Quarter Three 2020 Highlights:

- Net income totaled $4.1 million for the quarter ended September 30, 2020, or $0.34 per diluted common share, an increase of 16.5% from $3.5 million, or $0.29 per diluted common share, for the quarter ended September 30, 2019.

- A $2.2 million provision for loan losses was recorded during the quarter ended September 30, 2020, largely due to economic uncertainties from the COVID-19 pandemic, bringing the year to date provision to $5.7 million.

- Total assets grew $70.7 million, or 4.2%, to $1.75 billion for the quarter ended September 30, 2020, compared to $1.68 billion at June 30, 2020.

- Total loans receivable, net of deferred loan fees, grew $62.2 million, or 4.3%, during the quarter ended September 30, 2020 to $1.51 billion compared to $1.45 billion at June 30, 2020.

- Paycheck Protection Program (“PPP”) loans totaled $452.8 million at September 30, 2020.

- Total deposits increased $53.6 million, or 4.1%, during the quarter ended September 30, 2020 to $1.36 billion, compared to $1.31 billion at June 30, 2020.

- Utilized the Paycheck Protection Program Liquidity Facility (“PPPLF”) to fund a portion of our PPP loans. $202.6 million loans pledged and borrowed at September 30, 2020.

EVERETT, Wash., Oct. 27, 2020 (GLOBE NEWSWIRE) -- Coastal Financial Corporation (Nasdaq: CCB) (the “Company”), the holding company for Coastal Community Bank (the “Bank”), today reported unaudited financial results for the quarter ended September 30, 2020. Net income for the second quarter of 2020 was $4.1 million, or $0.34 per diluted common share, compared with net income of $3.7 million, or $0.30 per diluted common share, for the second quarter of 2020, and $3.5 million, or $0.29 per diluted common share, for the quarter ended September 30, 2019.

“As we continue to navigate our way through these uncertain times, I am reminded that the success of our Company is not dependent on just our financial results, but also on the team behind the results. Our team continues to be relentless in their commitment to helping our communities and each other, despite the disruptions and economic unrest resulting from the COVID-19 pandemic. This dedication enabled us to finish the third quarter of 2020 with net income of $4.1 million, which includes $2.2 million in provision for loan losses primarily in response to the economic uncertainties of the pandemic. As a preferred Small Business Administration (“SBA”) lender, we continued to accept and fund financial assistance to existing and new small business customers via the PPP as provided in the Coronavirus Aid, Relief and Economic Security Act (“CARES Act”), until the program ended in August 2020. We continue to develop our CCBX division, which provides Banking as a Service (“BaaS”) enabling broker dealers and digital financial service providers to offer their clients banking services, which continues to provide additional sources of fee income. We are excited about our recently announced collaboration with Google and look forward to introducing digital bank accounts through Google Pay, anticipated in 2021,” stated Eric Sprink, the President and CEO of the Company and the Bank.

“Our commitment to our customers was evidenced in part by the deferred or modified payments, pursuant to federal guidance, that we were able to provide to customers. The majority of these loans have successfully returned to active status, with just $19.6 million, representing 15 loans, remaining outstanding with deferred or modified payments as of October 23, 2020. This proactive approach to working with customers and modifying payments helped provide financial relief within our communities.

“We are steadfast in our dedication to the health and safety of our employees and customers. As guidance from our federal, state and local government and public health officials is updated, we continue to enhance and modify measures already in place to keep us all healthy and safe while remaining open and serving our customers at our drive-throughs, by appointment, call center, mobile banking, online banking and ATMs. In addition, the Company continues to successfully employ remote work arrangements to the fullest extent possible.”

Results of Operations

During the second and third quarters of 2020, significant focus was placed on helping the small businesses in our communities through the PPP. These loans have had a significant impact on our financial statements for the quarter ended September 30, 2020 and will continue to impact our results in the future. Throughout this earnings release, we will address the impact of these loans including borrowings received through PPPLF to help fund these loans and to aid in liquidity, increased customer deposit accounts from unused disbursements, and earnings and expenses related to these activities. Any estimated adjusted ratios that exclude the impact of this activity are non-GAAP measures. For more information about non-GAAP financial measures, see the end of this earnings release.

The table below summarizes key information regarding the PPP loans as of the period indicated:

| Loan Size | |||||||||||||||||||

| As of September 30, 2020 | |||||||||||||||||||

| $0.00 - $50,000.00 | $50,0000.01 - $150,000.00 | $150,000.01 - $350,000.00 | $350,000.01 - $2,000,000.00 | > 2,000,000.01 | Totals | ||||||||||||||

| (Dollars in thousands; unaudited) | |||||||||||||||||||

| Principal outstanding: | |||||||||||||||||||

| Existing customer | $ | 11,232 | $ | 27,696 | $ | 29,806 | $ | 86,302 | $ | 52,299 | $ | 207,335 | |||||||

| New customer | 20,604 | 34,355 | 42,793 | 86,707 | 61,052 | 245,511 | |||||||||||||

| Total principal outstanding | 31,836 | 62,051 | 72,599 | 173,009 | 113,351 | 452,846 | |||||||||||||

| Deferred fees outstanding | (1,161 | ) | (2,116 | ) | (2,417 | ) | (3,375 | ) | (752 | ) | (9,821 | ) | |||||||

| Deferred costs outstanding | 629 | 278 | 174 | 134 | 19 | 1,234 | |||||||||||||

| Net deferred fees | $ | (532 | ) | $ | (1,838 | ) | $ | (2,243 | ) | $ | (3,241 | ) | $ | (733 | ) | $ | (8,587 | ) | |

| Total principal, net of deferred fees | $ | 31,304 | $ | 60,213 | $ | 70,356 | $ | 169,768 | $ | 112,618 | $ | 444,259 | |||||||

| Weighted average maturity (years) | 2.21 | 1.75 | 1.63 | 1.63 | 1.64 | 1.69 | |||||||||||||

| Number of loans: | |||||||||||||||||||

| Existing customer | 498 | 307 | 129 | 108 | 13 | 1,055 | |||||||||||||

| New customer | 1,107 | 386 | 193 | 119 | 19 | 1,824 | |||||||||||||

| Total loan count | 1,605 | 693 | 322 | 227 | 32 | 2,879 | |||||||||||||

| Percent of total | 55.7 | % | 24.1 | % | 11.2 | % | 7.9 | % | 1.1 | % | 100.0 | % | |||||||

Net interest income was $15.1 million for the quarter ended September 30, 2020, an increase of 17.9% from $14.0 million for the quarter ended June 30, 2020, and an increase of 40.7% from $10.7 million for the quarter ended September 30, 2019. The increase compared to the prior quarter and prior year’s third quarter is largely related to increased interest income resulting from loan growth. This loan growth included $452.8 million in PPP loans as of September 30, 2020, which contributed $3.6 million in interest income for the quarter ended September 30, 2020. Net deferred fees on PPP loans are earned over the life of the loan, as a yield adjustment in interest income. Forgiveness of principal, early paydowns and payoffs on PPP loans will increase interest income earned in those periods from the recognition of PPP deferred fees. Our loan yield was 4.33% for the three months ended September 30, 2020, compared to 4.57% for the three months ended June 30, 2020. This loan yield was lower due to the lower rate that PPP loans bear and downward repricing of our variable rate loans in the low interest rate environment. Interest and fees on loans was $1.1 million higher compared to the three months ended June 30, 2020 and $4.6 million higher than the three months ended September 30, 2019 due to increased loan balances. Interest income from interest earning deposits with other banks decreased $31,000, and $387,000 from June 30, 2020 and September 30, 2019, respectively, to $99,000 for the three months ended September 30, 2020, compared to $130,000 and $486,000 the three months ended June 30, 2020 and September 30, 2019, respectively, as a result of decreased interest rates and interest paid by other banks due to excess cash in the market. Interest expense was $1.3 million for the quarter ended September 30, 2020, compared to $1.4 million for the quarter ended June 30, 2020, a $135,000 decrease from the quarter ended June 30, 2020 and a $330,000 decrease from the quarter ended September 30, 2019. Interest expense on deposit accounts was $880,000 a decrease of $216,000, or 19.7%, from the quarter ended June 30, 2020, and a decrease of $555,000, or 38.7%, from the quarter ended September 30, 2019. The interest expense decrease occurred despite an increase in average interest bearing deposits for the quarter ended September 30, 2020 of $42.1 million and $195.1 million, over the quarter ended June 30, 2020 and September 30, 2019, respectively, as a result of lower interest rates. Interest expense on borrowed funds was $418,000 for the quarter ended September 30, 2020, compared to $337,000 and $193,000 for the quarters ended June 30, 2020 and September 30, 2019, respectively. This increase was primarily the result of the PPPLF borrowings, which were obtained to provide liquidity to fund the PPP loans.

