|

|

| This week's gainers and losers |

Gainers: Exact Sciences, the diagnostics specialist, issued a better-than-expected guidance. Excluding the coronavirus business, annual sales for 2022 rose 25% to $2.08 billion. +45.3% The return of a more favorable risk appetite environment is benefiting the stocks that were shunned by investors recently. Coinbase also has the speculative aspect of crypto-currencies. It is up 43% for the week. Just Eat Takeaway is the archetype of a stock that is popular during these confidence-boosting phases. With -59% in 2022 and -47% in 2021, the stock still has a long way to go. +15.7

British insurer Direct Line Insurance has taken the brunt of the market's wrath after scrapping a 2022 dividend due to rising claims costs in the last quarter. -23.8% Baxter International, which specializes in the development, manufacturing and marketing of medical devices and medications intended for healthcare professionals, fell 14.2% following the recent announcement of global restructuring by the US multinational. Crowdstrike lost 7% this week after Morgan Stanley lowered its recommendation on the cybersecurity company. Fast Retailing, the owner of the Uniqlo brand, saw its results fall because of a difficult Chinese market and a decision to raise staff wages in Japan. -7.6% |

|

| Commodities |

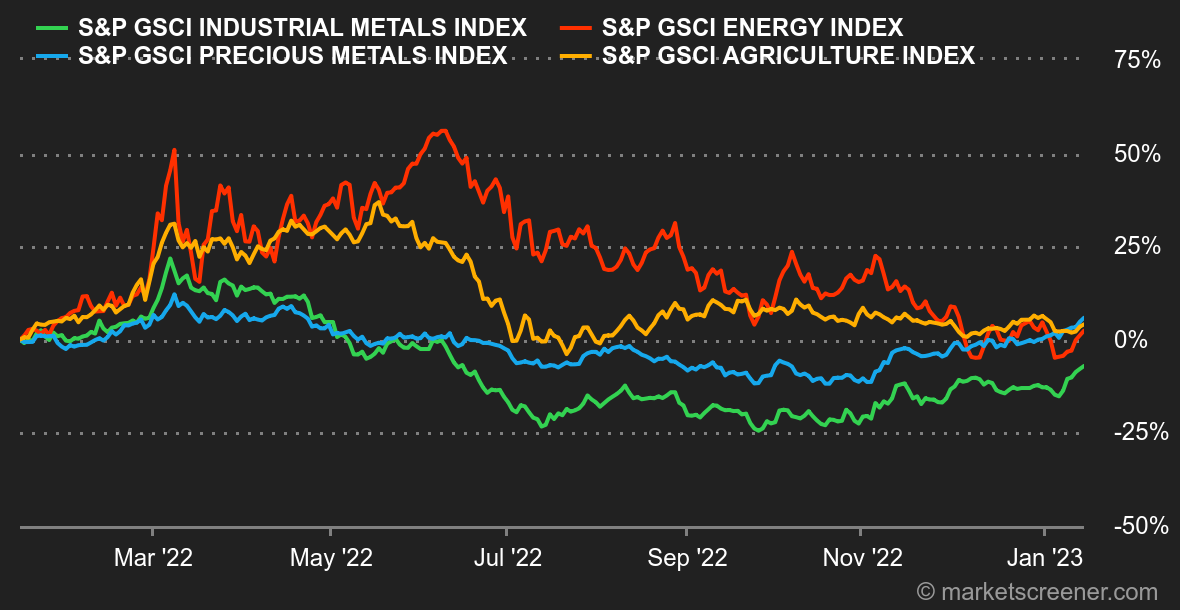

| Energy: This week saw oil markets bounce back. They are getting back on track after a gloomy start to the year. The weakness of the greenback and the return of risk appetite has allowed oil to rebound strongly this week. The proof is in the pudding, with Brent and WTI rising by around 7% to USD 84.60 and USD 79 per barrel respectively. In Europe, the price of natural gas continues to decline, with the Dutch TTF fluctuating around 65 EUR/MWh. Metals: Traders have gone into "risk-on" mode on industrial metals, which are benefiting from a favorable context: a falling dollar, expectations of monetary policies that are less harmful to activity and the reopening of China. Copper has passed the USD 9,000 per metric ton mark in London. The same dynamic was seen in precious metals, including gold, which benefited from an easing in bond yields. The ounce of gold is trading around 1900 dollars. Agricultural products: In its latest monthly report, the U.S. Department of Agriculture (USDA) lowered its estimate of corn production in the United States due to a contraction in crops dedicated to corn. For wheat, the USDA left its U.S. production estimates unchanged, with the exception of ending stocks, which were revised downward. At the price level, wheat is bought around 740 cents per bushel in Chicago. Corn, on the other hand, has logically risen to 670 cents. |

