|

|

| This week's gainers and losers |

Gainers: Biogen. The experimental treatment Lecanemab for Alzheimer's disease met its targets in a Phase III trial. Japanese partner Eisai is also making similar progress. +33.6% Rational AG, specialized in kitchen appliances, has raised its 2022 forecast, as the greater availability of electronic components since August has led to higher production volumes. +19.6% Wise, the British company known for its money transfer services, is targeting a 55% to 60% increase in revenue this year and raising its forecast. It benefits from the rise in British interest rates. +12.7%. Wynn Resorts, the Nasdaq-listed casino operator. Macau authorities have announced that they will allow Chinese tourists to return to gambling establishments as of November. +7.9% CarMax disappointed. The US car retailer reported quarterly profits and revenues below analysts' expectations, with inflation and rising interest rates weighing on car sales. It gives up 18%. Next, the British retailer has lowered its profit and sales forecasts for the full year. It also warned that the weak pound will further inflate sales prices next year. -13.4% Barclays has been heavily fined for marketing nearly $18 billion of structured products without authorization in 2019. The British bank also suffers from the chaotic context across the Channel. -11.8% Nio, the Nyse-listed Chinese automaker, is struggling with global economic concerns, inflation and rising rates, as well as the European energy crisis and the downturn in the EV sector. -11.7% Faced with weak demand for its latest iPhone, Apple has decided not to increase production of the 14 model, and has asked its suppliers to cut back. The tech giant fell 5.3% over the week.

|

|

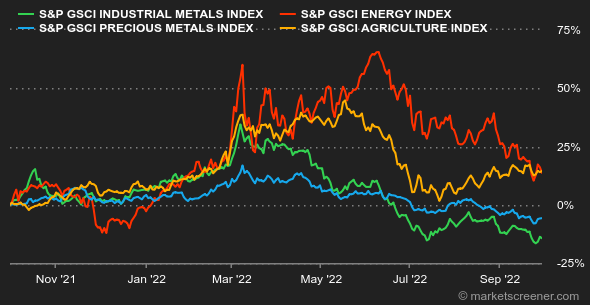

| Commodities |

| Energy: The atmosphere remains heavy on oil markets, which nevertheless recovered at the end of the week. Still penalized by fears of recession, the WTI traded below USD 80 and is now at around USD 82. As for Brent, the European benchmark was down to USD 84 and is currently trading around USD 88 per barrel. All eyes are now on OPEC+, which will hold a meeting next week and is expected to further reduce its production targets to support prices. Early rumors suggest that Russia has proposed an overall cut of one million barrels per day for the entire expanded cartel. While this decrease seems significant, it should be remembered that OPEC+ is producing well below its production quotas. At the same time, Hurricane Ian has caused major disruptions in the Gulf of Mexico, resulting in a drop of just over 10% in oil production in the region. On the natural gas side, the sabotage of the Nord Stream 1 and 2 pipelines unsurprisingly led to higher prices in Europe. The Rotterdam TTF is trading above EUR 200/MWh. Metals: After losing momentum throughout the week, base metal prices suddenly picked up on Thursday as the London Metal Exchange (LME) reportedly plans to ban metals from Russia from its warehouses. Copper is trading at around USD 7550 per metric ton, compared to USD 2200 for aluminum. In precious metals, gold is back in the black at USD 1,670 per ounce, as is silver at USD 19.15. Agricultural products: Grain prices remain strong in Chicago, where wheat and corn are trading at 910 and 675 cents per bushel respectively. In Europe, the European Commission reported that corn imports increased significantly, by about 80% year-on-year, to 6.7 million tons. |

|

| Macroeconomics |

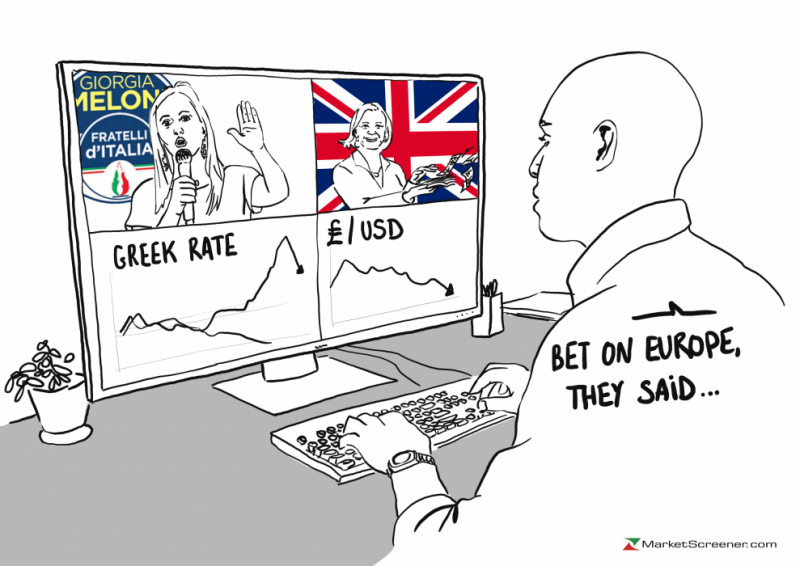

| Atmosphere: There were many speeches from central bankers during the week, and all of them reiterated the priority of monetary policy: to bend inflation even if the price to pay is high for economic activity. European inflation in September, which accelerated to 10%, shows that the battle is far from over. Meanwhile, Britain, the scene of conflicting policies between the Bank of England and the new government, is cause for concern. Rates: Nervousness is high in the bond market. Government bond yields tightened earlier this week with the announcement of a pro-growth budget in the UK, while the Bank of England is working to combat inflation. The market found the Truss government's first steps incomprehensible. The BoE was even forced to intervene by restarting a gilt buyback program to avoid creating an earthquake for British pension funds. All of this has stirred up investors, even if some easing was visible in yields at the end of the week: 10-year debt is paying 3.70% in the United States, 4.04% in the United Kingdom and 4.53% in Italy. Germany (2.10%) and France (2.71%) fare better. Currencies: The year 2022 is a wild one on the foreign exchange market. Since January 1, the dollar soared 40% against the yen, 25% against the pound sterling and 14% against the euro. At the same time, it has lost a third of its value... against the ruble. Geopolitics, inflation and divergent monetary agendas have made a mess of currencies. Cryptocurrencies: Bitcoin has been moving slightly higher since the beginning of the week, hovering around $19,500 at the time of writing. For the month of September, the digital currency, down 3% from the previous month, is poised to close at its lowest level since the beginning of the year. On the other hand, paradoxically, it has fallen less than US stock market indexes this month. But for the time being, in a still anxious macroeconomic context, the positive catalysts that would suggest a sustainable return to the upside are rare in the digital assets market. Calendar: The spotlight shifts to U.S. employment next week, culminating in September's statistics, which will be released on Friday. Prior to that, there will be the JOLTS job openings survey (Tuesday) and the ADP nonfarm payrolls report (Thursday). Investors will also be keeping an eye on the detailed minutes of the latest ECB meeting, which will also be released on Thursday. |

|

|

| Things to read this week | ||||||

|

|

*The weekly movements of indexes and stocks displayed on the dashboard are related to the period ranging from the open on Monday to the sending time of this newsletter on Friday. The weekly movements of commodities, precious metals and currencies displayed on the dashboard are related to a 7-day rolling period from Friday to Friday, until the sending time of this newsletter. These assets continue to quote on weekends. |

By

By