Net interest income increased $9.8 million, or 31.9%, to $40.5 million for the nine months ended September 30, 2020, compared to $30.7 million for the nine months ended September 30, 2019. These increases are largely related to increased interest income resulting from loan growth. Interest and fees on loans increased $11.0 million, or 33.3%, over the prior year period. This loan growth included $452.8 million in PPP loans as of September 30, 2020, which contributed $6.3 million in interest income for the nine months ended September 30, 2020. Overall growth in the other categories of the loan portfolio also contributed to this increase. Net deferred fees on PPP loans are earned over the life of the loan, as a yield adjustment in interest income. Forgiveness of principal, early paydowns and payoffs on PPP loans will increase interest income earned in those periods from the recognition of PPP deferred fees. Interest income from interest earning deposits with other banks decreased $1.4 million, or 69.8%, to $587,000 for the nine months ended September 30, 2020, compared to $1.9 million for the nine months ended September 30, 2019, as a result of decreased interest rates and interest paid by other banks due to excess cash in the market. Interest expense decreased $386,000, or 7.9%, to $4.5 million for the nine months ended September 30, 2020 compared to $4.9 million for the nine months ended September 30, 2019. Lower interest rates resulted in a decrease in interest expense despite a $136.9 million increase in average interest bearing deposits and $121.1 million increase in average borrowings for the nine months ended September 30, 2020, compared to the prior year period. Borrowings included $102.5 million in average PPPLF borrowings, which were obtained to partially fund the PPP loans.

Net interest margin for the quarter ended September 30, 2020 was 3.62%, a 16 basis point decrease from 3.78% for the quarter ended June 30, 2020 and a 67 basis point decrease from 4.29% for the quarter ended September 30, 2019. The decrease over the prior quarter and third quarter in 2019 was largely a result of the low interest rate on PPP loans and lower interest rates on all other loans, especially our variable rate loans. PPP loans accounted for an average of $448.3 million in gross loans for the quarter ended September 30, 2020, and bear a contractual interest rate of 1.0%, and yield approximately 3.16% after considering the amortization of deferred PPP loan fees, for the quarter ended September 30, 2020. Cost of funds decreased eight basis points in the quarter ended September 30, 2020 compared to the quarter ended June 30, 2020 and decreased 39 basis points from the quarter ended September 30, 2019. Deposits into noninterest bearing and low interest bearing accounts by new and existing customers contributed to the reduced cost of funds. In addition, the Federal Open Market Committee (“FOMC”) lowered the Fed Funds rates five times for a total decrease of 2.25% since June 2019, which has impacted market rates paid on deposits. The lower interest rate environment will continue to impact the Company's net interest margin. Net interest margin for the nine months ended September 30, 2020 decreased 41 basis points compared to the nine months ended September 30, 2019 as a result of the low rate on PPP loans and lower rates on all other loans, especially our variable rate loans. Cost of funds decreased 29 basis points to 0.45% for the nine months ended September 30, 2020 compared to 0.74% for the nine months ended September 30, 2019. Deposits into new and existing noninterest bearing accounts and the lowered Fed Funds rates contributed to the reduced cost of funds.

During the quarter ended September 30, 2020, the average balance of total loans receivable increased by $158.0 million, to $1.49 billion, compared to $1.33 billion for the quarter ended June 30, 2020, largely as a result of PPP loans. PPP loans bear a contractual interest rate of 1.0%, yielding approximately 3.16%, after considering the amortization of deferred PPP loan fees. The average balance of total loans receivable at September 30, 2020 increased by $627.4 million, compared to $865.7 million for the third quarter in 2019, due to overall growth in the loan portfolio, combined with the aforementioned growth in PPP loans. Total loan yield for the quarter ended September 30, 2020 was 4.33%, compared to 4.57% for the quarter ended June 30, 2020, and 5.36% for the quarter ended September 30, 2019. The reduction in loan yield was a result of the lower rate that PPP loans bear and the downward repricing of our variable rate loans in the low rate environment. PPP loans reduced the loan yield* by 45 basis points for the quarter ended September 30, 2020.

Contractual yield on loans receivable, excluding earned fees approximated 3.61% for the quarter ended September 30, 2020, compared to 3.91% for the quarter ended June 30, 2020, and 5.24% for the quarter ended September 30, 2019. During the quarter ended September 30, 2020, the average balance of PPP loans was $448.3 million. These loans bear a contractual rate of 1.0%, which negatively impacted the average contractual yield on loans. Excluding PPP loans and their related earned loan fees, the contractual yield on loans approximated 4.69%*. Also contributing to the reduction in contractual yield was the reduction in rates by the FOMC, which has resulted in lower rates on our variable rate loans and on new and renewing loans. Although we have rate floors in place for $361.8 million, or 23.8%, in existing loans, the rate reductions by FOMC has a corresponding impact on loan yields and the net interest margin in future periods.

Cost of deposits for the quarter ended September 30, 2020 were 0.27%, a decrease of eight basis points from 0.35% for the quarter ended June 30, 2020, and a 37 basis point decrease from the quarter ended September 30, 2019. Deposit growth in new and existing noninterest bearing and low interest bearing accounts contributed to the reduced cost of funds. We gained new customer relationships by making PPP loans to noncustomers that continue to move their deposit relationships to the Bank. Market conditions for deposits continued to be competitive during the quarter ended September 30, 2020; however, we continued lowering deposit rates, with the largest changes to our interest-bearing demand deposit and certificate of deposit rates being effective in second quarter of 2020, and we saw the full impact of those changes in the quarter ended September 30, 2020.

Return on average assets (“ROA”) was 0.95% for the quarter ended September 30, 2020 compared to 0.96% and 1.35% for the quarters ended June 30, 2020 and September 30, 2019, respectively. ROA was impacted in the third quarter of 2020 and prior quarter in 2020 by increased provision for loan losses due to the economic uncertainties of the COVID-19 pandemic and loan growth. Pre-tax, pre-provision ROA* was 1.72% for the quarters ended September 30, 2020 and June 30, 2020, compared to 1.95% for the quarter ended September 30, 2019.

_______________

* A reconciliation of the non-GAAP measures are set forth at the end of this earnings release.

The following table shows the Company’s key performance ratios for the periods indicated. The table also includes ratios that were adjusted by removing the impact of the PPP loans. The adjusted ratios are non-GAAP measures. For more information about non-GAAP financial measures, see the end of this earnings release.

