|

|

| This week's gainers and losers |

| Gainers: Aston Martin (+29%): The giant Geely has announced that it is increasing its stake in the British luxury carmaker. The Chinese carmaker has bought 42 million shares from majority shareholder Yew Tree, and subscribed for a further 28 million, for £234 million, a premium of 45% on Wednesday's closing price. Geely is now the group's third largest shareholder and will be able to support Aston Martin's technological ambitions and its expansion into the Chinese market. Palantir (+23%): The context is favorable for the American data analysis specialist. Last week, the group unveiled solid and better-than-expected quarterly results, supported by strong demand for its new artificial intelligence platform. This week, the group received support from Ark Investment, Cathie Wood's technology investment vehicle, which acquired more than 1.26 million shares of Palantir through several of its funds for just under $13 million. Super Micro Computer (+22%) The global technology company, which provides Silicon Valley-based accelerated compute platforms that are application-optimized server and storage systems for various markets, soared after it issued fourth-quarter guidance earlier that topped Wall Street expectations. Losers: John Wood (-36%): This was a tough week for John Wood group. Apollo Global Management announced four months ago that it was looking to buy the British oil engineering company for around £2.2 billion and to delist it, but the American private equity firm finally abandoned its project. However, on the back of strong quarterly results and good momentum in its various units, John Wood says he is confident of returning to free cash flow in 2024. Sea Limited (-17%): The Chinese giant listed on the NSE, active in video games, e-commerce and financial services, has unveiled mixed quarterly results. The company's revenue was up 5% for the period and in line with expectations, but profit was well below forecasts, weighed down by a one-off impairment charge. While the group has significantly reduced its expenses, it's still penalized by the decline in its games business, which is significantly offset by the good health of the e-commerce business. Grab (-13%): Mixed results for Grab too. The Nasdaq-listed Indonesian delivery and ride-sharing app reported better-than-expected quarterly revenues, which more than doubled over the period, and a much reduced loss. However, the group experienced a slowdown in its delivery business, down 9%, due to an early Ramadan in its main markets. Revenues from the car-sharing division are up 72% over the last three months. |

