|

Monday April 19 | Weekly market update |

| With the acceleration of vaccination campaigns and the significant improvement in the global economic outlook, financial markets continue to rise. |

| Indexes Last week, all indices were up. In Europe, the CAC40 with dividends reinvested is moving to new highs. The DAX duplicated this performance and climbed 1.17%. The Footsie is not to be outdone and is up by 1.5%. In southern Europe, the IBEX35 gained 0.36% while the Italian index was more dynamic (+1%). In the United States, the Dow Jones shows no weakness with an additive increase of 1.20% over the last five days, as well as the S&P500 (+1.30%) and the technology sector where the Nasdaq 100 is improving by 1.10%. French indice CAC 40 reinvested dividends at an all-time high  |

| Commodities Oil prices have been on the rise this week. The International Energy Agency (IEA) and OPEC provided further optimism by jointly raising their forecast for oil demand this year. The IEA raised its forecast for demand growth by nearly 230,000 barrels per day to 96.7 million barrels per day (mbpd), compared to 190,000 for OPEC, which expects demand of 96.3 mbpd. Brent crude is trading above USD 67 while the US benchmark is trading around USD 63.5 per barrel. Precious metals continue their rebound initiated two weeks ago. Investors' appetite for equities did not prevent gold from approaching USD 1,770. Silver, on the other hand, had an almost perfect week and climbed to 26 USD. As for the base metals segment, they ended the week in mixed order. While nickel and tin paused (at USD 16049 and 27800 respectively), aluminum and copper gained ground (at USD 2328 and 9190 respectively). The upward cycle continues for commodities  |

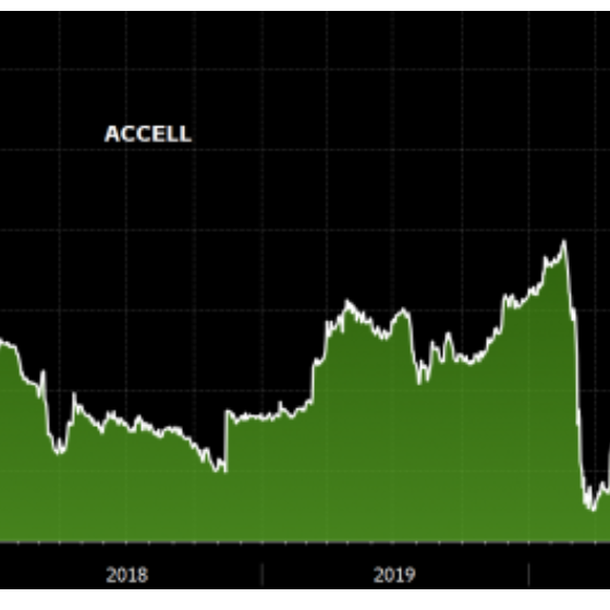

| Equities markets Based in Amsterdam, Accell Group, is one of the heavyweights in the production and marketing of bicycles in Europe. The company, leader in electric bicycles, posted a remarkable performance since the beginning of the year: +65%. Most of the 2020 sales are not made locally (20%) but on German territory (30%). Worth around 1 billion euros, it has been able to benefit from the trend in the value sector since the beginning of the year. The company is also riding the wave of the growing demand for electric bikes since 2019. European production of electric bicycles rose from 1.4 million units in 2017 to 2.4 million in 2019, according to EBMA (the European bicycle manufacturers association). Still according to the association, this figure could reach 8 million by 2025. What a great outlook. Accell stock's upward path after a bumpy ride  |