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||||

| (unaudited) | September 30, 2020 | June 30, 2020 | March 31, 2020 | December 31, 2019 | September 30, 2019 | September 30, 2020 | September 30, 2019 | ||||||||||||||||

| Return on average assets (1) | 0.95 | % | 0.96 | % | 0.96 | % | 1.31 | % | 1.35 | % | 0.96 | % | 1.27 | % | |||||||||

| Return on average equity (1) | 12.14 | % | 11.37 | % | 8.66 | % | 11.66 | % | 11.72 | % | 10.73 | % | 11.16 | % | |||||||||

| Pre-tax, pre-provision return on average assets (1)(2) | 1.72 | % | 1.72 | % | 1.77 | % | 1.95 | % | 1.95 | % | 2.51 | % | 1.83 | % | |||||||||

| Yield on earnings assets (1) | 3.93 | % | 4.16 | % | 4.79 | % | 4.90 | % | 4.94 | % | 4.23 | % | 4.89 | % | |||||||||

| Yield on loans receivable (1) | 4.33 | % | 4.57 | % | 5.25 | % | 5.36 | % | 5.36 | % | 4.65 | % | 5.38 | % | |||||||||

| Yield on loans receivable, as adjusted (1)(2) | 4.78 | % | 4.94 | % | n/a | n/a | n/a | 4.99 | % | n/a | |||||||||||||

| Contractual yield on loans receivable, excluding earned fees (1) | 3.61 | % | 3.91 | % | 5.08 | % | 5.15 | % | 5.24 | % | 4.08 | % | 5.23 | % | |||||||||

| Contractual yield on loans receivable, excluding earned fees, as adjusted (1)(2) | 4.69 | % | 4.84 | % | n/a | n/a | n/a | 4.86 | % | n/a | |||||||||||||

| Cost of funds (1) | 0.33 | % | 0.41 | % | 0.70 | % | 0.70 | % | 0.72 | % | 0.45 | % | 0.74 | % | |||||||||

| Cost of deposits (1) | 0.27 | % | 0.35 | % | 0.64 | % | 0.63 | % | 0.64 | % | 0.40 | % | 0.66 | % | |||||||||

| Net interest margin (1) | 3.62 | % | 3.78 | % | 4.15 | % | 4.26 | % | 4.29 | % | 3.81 | % | 4.22 | % | |||||||||

| Noninterest expense to average assets (1) | 2.26 | % | 2.34 | % | 3.18 | % | 2.90 | % | 2.98 | % | 2.52 | % | 3.05 | % | |||||||||

| Efficiency ratio | 56.73 | % | 57.66 | % | 64.26 | % | 59.86 | % | 60.46 | % | 59.31 | % | 62.50 | % | |||||||||

| Loans receivable to deposits | 110.98 | % | 110.77 | % | 100.01 | % | 97.02 | % | 94.78 | % | 110.98 | % | 94.78 | % | |||||||||

| (1) Annualized calculations shown for quarterly and nine month periods presented. | |||||||||||||||||||||||

| (2) A reconciliation of the non-GAAP measures are set forth at the end of this earnings release. | |||||||||||||||||||||||

Noninterest income was $1.9 million in the third quarter of 2020, an increase of $422,000 from $1.5 million at the second quarter of 2020, and a decrease of $146,000 from $2.1 million in the third quarter of 2019. The increase over the prior quarter was primarily due to a $147,000 increase in deposit service charges from the economy re-opening, resulting in increased transactions, a $101,000 increase in BaaS fees and a $110,000 increase in loan referral fees that are earned when we originate a variable rate loan and arrange for the borrower to enter into an interest rate swap agreement with a third party to fix the interest rate for an extended period. The $146,000 decrease over the quarter ended September 30, 2019 was due to a $322,000 decline in gain on sale of loans, a $171,000 decrease in gain on sale securities, which resulted from the restructuring of the investment portfolio last year, partially offset by a $180,000 more in loan referral fees and a $120,000 more in BaaS fees. As of September 30, 2020, there were four active CCBX relationships, one in the friends and family trials, four in onboarding/implementation, two signed letters of intent and a solid pipeline of potential new relationships.

Total noninterest expense for the third quarter of 2020 increased to $9.7 million compared to $8.9 million for the preceding quarter and compared to $7.7 million for the third quarter of 2019. Noninterest expense variances for the quarter ended September 30, 2020, as compared to the quarter ended June 30, 2020, included a $756,000 increase in salaries and employee benefits, which was largely related to the hiring staff for our BaaS CCBX division and additional staff for our ongoing banking growth initiatives. The increased expenses for the quarter ended September 30, 2020 compared to the third quarter in 2019 were largely due to a $1.0 million increase in salary expenses related to hiring staff for our BaaS CCBX division and additional staff for our ongoing banking growth initiatives. Occupancy expenses increased by $158,000 and $207,000 in the quarter ended September 30, 2020 over the quarters ended June 30, 2020 and September 30, 2019, respectively. The increase in occupancy is related to a one-time $119,000 building operating expense and higher rent and depreciation expenses resulting from the opening of our Arlington branch in the second quarter of 2020 and from our overall growth. In addition, legal and professional fees increased $211,000 in the third quarter of 2020 over the quarter ended September 30, 2019. The increase in legal and professional expenses is associated with BaaS CCBX division expenses and higher costs associated with legal and accounting work related to financial reporting.

The provision for income taxes was $1.1 million at September 30, 2020, a $115,000 increase compared to $967,000 for the second quarter of 2020 and a $163,000 increase compared to $919,000 for the third quarter of 2019, both as a result of increased taxable income. The Company uses a federal statutory tax rate of 21% as a basis for calculating provision for income taxes.

Financial Condition

The Company’s total assets increased $70.7 million, or 4.2%, to $1.75 billion at September 30, 2020 compared to $1.68 billion at June 30, 2020. The primary cause of the increase was $62.2 million in increased loans receivable, as a result of overall growth in the loan portfolio and from PPP loans that were processed early in the third quarter, combined with an increase in interest earning deposits with other banks, partially offset by a decrease in cash and due from banks. In the quarter ended September 30, 2020, total assets increased $659.6 million, or 60.5%, compared to $1.09 billion at September 30, 2019. This increase was largely the result of $635.3 million increase in loans receivable, combined with an increase in interest earning deposits with other banks, partially offset by a decrease in cash and due from banks.

Total loans receivable increased $62.2 million to $1.51 billion at September 30, 2020, from $1.45 billion at June 30, 2020, and $635.3 million from $874.1 million at September 30, 2019. The growth in loans receivable over the quarter ended June 30, 2020 was due primarily to an increase of $37.7 million in commercial and industrial loans, which includes $14.8 million in new PPP loans for small business owners and $22.9 million in other commercial and industrial loans, combined with $26.9 million increase in commercial real estate loans. Loans receivable is net of $8.6 million in net deferred origination fees on PPP loans, which are earned over the life of those loans, with a maximum maturity of five years. However, the majority of our PPP loans have a two-year maturity. The increase over the quarter ended September 30, 2019 was due to a $483.6 million increase in commercial and industrial loans, which includes $452.8 million in PPP loans and $30.7 million in all other commercial and industrial loans, $126.6 million in commercial real estate loans, $20.3 million in residential real estate loans, and $14.0 million in construction, land and land development loans. Partially offsetting the increase in net loans receivable is an additional $8.6 million in net deferred loan origination fees on PPP loans.

The PPP program closed to new loan applicants on August 8, 2020. We accepted and processed requests for existing and new customers for the duration of the program. Deferral on PPP payments was extended as we await final guidance on these loans; however, we have begun accepting applications from customers for loan forgiveness. It is still uncertain what the final forgiveness criteria will be, but we anticipate that forgiveness of PPP loans will begin in fourth quarter 2020, and the pace of forgiveness will increase in the first half of 2021. Forgiveness of principal, early paydowns and payoffs on PPP loans will increase interest income earned in those periods from the recognition of deferred PPP loan fees. Customers with two-year loans are also able to request that their PPP loan be extended to a five year maturity, which we anticipate may be a good option for customers not eligible for forgiveness.