|

| Commodities |

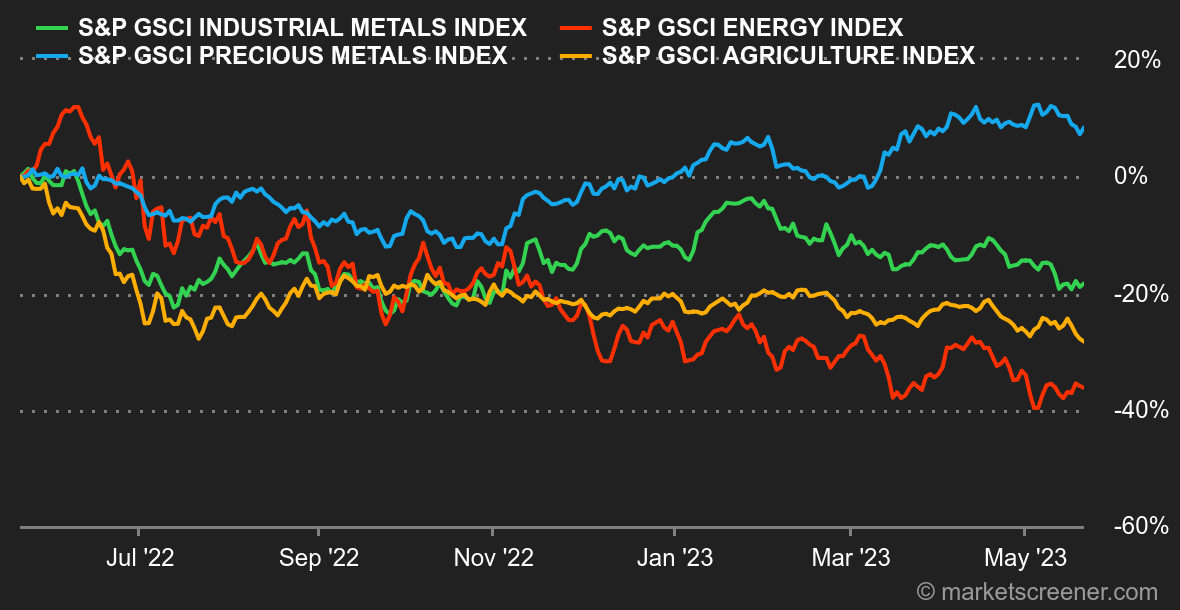

| Energy: Weekly oil inventories rose sharply this week, by around 5 million barrels, while economists were expecting a decline of 1.3 million barrels. However, this data has not prevented crude oil prices from rising by around 3% over the last five sessions. The reason for this is that traders are looking to the future, which is more likely to see a price recovery for two main reasons. Firstly, the US Department of Energy has announced the purchase of crude oil to start filling its strategic reserves. We are talking about 3 million barrels at the moment, which is relatively small, but the information is clear: the United States is starting to rebuild its strategic reserves, which, let's not forget, have melted like snow in the sun since last year. Secondly, the International Energy Agency has raised its demand growth forecast for 2023 and thus foresees a tighter market in the second half of the year. In this context, oil prices have recovered, with Brent crude at USD 76 per barrel and WTI at USD 72. In European natural gas, the Dutch benchmark, the Rotterdam TTF, is trading at EUR 30/MWh, a level not seen since November 2021. Metals: China is struggling to revive its economic machinery. The latest statistics on industrial production are not very flattering. Industrial production did indeed rise by 5.6% year-on-year, but the market was hoping for almost double that due to the lifting of restrictions linked to Covid-19. As a result, industrial metal prices have quite logically lost ground this week. Copper is trading at USD 8100 per tonne on the London Metal Exchange. Lead, aluminium and tin also lost ground. Only aluminium rebounded to USD 2280. In precious metals, gold is easing back below USD 2,000 per ounce. Agricultural products: Russia and Ukraine agreed to extend the Black Sea grain export agreement by two months. Uncertainty has faded in Chicago, at least until the next round of negotiations. Wheat and maize fell this week to 620 and 560 cents a bushel respectively. |

