Atmosphere: Bad week in Beijing. Due to the impact of multiple lockdowns, the Chinese economy is slowing down sharply in the second quarter. The GDP of the world's second largest economy fell by 2.6% over the period April-May-June, well below the consensus forecast of a decline of around 1.4%. This presents the People's Bank of China with a difficult choice: to lower interest rates or not. The first solution would risk fueling inflation, which has remained relatively low until now. The latter could plunge the economy into stagflation, caused mainly by the sluggish growth. The 4.0% GDP expansion expected for the year as a whole remains weak for the Chinese economy.

Rates: In terms of bond yields, the US yield spread widened this week to a record high dating back to 2000. Ten-year US debt is currently paying 2.96%, which is 0.10% and 0.17% less than the 2 and 5-year maturities respectively. As a reminder, a rate inversion is traditionally a harbinger of a recession and in any case always illustrates the fears of one. In Europe, the downward trend continues, with the French OAT falling back to 1.68% over 10 years after rising to 2.4% less than a month ago. The German bond is back to the levels of the end of May with a yield of 1.14% for the 10-year maturities. Finally, the Italian 10-year has stabilized since the beginning of the week at 3.35%, nearly 1% below the mid-June peak.

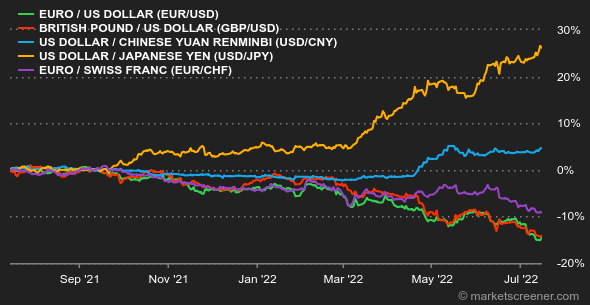

Currencies: The European single currency fell below parity - $0.9998 - against the dollar on Wednesday. This is the first time in nearly 20 years. At the time of writing, the euro has recovered slightly and is trading at $1.006. But it is still down nearly 12% since the beginning of the year. A decline caused in large part by growing fears of recession in addition to the war in Ukraine. Same trend against the Swiss franc - 0.9871CHF. The only positive point is that the euro has regained some color since the beginning of the week against the pound sterling - 0.8507GBP while the departure of Boris Johnson was rather in its disadvantage.

Cryptocurrencies: Complicated period also for crypto-investors. Like OpenSee, which is reducing its workforce by 20%, due to the "unprecedented combination of crypto winter and macroeconomic instability", it is a good part of the industry that is currently in turmoil. Between cost-cutting in spades after glittering club sponsorship and stadium naming deals, operational difficulties are appearing at some key companies in the ecosystem - Celsius Network, 3AC... Bitcoin, which has hit the $21,600 mark for a second time since mid-June, is not helping this complex situation.

Calendar: The next week looks to be rather quiet in terms of economic statistics. The only event on the horizon, but not the least, is the ECB meeting next Thursday. A 25 basis point hike, its first in over a decade, should be announced. The next day, the U.S. manufacturing PMI is also expected.

|

By

By