The following table summarizes the loan portfolio at the periods indicated.

| As of | ||||||||||||||||||

| September 30, 2020 | June 30, 2020 | September 30, 2019 | ||||||||||||||||

| (Dollars in thousands; unaudited) | Balance | % to Total | Balance | % to Total | Balance | % to Total | ||||||||||||

| Commercial and industrial loans: | ||||||||||||||||||

| PPP loans | $ | 452,846 | 29.8 | % | $ | 438,077 | 30.0 | % | $ | - | 0.0 | % | ||||||

| All other commercial & industrial loans | 136,358 | 8.9 | 113,473 | 7.8 | 105,634 | 12.1 | ||||||||||||

| Real estate loans: | ||||||||||||||||||

| Construction, land and land development loans | 100,955 | 6.6 | 102,422 | 7.0 | 86,919 | 9.9 | ||||||||||||

| Residential real estate loans | 121,147 | 8.0 | 122,949 | 8.4 | 100,818 | 11.5 | ||||||||||||

| Commercial real estate loans | 705,186 | 46.4 | 678,335 | 46.5 | 578,607 | 66.1 | ||||||||||||

| Consumer and other loans | 3,927 | 0.3 | 4,735 | 0.3 | 3,720 | 0.4 | ||||||||||||

| Gross loans receivable | 1,520,419 | 100.0 | % | 1,459,991 | 100.0 | % | 875,698 | 100.0 | % | |||||||||

| Net deferred origination fees - PPP loans | (8,586 | ) | (10,639 | ) | - | |||||||||||||

| Net deferred origination fees - Other loans | (2,444 | ) | (2,208 | ) | (1,586 | ) | ||||||||||||

| Loans receivable | $ | 1,509,389 | $ | 1,447,144 | $ | 874,112 | ||||||||||||

Please see Appendix A for additional loan portfolio detail regarding industry concentrations in response to the volatile economic environment due to the COVID-19 pandemic.

Total deposits increased $53.6 million, or 4.1%, to $1.36 billion at September 30, 2020 from $1.31 billion at June 30, 2020. The increase is largely due to a $58.0 million increase in core deposits and is primarily the result of expanding and growing banking relationships with new customers, including deposit relationships from PPP loans made to noncustomers, who moved their banking relationship to the Bank. During the quarter ended September 30, 2020, noninterest bearing deposits increased $6.9 million, or 1.2%, to $570.7 million from $563.8 million at June 30, 2020. NOW and money market accounts increased $48.5 million and savings accounts increased $2.6 million, while BaaS-brokered deposits decreased $1.7 million and time deposits decreased $2.8 million. Total deposits increased $437.8 million, or 47.5%, compared to $922.2 million at September 30, 2019. Noninterest bearing deposits increased $221.6 million, or 63.5%, from $349.1 million at September 30, 2019. NOW and money market accounts increased $208.6 million, or 50.1%, savings accounts increased $22.5 million and BaaS-brokered deposits increased $11.5 million while time deposits decreased $26.4 million. Efforts to retain and grow core deposits are evidenced by the high ratios in these categories when compared to total deposits.

The following table summarizes the deposit portfolio at the periods indicated.

| As of | ||||||||||||||||||

| September 30, 2020 | June 30, 2020 | September 30, 2019 | ||||||||||||||||

| (Dollars in thousands, unaudited) | Balance | % to Total | Balance | % to Total | Balance | % to Total | ||||||||||||

| Demand, noninterest bearing | $ | 570,664 | 42.0 | % | $ | 563,794 | 43.2 | % | $ | 349,087 | 37.9 | % | ||||||

| NOW and money market | 624,891 | 45.9 | 576,376 | 44.1 | 416,315 | 45.1 | ||||||||||||

| Savings | 74,694 | 5.5 | 72,045 | 5.5 | 52,191 | 5.7 | ||||||||||||

| Total core deposits | 1,270,249 | 93.4 | 1,212,215 | 92.8 | 817,593 | 88.7 | ||||||||||||

| BaaS-brokered deposits | 24,870 | 1.8 | 26,529 | 2.0 | 13,340 | 1.4 | ||||||||||||

| Time deposits less than $250,000 | 41,676 | 3.1 | 43,900 | 3.4 | 58,369 | 6.3 | ||||||||||||

| Time deposits $250,000 and over | 23,216 | 1.7 | 23,783 | 1.8 | 32,947 | 3.6 | ||||||||||||

| Total deposits | $ | 1,360,011 | 100.0 | % | $ | 1,306,427 | 100.0 | % | $ | 922,249 | 100.0 | % | ||||||

To bolster the effectiveness of the SBA PPP loan program, the Federal Reserve is supplying liquidity to participating financial institutions through non-recourse term financing secured by PPP loans to small businesses. We continued to utilize the PPPLF in the third quarter of 2020. The PPPLF extends low cost borrowing lines, 0.35% interest rate, to eligible financial institutions that originate PPP loans, taking the loans as collateral at face value. Borrowings are required to be paid down as the pledged PPP loans are paid down. As of September 30, 2020, there was $202.6 million in outstanding PPPLF advances and pledged PPP loans, compared to $190.2 million at June 30, 2020.

The Federal Home Loan Bank (“FHLB”) allows us to borrow against our line of credit, which is collateralized by certain loans. As of September 30, 2020, we borrowed a total of $25.0 million in FHLB long term advances. This includes a $10.0 million advance with a remaining term of 2.5 years and $15.0 million advance with a remaining term of 4.5 years. These advances provide an alternative and stable source of funding for loan demand. Although there are no immediate plans to borrow additional funds, additional FHLB borrowing capacity of $67.7 million was available under this arrangement as of September 30, 2020.

Total shareholders’ equity increased $4.3 million since June 30, 2020. The increase in shareholders’ equity was primarily due to $4.1 million in net earnings for the three months ended September 30, 2020.

Capital Ratios

The Company and the Bank remain well capitalized at September 30, 2020, as summarized in the following table.

| Capital Ratios: | Coastal Community Bank | Coastal Financial Corporation | Financial Institution Basel III Regulatory Guidelines | ||||||||

| (unaudited) | |||||||||||

| Tier 1 leverage capital | 9.43 | % | 9.20 | % | 5.00 | % | |||||

| Common Equity Tier 1 risk-based capital | 12.66 | % | 12.14 | % | 6.50 | % | |||||

| Tier 1 risk-based capital | 12.66 | % | 12.45 | % | 8.00 | % | |||||

| Total risk-based capital | 13.92 | % | 14.61 | % | 10.00 | % | |||||

As previously disclosed, during the quarter ended March 31, 2020, the Company contributed $7.5 million in capital to the Bank due to the volatile economic environment. No additional contributions have been made; however, the Company could downstream additional funds to the Bank in the future, if necessary.

Asset Quality

The allowance for loan losses was $17.0 million and 1.13% of loans receivable at September 30, 2020 compared to $14.8 million and 1.03% at June 30, 2020 and $10.9 million and 1.25% at September 30, 2019. At September 30, 2020, there was $444.3 million in PPP loans, net of deferred fees, which are 100% guaranteed by the SBA. Excluding PPP loans, the allowance for loan losses to loans receivable* would be 1.60% for the quarter ended September 30, 2020. Provision for loan losses totaled $2.2 million for the three months ended September 30, 2020, $1.9 million for the three months ended June 30, 2020, and $637,000 for the three months ended September 30, 2019. Net charge-offs totaled $1,000 for the quarter ended September 30, 2020, compared to $8,000 for the quarter ended June 30, 2020 and $192,000 for the quarter ended September 30, 2019.