|

| Macroeconomics |

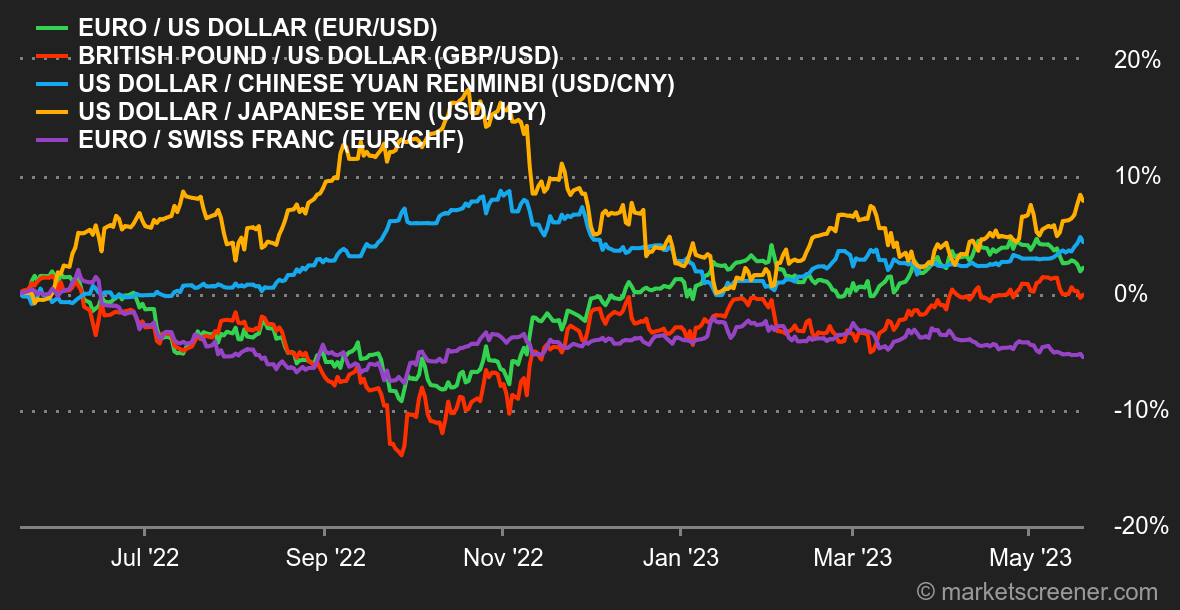

Atmosphere: Selective hearing. There were two phases in the US macroeconomic statistics. At the beginning of the week, the Empire State manufacturing index and retail sales confirmed a weakened momentum. But at the end, weekly jobless claims and another manufacturing index, the Philly Fed, came out (slightly) stronger than expected. All in all, the market was reinforced in its belief that the US central bank will leave rates unchanged in June, even if the bullish camp gained a few points (the forecasts are two-thirds in favour of a status quo and one-third in favour of an increase). As for the many comments from central bankers, they always point in the same direction: inflation is still a threat. But if the market believes the ECB and the BOE when they say they will tighten further, it no longer listens to the Fed. At the same time, investors have stopped being anxious about the US debt ceiling. While nothing has been signed at this stage, the soothing comments from Democratic and Republican leaders have been enough to reawaken risk appetite. Currencies. The dollar is going up, up, up. Against the backdrop of more favourable macro and fiscal data in the US, the dollar continued to rise. A rate hike in June is not the preferred hypothesis of the financial community, but it is not out of the question either, even though this possibility was clearly dismissed at the beginning of the month. So even though the ECB is said to be more aggressive lately, the EUR/USD is back below 1.08. The dollar has rallied even stronger against the yen to JPY 138.169. Traders are now looking at the JPY 140 mark, last crossed in November 2022. Rates. This week was not marked by any major macroeconomic statistics. However, it seems to us that the retail sales publications marked a significant turning point. They were up +0.4% in April, and have taken away the fears of a US recession. The weekly jobless claims figures also helped the stock market indices to jump ahead to a new record high for the year 2023. At the same time, bond yields followed the same pattern: the US 10-year is currently testing its resistance at 3.64% while the German 10-year is just below 2.55%. It will be interesting to watch how the indices behave if these significant levels are breached to confirm that investors are now more focused on recession risks than inflation fears. Cryptocurrencies. Bitcoin remains just about balanced this week, hovering around $27,000 at the time of writing. The ether, on the other hand, is regaining some ground, rising 1% since Monday and climbing back above $1800. The cryptocurrency ecosystem is still struggling to provide strong catalysts to boost the overall market. While crypto-assets have so far shown a strong correlation with the Nasdaq, the last few days have shown that they have not benefited from the return of risk appetite, as evidenced by the surge in the US stock index this week. Calendar. Next week, the main macroeconomic statistics will begin in France on Tuesday, with the publication of the manufacturing PMI and the services PMI. This will be followed by the same indicators for Germany , the UK and the US. On Wednesday, the focus will be on the UK, with the release of annual inflation (CPI y/y) and two speeches by Bank of England President Bailey. Investors will also be watching the Ifo business climate index in Germany and the FOMC meeting. On Thursday, quarterly GDP (q/q GDP, second reading) and initial jobless claims in the US will be released, both crucial data to assess the economic situation. At the end of the week, investors in the US will be waiting for the PCE core (consumer price index, excluding volatile items). |

|

|

| Things to read this week | ||||||

|

|

*The weekly movements of indexes and stocks displayed on the dashboard are related to the period ranging from the open on Monday to the sending time of this newsletter on Friday. The weekly movements of commodities, precious metals and currencies displayed on the dashboard are related to a 7-day rolling period from Friday to Friday, until the sending time of this newsletter. These assets continue to quote on weekends. |

By

By