Atmosphere: "Let's go again. Oh well, no". Investors seem to have sincerely believed that the first signs of a slowdown in the US economy would shake the Fed's determination to raise rates. That was the mood at the beginning of the week, and it was reinforced by the Australian central bank, which surprised everyone by raising its own rates at a minimum. But it didn't last and the release of strong employment data in the US on Friday didn't help matters. The unemployment rate fell from 3.7% to 3.5% and the labor market barely slowed. Another case of good news is bad news. If the economy holds up, the Fed will probably have to tighten its monetary policy even more. And investors don't like that at all.

Rates: The yield on 10-year U.S. government debt fell from 4% last week to less than 3.6% on Tuesday. But the latest data available, including September employment, pushed it back up to 3.88%. In Europe, bonds are also falling as yields rebound. The Bund is at 2.18% on 10 years and the OAT at 2.78%. British Gilts are at 4.2%, exceeded only by Italian BTP (4.65%) and Greek debt (4.77%). The inflationary outlook continues to keep yields high.

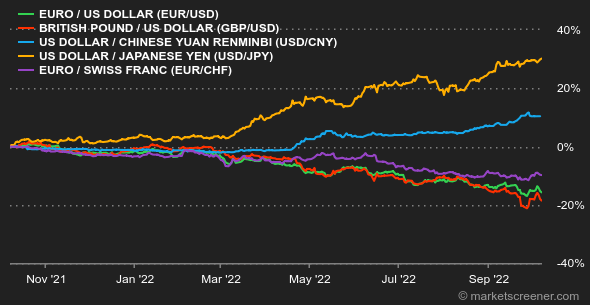

Currencies: There was a lot of turmoil at the beginning of the week, especially in mining-related currencies such as the Australian dollar (AUD) and the Canadian dollar (CAD), which crumbled against the US dollar. But things have pretty much rebalanced since then. The EUR/USD is trading at 0.9758, while the British pound is trading at USD 1.1146 to GBP 1. The Bank of Japan's efforts to support the yen are not keeping the currency from falling back to JPY 145.08 per USD 1.

Cryptocurrencies: Bitcoin is starting October on the same track as previous weeks, still sailing around $19,500 at the time of writing. A low volatility that indicates the mistrust, the wait-and-see attitude and the observation of individual, professional and institutional investors, while waiting to see more clearly in a still very tense macroeconomic context. The ether, the second crypto-currency of the market in terms of capitalization, also fails to attract capital despite the success of its merger that took place in mid-September. Crypto-investors will therefore have to wait a while longer before regaining some optimism.

Calendar: A quartet of US statistics will set the tone next week. September's producer price index (Wednesday) and consumer price index (Thursday), followed by September's retail sales and the University of Michigan's preliminary consumer confidence index for October (Friday). Central banks are still on the prowl, with a speech by Lael Brainard (Fed) scheduled for Monday, followed on Wednesday by a speech by Christine Lagarde (ECB) and the release of the minutes from the last Fed meeting.

|

By

By