|

|

| This week's gainers and losers |

|

|

| Commodities |

|

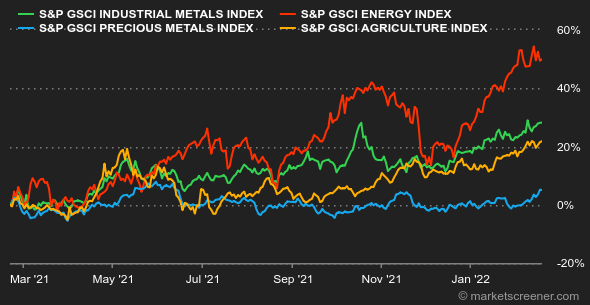

Oil markets remain tense and particularly sensitive to the Ukrainian risk, with Washington and Moscow sending mixed signals. However, prices have fallen back slightly this week and this is enough to end their eight-week run of consecutive increases. While traders are keeping a close eye on developments in Ukraine, they are also eyeing the Iranian nuclear talks, which appear to be moving in a positive direction. Tehran has said that a deal is close, raising hopes that Iranian oil will soon be back on global markets. Brent crude is trading around USD 91.50 a barrel, compared to USD 90.3 for the U.S. benchmark. Like oil, geopolitical tensions are also impacting industrial and precious metals. Gold is thus back in the spotlight and taking advantage of its safe haven status. The price of the barbarian relic has indeed jumped to briefly reach 1900 USD. Still in the precious metals register, silver is trading near USD 24 per ounce while platinum and palladium are up to USD 1088 and 2320 respectively. As for industrial metals, prices remain strong and are benefiting from a weaker greenback. Aluminum stabilized at around USD 3,300 per metric ton while nickel broke the USD 24,000 mark. A word on agricultural commodities. Corn prices have been flat over the last five days in Chicago and are trading at 647 and 799 cents per bushel respectively. |

|

| Macroeconomics |

|

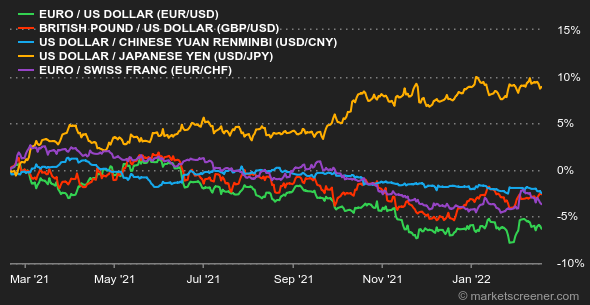

The bad news is that statistics released this week will not ease inflationary fears. In the US, January producer prices rose twice as fast as expected and consumption is still in the black. In the UK, prices rose by 5.4% year-on-year. Everything points to a vigorous monetary response through rate hikes, which is only moderately pleasing to financiers, who are hungry for cheap money. But the main source of nervousness for investors this week was the Russian bear and its claws at the Ukrainian border. How far is Vladimir Putin willing to go and what are his real designs? If you have the answer, please contact the nearest Western chancellery as a matter of urgency. Movements have been relatively contained this week in the foreign exchange market. It should be noted, however, that the Australian dollar recovered 1% against the US dollar to USD 0.72043. The euro fell slightly against the franc to CHF 1.04464. The EUR/USD pair was neutral at around USD 1.13404. Sovereign debt yields were down this week, especially on the US 10-year, which is back at 1.94%. Projections show that the likelihood of a double rate hike by the Fed in March is on the back foot with financial intermediaries. The German Bund is at 0.2% and flirts with Swiss debt at 0.22%. The French OAT is stable at 0.69%. Bitcoin and its peers are testing the nerves of crypto-investors. While the price of the crypto-currency seemed to resume the bullish path in recent days, in the last 48 hours, the market leader has shed almost 10% of its valuation and thus returns to flirt with the $40,000 threshold. With a tense geopolitical situation, investors' appetite for risky assets may be put on hold for a while. Next week, PMI activity indicators for the major economies return on Monday. The German Ifo confidence index will follow on Tuesday, before Friday's PCE inflation data and US durable goods orders. |

|

|

| Things to read this week | ||||

|

|

*The weekly movements of indexes and stocks displayed on the dashboard are related to the period ranging from the open on Monday to the sending time of this newsletter on Friday. The weekly movements of commodities, precious metals and currencies displayed on the dashboard are related to a 7-day rolling period from Friday to Friday, until the sending time of this newsletter. These assets continue to quote on weekends. |

By

By