The Company’s provision for loan losses during the quarters ended September 30, 2020, June 30, 2020 and March 31, 2020, is related to an increase in qualitative factors related to the economic uncertainties caused by the COVID-19 pandemic and loan growth. The Company is not required to implement the provisions of the Current Expected Credit Loss accounting standard until January 1, 2023 and will continue to account for the allowance for credit losses under the incurred loss model.

_______________

* A reconciliation of the non-GAAP measures are set forth at the end of this earnings release.

At September 30, 2020, our nonperforming assets were $4.5 million, or 0.26% of total assets, compared to $4.4 million, or 0.26%, of total assets at June 30, 2020, and $1.3 million, or 0.12%, of total assets at September 30, 2019. Nonperforming assets increased $42,000 during the quarter ended September 30, 2020, compared to the quarter ended June 30, 2020, with the addition of one loan partially offset by principal paydowns.

Management is actively monitoring the loan portfolio to identify borrowers experiencing difficulties with repayment and are proactively working with them to reduce potential losses through the past prudent use of PPP loans, deferrals, and modifications in accordance with regulatory guidelines. There were no repossessed assets or other real estate owned at September 30, 2020. Our nonperforming loans to loans receivable ratio was 0.30% at September 30, 2020, compared to 0.31% at June 30, 2020, and 0.15% at September 30, 2019. Commercial and industrial nonaccrual loans totaled $625,000 at September 30, 2020 and consisted of three lending relationships. One loan moved to nonperforming status during the third quarter of 2020 for $117,000 in residential real estate, bringing the balance in that category to $178,000 at September 30, 2020. The addition of this loan to nonperforming status in the third quarter of 2020, which was not related to the COVID-19 pandemic, was partially offset by principal reductions and resulted in a slight overall decrease in our ratio of nonperforming loans to loans receivable and no change to the nonperforming assets to total assets ratio compared to June 30, 2020.

Credit quality has remained stable as of September 30, 2020, as demonstrated by the low level of charge-offs and nonperforming loans. The short and long-term economic impact of the COVID-19 pandemic, trade issues, political gridlock, and decline in oil prices is unknown; however, the Company remains diligent in its efforts to communicate and proactively work with borrowers to help mitigate potential credit deterioration.

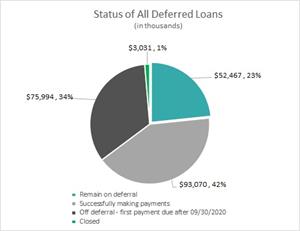

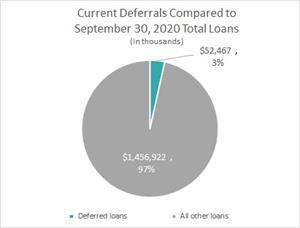

Pursuant to federal guidance, the Company deferred and/or modified payments on loans to assist customers financially during the COVID-19 pandemic and economic shutdown. The majority of those loans have successfully returned to active status. At September 30, 2020, the Company had 44 loans, or $52.5 million, that remained outstanding with deferred or modified payments. This decreased from June 30, 2020 when we had 215 loans, or $207.2 million, on deferred or modified payments. All of the loans that have migrated to active status are current, with 128 loans, or $93.1 million, successfully resuming payments and 65 loans, or $76.0 million, back on active status with an initial payment due in the fourth quarter of 2020. In addition, $3.0 million of deferred and/or modified loans have paid-in-full or closed as of September 30, 2020. The purpose of this program was to provide cash flow relief for small business customers as they navigated through the uncertainties of the COVID-19 pandemic. The Company’s deferral program was successful as evidenced by customers’ ability to migrate from deferral to active status and resume making payments as planned. Additional information on these loans can be found in Appendix A.

The following table details the Company’s nonperforming assets for the periods indicated.

| As of | ||||||||||

| September 30, | June 30, | September 30, | ||||||||

| (Dollars in thousands, unaudited) | 2020 | 2020 | 2019 | |||||||

| Nonaccrual loans: | ||||||||||

| Commercial and industrial loans | $ | 625 | $ | 689 | $ | 1,233 | ||||

| Real estate: | ||||||||||

| Construction, land and land development | 3,269 | 3,270 | - | |||||||

| Residential real estate | 178 | 63 | 67 | |||||||

| Commercial real estate | 405 | 413 | - | |||||||

| Total nonaccrual loans | 4,477 | 4,435 | 1,300 | |||||||

| Accruing loans past due 90 days or more: | ||||||||||

| Total accruing loans past due 90 days or more | - | - | - | |||||||

| Total nonperforming loans | 4,477 | 4,435 | 1,300 | |||||||

| Other real estate owned | - | - | - | |||||||

| Repossessed assets | - | - | - | |||||||

| Total nonperforming assets | $ | 4,477 | $ | 4,435 | $ | 1,300 | ||||

| Troubled debt restructurings, accruing | - | - | - | |||||||

| Total nonperforming loans to loans receivable | 0.30 | % | 0.31 | % | 0.15 | % | ||||

| Total nonperforming assets to total assets | 0.26 | % | 0.26 | % | 0.12 | % | ||||

About Coastal Financial

Coastal Financial Corporation (Nasdaq: CCB) (the “Company”), is an Everett, Washington based bank holding company whose wholly owned subsidiaries are Coastal Community Bank (“Bank”) and Arlington Olympic LLC. The $1.7 billion community bank that the Bank operates provides service through 15 branches in Snohomish, Island, and King Counties, the Internet and its mobile banking application. The Bank provides banking as a service to broker dealers and digital financial service providers through its CCBX Division. In 2021, the Bank expects to introduce a digital bank offering in collaboration with Google. To learn more about Coastal visit www.coastalbank.com.

Contact

Eric Sprink, President & Chief Executive Officer, (425) 357-3659

Joel Edwards, Executive Vice President & Chief Financial Officer, (425) 357-3687

Forward-Looking Statements

This earnings release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements reflect our current views with respect to, among other things, future events and our financial performance. Any statements about our management’s expectations, beliefs, plans, predictions, forecasts, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. These statements are often, but not always, made through the use of words or phrases such as “anticipate,” “believes,” “can,” “could,” “may,” “predicts,” “potential,” “should,” “will,” “estimate,” “plans,” “projects,” “continuing,” “ongoing,” “expects,” “intends” and similar words or phrases. Any or all of the forward-looking statements in this earnings release may turn out to be inaccurate. The inclusion of or reference to forward-looking information in this earnings release should not be regarded as a representation by us or any other person that the future plans, estimates or expectations contemplated by us will be achieved. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. Our actual results could differ materially from those anticipated in such forward-looking statements as a result of risks, uncertainties and assumptions that are difficult to predict. Factors that could cause actual results to differ materially from those in the forward-looking statements include, without limitation, the risks and uncertainties discussed under “Risk Factors” in our Annual Report on Form 10-K for the most recent period filed, our Quarterly Report on Form 10-Q for the most recent quarter, and in any of our subsequent filings with the Securities and Exchange Commission.

If one or more events related to these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may differ materially from what we anticipate. You are cautioned not to place undue reliance on forward-looking statements. Further, any forward-looking statement speaks only as of the date on which it is made and we undertake no obligation to update or revise any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events, except as required by law.

