move, even if inflation figures seem to be calming down in Europe. These two major events will be surrounded by many other statistics, which you will find below. Currencies. The yen lost ground at the end of the week after the Bank of Japan maintained a very loose approach to monetary policy. It fell to JPY 136.1750. The new governor Kazuo Ueda preferred to wait and see rather than to put his stamp on it as soon as he took office. In the EUR/USD, the single currency's bullishness evaporated at the end of the week, with a return to the 1.10 level. The EUR/CHF was at CHF 0.9829 at the end of the week. Rates. The latest macroeconomic data is not very encouraging, to the point that some global macro analysts are talking about the worst of three worlds: rising inflation, a very resilient labour market and sluggish growth. It is only a (small) step from there to stagflation. Unemployment claims came in well below expectations at 230k instead of 248k. US GDP fell to +1.1% annualized from +1.9% expected. Finally, the Fed's preferred indicator for inflation, the Core PCE, rose by 0.3% on a monthly basis and 4.6% on an annual basis. Even if these figures are in line with expectations, it still seems too early to consider that the battle against inflation is already won. In other words, the Fed still has a long way to go to rein in the monster it has created, to the point where the odds of a 25bps rate hike are now 86% according to CME's Fedwatch tool. Household spending fell from +0.1% in February to 0.0% in March. This contraction, which can easily be attributed to rising prices, may mark the end of the "fat cow" period fueled by excess savings linked to the Covid period. Cryptocurrencies. Bitcoin is up 6% this week and is once again approaching the psychological threshold of $30,000 at the time of writing. Ethereum, on the other hand, has seen a much smaller increase, posting a slight rise of 1.70%. This week, the eyes of crypto-investors were again turned to the United States where debates to build a regulatory framework for the industry remain at a standstill. Coinbase even filed a lawsuit against the SEC to push regulators to establish clear rules for industry players. Calendar. Next week, which will begin with a public holiday with most European stock markets closed (England, France, Germany, etc.), will be full of important economic events. The major event is scheduled for Wednesday: the Fed's decision on interest rates. Before that, investors will be watching the publication of the ISM manufacturing index in the United States (Monday), as well as that of the services index (Wednesday), which will have an impact on the estimation of the economic situation. The ECB will also join its US counterpart on Thursday, preceded by the publication of inflation data in the euro zone on Tuesday. Finally, investors will be looking out for the monthly US employment figures on Friday, as well as the employment surveys due on Thursday. |

|

|

| Things to read this week | ||||||

|

|

*The weekly movements of indexes and stocks displayed on the dashboard are related to the period ranging from the open on Monday to the sending time of this newsletter on Friday. The weekly movements of commodities, precious metals and currencies displayed on the dashboard are related to a 7-day rolling period from Friday to Friday, until the sending time of this newsletter. These assets continue to quote on weekends. |

By

By