|

| Macroeconomics |

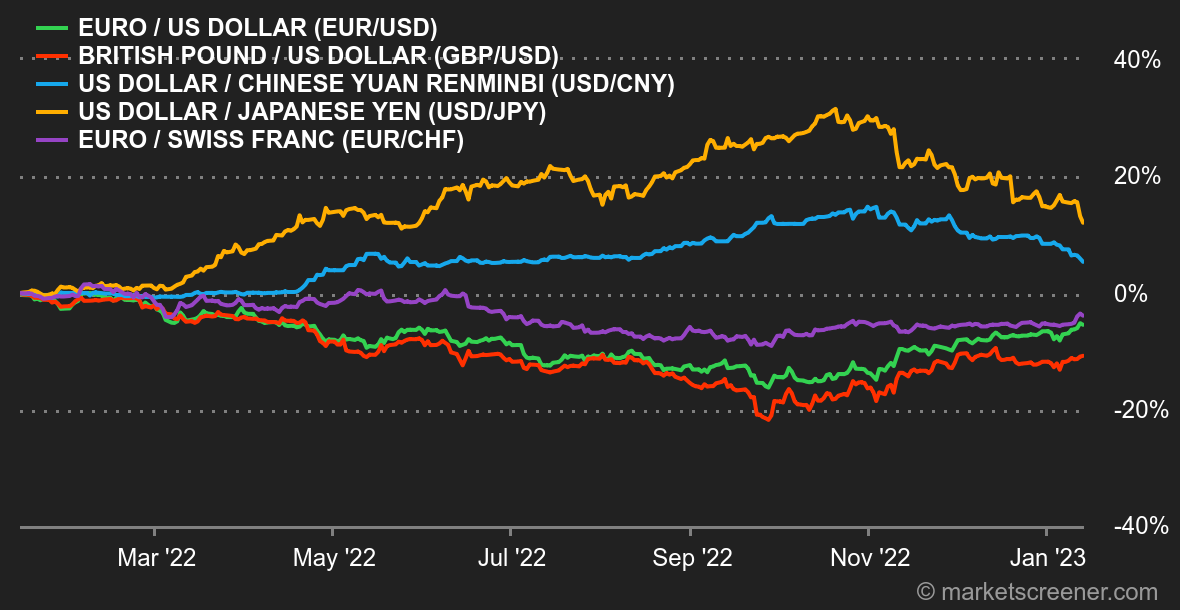

| Atmosphere. The glass is half full. Investors are cheering clues that the US central bank is about to pivot to a more dovish policy. Fed boss Jerome Powell did not use the platform he had on Tuesday to calm investors' renewed risk appetite. In addition, the December inflation figures for the US were fully in line with expectations, i.e. a further slowdown in the overheating of prices. This easing was visible in the dollar and bond yields, which declined. In Europe, the economy is still resilient, as evidenced by a more robust than expected industrial production in November, according to Eurostat. However, there is still a sense of caution in the background, as investors are having difficulty accurately assessing the damage that rising rates will have on the economy in the months ahead. Currencies. The U.S. dollar remained under pressure for most of the week, consistent with financial market sentiment that the Fed will be softer than expected in the coming weeks. The euro rallied to $1.08, its best level since April. Among the week's notable moves, the Russian ruble began a rebound, after collapsing 17% in December after Western measures to cap oil prices. It is rising against all major currencies, including the USD at 68.6040 RUB. The euro, meanwhile, also regained ground against the franc, at CHF 1.0047 per EUR. Interest Rates. Last Thursday's release of CPI in line with expectations confirmed the slowdown of inflation in the US. While it is still too early to claim victory, investors preferred to see the glass half full. This new positive figure - it's all a matter of interpretation - eases the pressure on the Fed, which could simply raise its key rates by 25 basis points at its next policy meeting scheduled for February 1. The yield on the 10-year bond has come close to its December low of around 3.40/3.35%. In Germany, it is also time for long-term rates to ease: the Bund yield is currently testing its 34-day moving average around 2.16%. The next supports are located at 1.93% and 1.77%. Crypto-currencies. Crypto-investors can, at last, smile a little this week. Bitcoin is up more than 11% and back above $19,000 at the time of writing. The total capitalization of the cryptocurrency market has recovered over $70 billion in the wake of market participants' renewed appetite for risky assets. However, the cryptocurrency ecosystem will need to find strong internal catalysts to regain investor confidence after the destructive events of 2022. Calendar. The week begins with a holiday on Monday in the US (a day dedicated to Martin Luther King). The highlights will be the first estimate of Chinese Q4 2022 GDP (Tuesday) and a double US statistic on Wednesday: December retail sales and producer prices. The German ZEW financial confidence index (Tuesday) and a speech by ECB boss Christine Lagarde on Wednesday are also scheduled. It is also worth noting that the World Economic Forum in Davos is being held from January 16 to 20. |

|

|

| Things to read this week | ||||||

|

|

*The weekly movements of indexes and stocks displayed on the dashboard are related to the period ranging from the open on Monday to the sending time of this newsletter on Friday. The weekly movements of commodities, precious metals and currencies displayed on the dashboard are related to a 7-day rolling period from Friday to Friday, until the sending time of this newsletter. These assets continue to quote on weekends. |

By

By