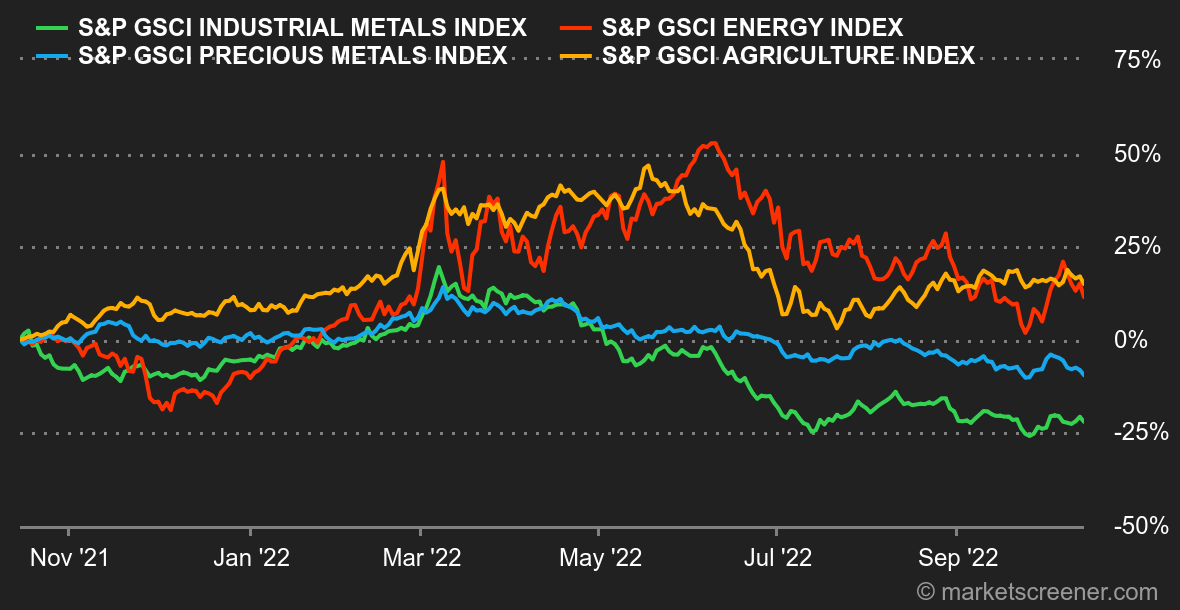

Atmosphere: A big mess. Two events marked the week. The US inflation figures on the one hand and the British economic saga on the other. In Great Britain, the match between the Bank of England and Liz Truss has largely turned to the advantage of the older of the two ladies. The Prime Minister sacked her short-lived finance minister, Kwasi Kwarteng, who was clearly used as a fuse after the fiasco of the tax cut announcements. History will tell whether this will help to restore some of the image of the beginning of his mandate. At the same time, US inflation in September exceeded expectations. But in an unlikely move as only financial markets know how to make, stocks rebounded in the opposite direction of their usual reaction. However, on Friday, the But on Friday, the survey from the University of Michigan showed U.S. consumers raised their expectations for future inflation, sending stocks lower.

Rates: Gilts, the British bonds, went through all the stages this week, tossed back and forth between statements from one side and the other. The departure of Kwasi Kwarteng and the Bank of England's efforts to calm the situation have clearly eased the mood. The yield on British 10-year debt went from 5% to less than 4% in a few days. The improvement has spread to the continent where the French OAT is down to 2.80% and the German Bund to 2.19%, a return to last Friday's positions. In the United States, the 10-year reached 3.93%, a level that has changed little despite the still overheated inflation figures. The market is now almost convinced that the Fed will raise rates by 75 basis points again in early November, but this has become the norm. You get used to anything.

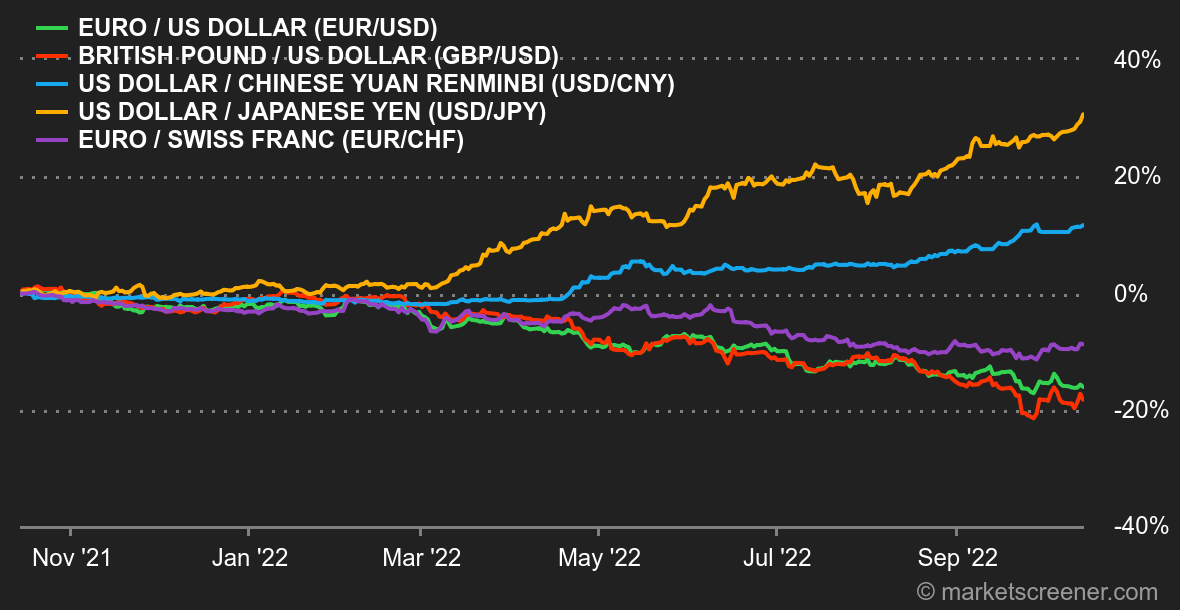

Currencies: The euro and the dollar were broadly neutral on the week, with the exchange rate hovering around EUR 0.97255 to USD 1 on Friday. The British pound regained some color with the British government's political about-face. It was EUR 0.8678 to GBP 1 at the end of the week. The dollar remains broadly firm against all currencies, and continues to climb against the yen. At JPY 147.72 per USD, the Japanese currency is trading lower than the level at which the Bank of Japan deemed it necessary to intervene earlier this month. Since January 1, the greenback is up 28% against the yen, due to the widely divergent monetary policies between the two countries.*

Crypto-currencies: The leader of the sector, bitcoin, has been hovering around $19,000 for the past month, putting on hold the downward spiral it has been experiencing lately. For now, in a macroeconomic context that is still anxiety-provoking, any technical rebound is relatively fragile, which proves that institutional, professional and retail investors are still wary of crypto-currencies.

Calendar: The beginning of the week will be marked by the announcement of the first estimate of Chinese GDP growth in the third quarter (Tuesday). This will be followed by the UK consumer price index for September (Wednesday) and the US Philly Fed manufacturing index (Thursday). James Bullard, one of the most prominent Fed members of the moment, is scheduled to deliver a speech on Wednesday. On the corporate side, some big names will announce their quarterly results next week: Johnson & Johnson, Roche, Netflix, Tesla, Nestlé, ASML, IBM and L'Oréal among others.

|

By

By