COASTAL FINANCIAL CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION

(Dollars in thousands; unaudited)

| ASSETS | ||||||||||||

| September 30, | June 30, | September 30, | ||||||||||

| 2020 | 2020 | 2019 | ||||||||||

| Cash and due from banks | $ | 14,136 | $ | 26,510 | $ | 22,060 | ||||||

| Interest earning deposits with other banks | 168,034 | 147,666 | 131,287 | |||||||||

| Investment securities, available for sale, at fair value | 20,428 | 20,448 | 28,319 | |||||||||

| Investment securities, held to maturity, at amortized cost | 3,354 | 3,870 | 4,377 | |||||||||

| Other investments | 5,951 | 5,951 | 4,405 | |||||||||

| Loans receivable | 1,509,389 | 1,447,144 | 874,112 | |||||||||

| Allowance for loan losses | (17,046 | ) | (14,847 | ) | (10,888 | ) | ||||||

| Total loans receivable, net | 1,492,343 | 1,432,297 | 863,224 | |||||||||

| Premises and equipment, net | 16,881 | 16,668 | 13,167 | |||||||||

| Operating lease right-of-use assets | 7,379 | 7,635 | 8,666 | |||||||||

| Accrued interest receivable | 8,216 | 5,944 | 2,629 | |||||||||

| Bank-owned life insurance, net | 7,031 | 6,981 | 6,832 | |||||||||

| Deferred tax asset, net | 2,722 | 2,721 | 2,206 | |||||||||

| Other assets | 3,144 | 2,265 | 2,888 | |||||||||

| Total assets | $ | 1,749,619 | $ | 1,678,956 | $ | 1,090,060 | ||||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||||||

| LIABILITIES | ||||||||||||

| Deposits | $ | 1,360,011 | $ | 1,306,427 | $ | 922,249 | ||||||

| Federal Home Loan Bank advances | 24,999 | 24,999 | 20,000 | |||||||||

| Paycheck Protection Program Liquidity Facility | 202,595 | 190,156 | ||||||||||

| Subordinated debt, net | 9,989 | 9,986 | 9,975 | |||||||||

| Junior subordinated debentures, net | 3,584 | 3,584 | 3,582 | |||||||||

| Deferred compensation | 891 | 919 | 1,000 | |||||||||

| Accrued interest payable | 481 | 312 | 303 | |||||||||

| Operating lease liabilities | 7,579 | 7,831 | 8,847 | |||||||||

| Other liabilities | 4,258 | 3,765 | 3,682 | |||||||||

| Total liabilities | 1,614,387 | 1,547,979 | 969,638 | |||||||||

| SHAREHOLDERS’ EQUITY | ||||||||||||

| Common stock | 87,479 | 87,309 | 86,866 | |||||||||

| Retained earnings | 47,707 | 43,617 | 33,614 | |||||||||

| Accumulated other comprehensive income (loss), net of tax | 46 | 51 | (58 | ) | ||||||||

| Total shareholders’ equity | 135,232 | 130,977 | 120,422 | |||||||||

| Total liabilities and shareholders’ equity | $ | 1,749,619 | $ | 1,678,956 | $ | 1,090,060 | ||||||

COASTAL FINANCIAL CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(Dollars in thousands, except per share amounts; unaudited)

| Three Months Ended | |||||||||

| September 30, | June 30, | September 30, | |||||||

| 2020 | 2020 | 2019 | |||||||

| INTEREST AND DIVIDEND INCOME | |||||||||

| Interest and fees on loans | $ | 16,244 | $ | 15,154 | $ | 11,691 | |||

| Interest on interest earning deposits with other banks | 99 | 130 | 486 | ||||||

| Interest on investment securities | 27 | 53 | 168 | ||||||

| Dividends on other investments | 24 | 89 | 10 | ||||||

| Total interest and dividend income | 16,394 | 15,426 | 12,355 | ||||||

| INTEREST EXPENSE | |||||||||

| Interest on deposits | 880 | 1,096 | 1,435 | ||||||

| Interest on borrowed funds | 418 | 337 | 193 | ||||||

| Total interest expense | 1,298 | 1,433 | 1,628 | ||||||

| Net interest income | 15,096 | 13,993 | 10,727 | ||||||

| PROVISION FOR LOAN LOSSES | 2,200 | 1,930 | 637 | ||||||

| Net interest income after provision for loan losses | 12,896 | 12,063 | 10,090 | ||||||

| NONINTEREST INCOME | |||||||||

| Deposit service charges and fees | 824 | 677 | 795 | ||||||

| BaaS fees | 576 | 475 | 456 | ||||||

| Loan referral fees | 180 | 70 | - | ||||||

| Mortgage broker fees | 125 | 152 | 140 | ||||||

| Sublease and lease income | 30 | 31 | 16 | ||||||

| Gain on sales of loans, net | 47 | - | 369 | ||||||

| Gain on sales of securities, net | - | - | 171 | ||||||

| Other | 160 | 115 | 141 | ||||||

| Total noninterest income | 1,942 | 1,520 | 2,088 | ||||||

| NONINTEREST EXPENSE | |||||||||

| Salaries and employee benefits | 5,971 | 5,215 | 4,971 | ||||||

| Occupancy | 1,091 | 933 | 884 | ||||||

| Data processing | 577 | 621 | 509 | ||||||

| Director and staff expenses | 156 | 187 | 241 | ||||||

| Excise taxes | 291 | 262 | 184 | ||||||

| Marketing | 52 | 116 | 98 | ||||||

| Legal and professional fees | 381 | 474 | 170 | ||||||

| Federal Deposit Insurance Corporation assessments | 148 | 74 | (4 | ) | |||||

| Business development | 72 | 48 | 122 | ||||||

| Other | 927 | 1,015 | 573 | ||||||

| Total noninterest expense | 9,666 | 8,945 | 7,748 | ||||||

| Income before provision for income taxes | 5,172 | 4,638 | 4,430 | ||||||

| PROVISION FOR INCOME TAXES | 1,082 | 967 | 919 | ||||||

| NET INCOME | $ | 4,090 | $ | 3,671 | $ | 3,511 | |||

| Basic earnings per common share | $ | 0.34 | $ | 0.31 | $ | 0.30 | |||

| Diluted earnings per common share | $ | 0.34 | $ | 0.30 | $ | 0.29 | |||

| Weighted average number of common shares outstanding: | |||||||||

| Basic | 11,919,850 | 11,917,394 | 11,901,873 | ||||||

| Diluted | 12,181,272 | 12,190,284 | 12,188,507 | ||||||

COASTAL FINANCIAL CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(Dollars in thousands, except per share amounts; unaudited)

| Nine Months Ended | |||||

| September 30, | September 30, | ||||

| 2020 | 2019 | ||||

| INTEREST AND DIVIDEND INCOME | |||||

| Interest and fees on loans | $ | 44,025 | $ | 33,027 | |

| Interest on interest earning deposits with other banks | 587 | 1,946 | |||

| Interest on investment securities | 199 | 481 | |||

| Dividends on other investments | 129 | 99 | |||

| Total interest and dividend income | 44,940 | 35,553 | |||

| INTEREST EXPENSE | |||||

| Interest on deposits | 3,530 | 4,291 | |||

| Interest on borrowed funds | 957 | 582 | |||

| Total interest expense | 4,487 | 4,873 | |||

| Net interest income | 40,453 | 30,680 | |||

| PROVISION FOR LOAN LOSSES | 5,708 | 1,724 | |||

| Net interest income after provision for loan losses | 34,745 | 28,956 | |||

| NONINTEREST INCOME | |||||

| Deposit service charges and fees | 2,224 | 2,302 | |||

| BaaS fees | 1,630 | 1,404 | |||

| Loan referral fees | 1,303 | 1,106 | |||

| Mortgage broker fees | 439 | 336 | |||

| Sublease and lease income | 91 | 36 | |||

| Gain on sales of loans, net | 47 | 490 | |||

| Gain on sales of securities, net | - | 171 | |||

| Other | 399 | 359 | |||

| Total noninterest income | 6,133 | 6,204 | |||

| NONINTEREST EXPENSE | |||||

| Salaries and employee benefits | 16,869 | 14,058 | |||

| Occupancy | 2,951 | 2,808 | |||

| Data processing | 1,749 | 1,537 | |||

| Director and staff expenses | 613 | 698 | |||

| Excise taxes | 756 | 529 | |||

| Marketing | 280 | 300 | |||

| Legal and professional fees | 1,178 | 872 | |||

| Federal Deposit Insurance Corporation assessments | 292 | 205 | |||

| Business development | 245 | 320 | |||

| Other | 2,697 | 1,726 | |||

| Total noninterest expense | 27,630 | 23,053 | |||

| Income before provision for income taxes | 13,248 | 12,107 | |||

| PROVISION FOR INCOME TAXES | 2,763 | 2,514 | |||

| NET INCOME | $ | 10,485 | $ | 9,593 | |

| Basic earnings per common share | $ | 0.88 | $ | 0.81 | |

| Diluted earnings per common share | $ | 0.86 | $ | 0.79 | |

| Weighted average number of common shares outstanding: | |||||

| Basic | 11,915,513 | 11,893,734 | |||

| Diluted | 12,183,845 | 12,193,071 | |||

COASTAL FINANCIAL CORPORATION

AVERAGE BALANCES, YIELDS, AND RATES – QUARTERLY

(Dollars in thousands; unaudited)

