The US regulatory and litigation pathway for biosimilars (the

Litigation followed many biosimilar applications, but most cases have now been resolved. Some biosimilars were approved without litigation and some litigations were completed without FDA approval of the biosimilar.

Biosimilar approvals and marketing

The FDA has approved biosimilars of simple biologics, such as Neupogen (filgrastim,

Biosimilars are also being approved for clinical indications of innovator biologics through extrapolation. Such extrapolation — in which evidence obtained by a biosimilar maker for one indication is extrapolated to approved indications of the reference biologic, without testing the biosimilar in the additional indications — offers extraordinary savings, as biosimilar makers can avoid trials for each indication.

The first biosimilar,

Sales data from EvaluatePharma

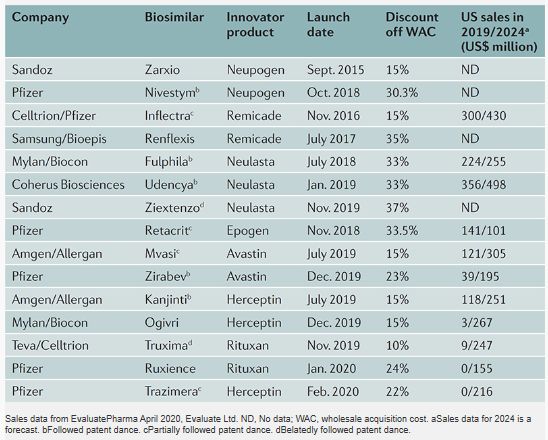

There are now biosimilars of seven innovator products on the US market. Biosimilars have launched at 10-37% off the WAC of the innovator products, with the second and third biosimilars of the same innovator product typically coming in at greater discount than the first. Many biosimilars were launched prior to the completion of patent litigation concerning their biosimilars.

Biosimilar litigation

The litigation pathway for biosimilar products has also matured in the past 10 years. The litigation pathway is highly orchestrated and starts when the biosimilar maker provides the innovator company with regulatory and manufacturing information, after the FDA accepts its application for review. The parties then exchange positions on infringement and validity and negotiate which patents to assert (the BPCIA 'patent dance').

From the beginning, litigation under the BPCIA has been a 'choose your own adventure'. Some biosimilar makers have bypassed the litigation pathway entirely and not provided information to the innovator, leaving the innovator to sue the biosimilar maker without clear information. The first such litigation, involving

In the next decade, biosimilar makers are likely to continue to take advantage of the patent dance. Biosimilars cannot be approved until the innovator product has been on the market for 12 years, providing time and incentive to proceed in an informed manner.

Originally published by Nature Reviews Drug Discovery,

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

Ms

1177 Avenue Of The Americas

NY 10036

Tel: 2127159100

Fax: 2127158000

E-mail: Pmanuele@kramerlevin.com

URL: www.kramerlevin.com

© Mondaq Ltd, 2020 - Tel. +44 (0)20 8544 8300 - http://www.mondaq.com, source