|

|

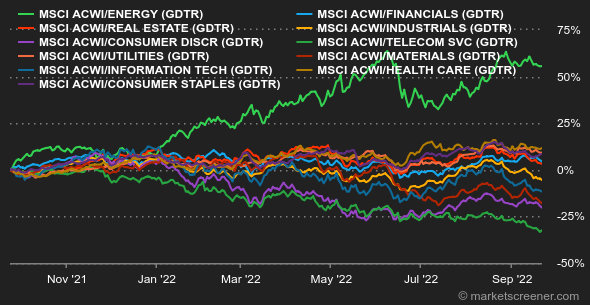

| This week's gainers and losers |

Gainers:

Losers:

|

|

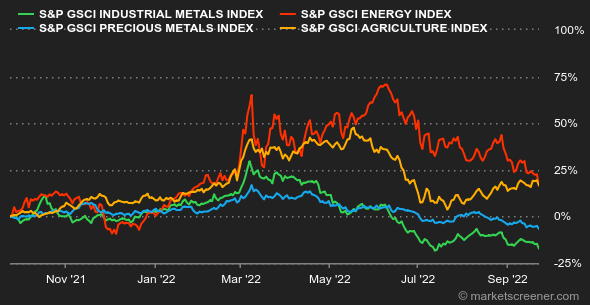

| Commodities |

| Energy: Monetary tightening by the Fed, but also by other central banks, is weighing on risk assets such as oil. Traders continue to see the glass as half empty, concerned about the consequences on demand of monetary tightening, which can be described as widespread. In this context, the new rise in tensions in Ukraine, where the Kremlin has planned referendums to annex 4 Ukrainian regions as well as the mobilization of 300,000 reservists, takes a back seat. The EU is reportedly considering new sanctions against Moscow, including a cap on Russian oil prices. However, reaching a consensus may prove difficult due to the position of some countries such as Hungary. North Sea Brent is trading around USD 89 while US WTI is trading at a discount of almost USD 7 at USD 82 per barrel. Metals: The strengthening dollar weighed on the industrial metals segment, with the exception of nickel and tin, which stabilized at USD 24560 and USD 21650 respectively. Rio Tinto's forecast also weighed on market sentiment as the mining group expects a "challenging" environment for copper in the near term due to soaring prices, which could weigh on demand for the metals. Finally, zinc stocks recorded a further decline in LME facilities to their lowest level since February 2020. On the precious metals side, gold is showing some resistance and is stabilizing around USD 1670. Agricultural commodities: Rising friction in Ukraine has supported wheat prices as it raises new concerns about compliance with Black Sea supply agreements. Wheat is trading near 900 cents a bushel in Chicago, compared to 680 cents for corn. |

|

| Macroeconomics |

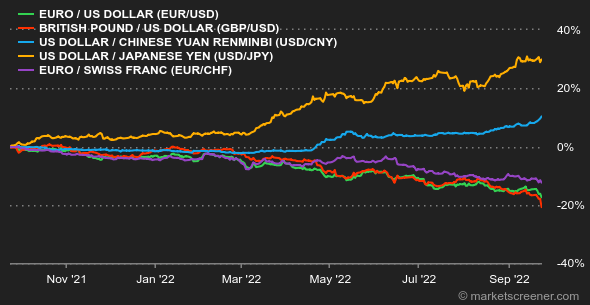

| Atmosphere: Did everyone get it right this time? The U.S. central bank has reiterated that the fight against inflation will be tough, complicated and long. Other countries have also raised rates, including Norway, Switzerland and the UK. The impact of these restrictive monetary policies can already be seen on activity indices, but not yet on prices... hence some distress among investors. Currencies: Two important pieces of news this week. On the one hand, the euro has just tested lows against the dollar, below 0.98 USD for 1 EUR. On the other hand, the Bank of Japan wants to put an end to the yen's slide against the greenback (-25% since January 1). It has intervened in the market for the first time in the millennium to protect the 145 JPY/USD mark. Forex traders are not really surprised, but are wondering how the BoJ can hold the shock, while continuing its accommodative policy. Rates: The Fed's determination has broken the last dikes in the bond market. The yield on U.S. 10-year debt rose from 3.47% last week to 3.77% on Friday. The yield curve is still inverted with the 2-year maturity paying 4.24%. In Europe, the trajectory is identical, with more pronounced increases among issuers considered less qualitative. Swiss debt is at 1.37% over 10 years, the German Bund at 2.04%, the French OAT at 2.62% and the Italian BTP at 4.31%. The British Gilt is at 3.76%. Cryptocurrencies: Crypto-currencies remain under pressure like the rest of financial assets. Bitcoin is below USD 19,000 per unit (-9% in one month) while Ether is trading around USD 1290 (-18% in one month). Calendar: From what we've seen, every day next week will host at least one central banker speech. If they start grating on you, you might want to avoid the media for a few days. In the US, there will also be some important statistics, including Durable Goods Orders and Consumer Confidence (Tuesday) and PCE inflation (Friday). In Europe, the German business climate (Monday) will precede the first estimate of September inflation, as early as Friday. |

|

|

| Things to read this week | ||||||

|

|

*The weekly movements of indexes and stocks displayed on the dashboard are related to the period ranging from the open on Monday to the sending time of this newsletter on Friday. The weekly movements of commodities, precious metals and currencies displayed on the dashboard are related to a 7-day rolling period from Friday to Friday, until the sending time of this newsletter. These assets continue to quote on weekends. |

By

By