| For the Three Months Ended | ||||||||||||||||||||||||||||||

| September 30, 2020 | June 30, 2020 | September 30, 2019 | ||||||||||||||||||||||||||||

| Average | Interest & | Yield / | Average | Interest & | Yield / | Average | Interest & | Yield / | ||||||||||||||||||||||

| Balance | Dividends | Cost (4) | Balance | Dividends | Cost (4) | Balance | Dividends | Cost (4) | ||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||||||

| Interest earning assets: | ||||||||||||||||||||||||||||||

| Interest earning deposits | $ | 137,568 | $ | 99 | 0.29 | % | $ | 127,721 | $ | 130 | 0.41 | % | $ | 85,406 | $ | 486 | 2.26 | % | ||||||||||||

| Investment securities (1) | 23,882 | 27 | 0.45 | 21,835 | 53 | 0.98 | 36,974 | 168 | 1.80 | |||||||||||||||||||||

| Other Investments | 5,951 | 24 | 1.60 | 5,841 | 89 | 6.13 | 3,621 | 10 | 1.10 | |||||||||||||||||||||

| Loans receivable (2) | 1,493,024 | 16,244 | 4.33 | 1,334,991 | 15,154 | 4.57 | 865,674 | 11,691 | 5.36 | |||||||||||||||||||||

| Total interest earning assets | 1,660,425 | 16,394 | 3.93 | 1,490,388 | 15,426 | 4.16 | 991,675 | 12,355 | 4.94 | |||||||||||||||||||||

| Noninterest earning assets: | ||||||||||||||||||||||||||||||

| Allowance for loan losses | (15,711 | ) | (13,555 | ) | (10,548 | ) | ||||||||||||||||||||||||

| Other noninterest earning assets | 60,160 | 61,713 | 50,842 | |||||||||||||||||||||||||||

| Total assets | $ | 1,704,874 | $ | 1,538,546 | $ | 1,031,969 | ||||||||||||||||||||||||

| Liabilities and Shareholders’ Equity | ||||||||||||||||||||||||||||||

| Interest bearing liabilities: | ||||||||||||||||||||||||||||||

| Interest bearing deposits | $ | 750,790 | $ | 880 | 0.47 | % | $ | 708,724 | $ | 1,096 | 0.62 | % | $ | 555,665 | $ | 1,435 | 1.02 | % | ||||||||||||

| Subordinated debt, net | 9,987 | 148 | 5.90 | 9,984 | 147 | 5.92 | 9,973 | 148 | 5.89 | |||||||||||||||||||||

| Junior subordinated debentures, net | 3,584 | 23 | 2.55 | 3,583 | 26 | 2.92 | 3,582 | 42 | 4.65 | |||||||||||||||||||||

| PPPLF borrowings | 199,076 | 176 | 0.35 | 107,443 | 94 | 0.35 | - | - | 0.00 | |||||||||||||||||||||

| FHLB advances and other borrowings | 24,999 | 71 | 1.13 | 24,999 | 70 | 1.13 | 539 | 3 | 2.21 | |||||||||||||||||||||

| Total interest bearing liabilities | 988,436 | 1,298 | 0.52 | 854,733 | 1,433 | 0.67 | 569,759 | 1,628 | 1.13 | |||||||||||||||||||||

| Noninterest bearing deposits | 569,615 | 541,448 | 330,553 | |||||||||||||||||||||||||||

| Other liabilities | 12,781 | 12,498 | 12,756 | |||||||||||||||||||||||||||

| Total shareholders' equity | 134,042 | 129,867 | 118,901 | |||||||||||||||||||||||||||

| Total liabilities and shareholders' equity | $ | 1,704,874 | $ | 1,538,546 | $ | 1,031,969 | ||||||||||||||||||||||||

| Net interest income | $ | 15,096 | $ | 13,993 | $ | 10,727 | ||||||||||||||||||||||||

| Interest rate spread | 3.41 | % | 3.49 | % | 3.81 | % | ||||||||||||||||||||||||

| Net interest margin (3) | 3.62 | % | 3.78 | % | 4.29 | % | ||||||||||||||||||||||||

| (1) For presentation in this table, average balances and the corresponding average rates for investment securities are based upon historical cost, adjusted for amortization of premiums and accretion of discounts. | ||||||||||||||||||||||||||||||

| (2) Includes nonaccrual loans. | ||||||||||||||||||||||||||||||

| (3) Net interest margin represents net interest income divided by the average total interest earning assets. | ||||||||||||||||||||||||||||||

| (4) Yields and costs are annualized. | ||||||||||||||||||||||||||||||

COASTAL FINANCIAL CORPORATION

AVERAGE BALANCES, YIELDS, AND RATES – YEAR-TO-DATE

(Dollars in thousands; unaudited)

| For the Nine Months Ended | |||||||||||||||||||

| September 30, 2020 | September 30, 2019 | ||||||||||||||||||

| Average | Interest & | Yield / | Average | Interest & | Yield / | ||||||||||||||

| Balance | Dividends | Cost (4) | Balance | Dividends | Cost (4) | ||||||||||||||

| Assets | |||||||||||||||||||

| Interest earning assets: | |||||||||||||||||||

| Interest earning deposits | $ | 122,941 | $ | 587 | 0.64 | % | $ | 108,230 | $ | 1,946 | 2.40 | % | |||||||

| Investment securities (1) | 24,252 | 199 | 1.10 | 38,883 | 481 | 1.65 | |||||||||||||

| Other Investments | 5,435 | 129 | 3.17 | 3,479 | 99 | 3.80 | |||||||||||||

| Loans receivable (2) | 1,265,705 | 44,025 | 4.65 | 820,560 | 33,027 | 5.38 | |||||||||||||

| Total interest earning assets | 1,418,333 | 44,940 | 4.23 | 971,152 | 35,553 | 4.89 | |||||||||||||

| Noninterest earning assets: | |||||||||||||||||||

| Allowance for loan losses | (13,651 | ) | (10,068 | ) | |||||||||||||||

| Other noninterest earning assets | 57,830 | 49,536 | |||||||||||||||||

| Total assets | $ | 1,462,512 | $ | 1,010,620 | |||||||||||||||

| Liabilities and Shareholders’ Equity | |||||||||||||||||||

| Interest bearing liabilities: | |||||||||||||||||||

| Interest bearing deposits | $ | 696,051 | $ | 3,530 | 0.68 | % | $ | 559,119 | $ | 4,291 | 1.03 | % | |||||||

| Subordinated debt, net | 9,984 | 441 | 5.90 | 9,970 | 439 | 5.89 | |||||||||||||

| Junior subordinated debentures, net | 3,583 | 83 | 3.09 | 3,582 | 129 | 4.81 | |||||||||||||