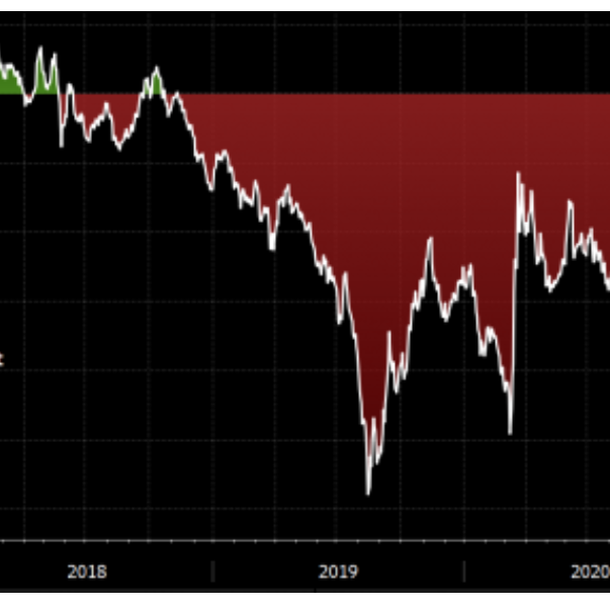

| Bond market In the bond market, the weather remains uncloudy despite the setbacks of Johnson & Johnson's vaccine and the ongoing debates on the reliability of the Covid-19 rapid tests. Neither Bund yields nor periphery spreads have moved much. The German major bond is trading on a -0.28% basis. This stability is mirrored in the French OAT at -0.02%. In the Eurozone, 10-year benchmarks in Italy (0.77%), Spain (0.38%) and Portugal (0.39%) are following similar patterns. Still on the continental level, Swiss debt is up to -0.2%, a one-year high, after having hit a low of -1.20% (see chart). On the other side of the Atlantic, on the other hand, spring economic sentiment is growing vigorously thanks to the advance of vaccination and in response to the large series of fiscal measures that have been launched. This optimistic mood is also being fueled by real economic factors such as retail sales, capacity utilization and industrial production. In the face of this dynamic recovery, inflation is not scaring investors and the Tbond yield is even giving up some ground at 1.58%. The Swiss ten-year is approaching the symbolic zero line  |

| Forex market The euro's recovery against the dollar has been accomplished with some discipline as the currency has bounced off its 20-week average and has reached the symbolic level of USD 1.20. This move comes as both hot and cold weather are sweating through recent official speeches. St. Louis Fed President James Bullard said that a 75% inoculation rate would be a sign of the end of the crisis and would allow for a reduction in asset purchases by the Fed. These words contradict those of the president of the Boston Fed, Eric Rosengren, who does not see a return to full employment for two years, a condition deemed necessary to raise rates. Across the Channel, the British pound is losing ground against all of its counterparts, with the EUR/GBP pair trading at 0.86 GBP. In the southern hemisphere, renewed optimism among investors in the global economy favors the Australian dollar, which continues its upward trajectory against the greenback at USD 0.77 It is difficult not to mention in this section the stratospheric prices of crypto-currencies, which are globally valued at around 2,000 billion dollars, including Bitcoin, which alone represents half of these digital assets. |

| Economic data In Europe, March retail sales increased by 3% from last month. The CPI remained stable at 1.3%. The ZEW index decreased from 74 to 63.3 and even came in below estimates (77.2). In Great Britain, GDP grew by 0.4% this month, slightly below expectations. In the United States, CPI increased by 0.6%, more than expected but without impacting the markets, which were expecting a slower increase. Retail sales largely exceeded expectations, increasing by 9.8% instead of the 5.8% initially expected by analysts. In the labor market, the number of job seekers fell by 25% in one week, reaching the lowest level since March 2020. |

| Total complacency Specialized commentators will soon run out of words to describe the bullish trajectories of indices. Records are being broken every day and optimism is at its peak. This little light that is now appearing at the end of the tunnel is giving investors immense hope, sweeping aside not only the far from homogeneous global management of the pandemic, but also the inflationary risks. It is like a desire to take into consideration only the blue sky scenario. All sectors are benefiting and the famous "value-growth" trade-offs have disappeared from the debate on the tactics to adopt. The new stock market month that is beginning could constitute a phase that is conducive to a certain lull in this exuberance. |

By

By