| PPPLF borrowings | 102,527 | 269 | 0.35 | - | - | 0.00 | |||||||||||||

| FHLB advances and other borrowings | 19,304 | 164 | 1.13 | 794 | 14 | 2.36 | |||||||||||||

| Total interest bearing liabilities | 831,449 | 4,487 | 0.72 | 573,465 | 4,873 | 1.14 | |||||||||||||

| Noninterest bearing deposits | 488,296 | 309,270 | |||||||||||||||||

| Other liabilities | 12,607 | 12,971 | |||||||||||||||||

| Total shareholders' equity | 130,160 | 114,914 | |||||||||||||||||

| Total liabilities and shareholders' equity | $ | 1,462,512 | $ | 1,010,620 | |||||||||||||||

| Net interest income | $ | 40,453 | $ | 30,680 | |||||||||||||||

| Interest rate spread | 3.51 | % | 3.76 | % | |||||||||||||||

| Net interest margin (3) | 3.81 | % | 4.22 | % | |||||||||||||||

| (1) For presentation in this table, average balances and the corresponding average rates for investment securities are based upon historical cost, adjusted for amortization of premiums and accretion of discounts. | |||||||||||||||||||

| (2) Includes nonaccrual loans. | |||||||||||||||||||

| (3) Net interest margin represents net interest income divided by the average total interest earning assets. | |||||||||||||||||||

| (4) Yields and costs are annualized. | |||||||||||||||||||

COASTAL FINANCIAL CORPORATION

QUARTERLY STATISTICS

(Dollars in thousands, except share and per share data; unaudited)

| Three Months Ended | |||||||||||||||

| September 30, | June 30, | March 31, | December 31, | September 30, | |||||||||||

| 2020 | 2020 | 2020 | 2019 | 2019 | |||||||||||

| Income Statement Data: | |||||||||||||||

| Interest and dividend income | $ | 16,394 | $ | 15,426 | $ | 13,120 | $ | 13,034 | $ | 12,355 | |||||

| Interest expense | 1,298 | 1,433 | 1,756 | 1,703 | 1,628 | ||||||||||

| Net interest income | 15,096 | 13,993 | 11,364 | 11,331 | 10,727 | ||||||||||

| Provision for loan losses | 2,200 | 1,930 | 1,578 | 820 | 637 | ||||||||||

| Net interest income after provision for loan losses | 12,896 | 12,063 | 9,786 | 10,511 | 10,090 | ||||||||||

| Noninterest income | 1,942 | 1,520 | 2,671 | 2,059 | 2,088 | ||||||||||

| Noninterest expense | 9,666 | 8,945 | 9,019 | 8,015 | 7,748 | ||||||||||

| Net income - pre-tax, pre-provision (1) | 7,372 | 6,568 | 5,016 | 5,375 | 5,067 | ||||||||||

| Provision for income tax | 1,082 | 967 | 714 | 947 | 919 | ||||||||||

| Net income | 4,090 | 3,671 | 2,724 | 3,608 | 3,511 | ||||||||||

| As of and for the Three Month Period | |||||||||||||||

| September 30, | June 30, | March 31, | December 31, | September 30, | |||||||||||

| 2020 | 2020 | 2020 | 2019 | 2019 | |||||||||||

| Balance Sheet Data: | |||||||||||||||

| Cash and cash equivalents | $ | 182,170 | $ | 174,176 | $ | 129,236 | $ | 127,814 | $ | 153,347 | |||||

| Investment securities | 23,782 | 24,318 | 19,759 | 32,710 | 32,696 | ||||||||||

| Loans receivable | 1,509,389 | 1,447,144 | 1,005,180 | 939,103 | 874,112 | ||||||||||

| Allowance for loan losses | (17,046 | ) | (14,847 | ) | (12,925 | ) | (11,470 | ) | (10,888 | ) | |||||

| Total assets | 1,749,619 | 1,678,956 | 1,184,071 | 1,128,526 | 1,090,060 | ||||||||||

| Interest bearing deposits | 789,347 | 742,633 | 659,559 | 596,716 | 573,162 | ||||||||||

| Noninterest bearing deposits | 570,664 | 563,794 | 345,503 | 371,243 | 349,087 | ||||||||||

| Core deposits (2) | 1,270,249 | 1,212,215 | 892,408 | 862,516 | 817,593 | ||||||||||

| Total deposits | 1,360,011 | 1,306,427 | 1,005,062 | 967,959 | 922,249 | ||||||||||

| Total borrowings | 241,167 | 228,725 | 38,564 | 23,562 | 33,557 | ||||||||||

| Total shareholders’ equity | 135,232 | 130,977 | 127,166 | 124,173 | 120,422 | ||||||||||

| Share and Per Share Data (3): | |||||||||||||||

| Earnings per share – basic | $ | 0.34 | $ | 0.31 | $ | 0.23 | $ | 0.30 | $ | 0.30 | |||||

| Earnings per share – diluted | $ | 0.34 | $ | 0.30 | $ | 0.22 | $ | 0.30 | $ | 0.29 | |||||

| Dividends per share | - | - | - | - | - | ||||||||||

| Book value per share (4) | $ | 11.34 | $ | 10.98 | $ | 10.66 | $ | 10.42 | $ | 10.11 | |||||

| Tangible book value per share (5) | $ | 11.34 | $ | 10.98 | $ | 10.66 | $ | 10.42 | $ | 10.11 | |||||

| Weighted avg outstanding shares – basic | 11,919,850 | 11,917,394 | 11,909,248 | 11,903,750 | 11,901,873 | ||||||||||

| Weighted avg outstanding shares – diluted | 12,181,272 | 12,190,284 | 12,208,175 | 12,213,512 | 12,188,507 | ||||||||||

| Shares outstanding at end of period | 11,930,243 | 11,926,263 | 11,929,413 | 11,913,885 | 11,912,115 | ||||||||||

| Stock options outstanding at end of period | 769,607 | 774,587 | 774,937 | 784,217 | 786,257 | ||||||||||

| See footnotes on following page | |||||||||||||||

| As of and for the Three Month Period | |||||||||||||||

| September 30, | June 30, | March 31, | December 31, | September 30, | |||||||||||

| 2020 | 2020 | 2020 | 2019 | 2019 | |||||||||||

| Credit Quality Data: | |||||||||||||||

| Nonperforming assets to total assets | 0.26 | % | 0.26 | % | 0.06 | % | 0.09 | % | 0.12 | % | |||||

| Nonperforming assets to loans receivable and OREO | 0.30 | % | 0.31 | % | 0.08 | % | 0.11 | % | 0.15 | % | |||||

| Nonperforming loans to total loans receivable | 0.30 | % | 0.31 | % | 0.08 | % | 0.11 | % | 0.15 | % | |||||

| Allowance for loan losses to nonperforming loans | 380.7 | % | 334.8 | % | 1694.0 | % | 1113.6 | % | 837.5 | % | |||||

| Allowance for loan losses to total loans receivable | 1.13 | % | 1.03 | % | 1.29 | % | 1.22 | % | 1.25 | % | |||||

| Allowance for loan losses to loans receivable, as adjusted (1) | 1.60 | % | 1.46 | % | n/a | n/a | n/a | ||||||||

| Gross charge-offs | $ | 2 | $ | 13 | $ | 124 | $ | 242 | $ | 196 | |||||

| Gross recoveries | $ | 1 | $ | 5 | $ | 1 | $ | 4 | $ | 4 | |||||

| Net charge-offs to average loans (6) | 0.00 | % | 0.00 | % | 0.05 | % | 0.10 | % | 0.09 | % | |||||

| Capital Ratios (7): | |||||||||||||||

| Tier 1 leverage capital | 9.20 | % | 9.38 | % | 11.43 | % | 11.64 | % | 12.00 | % | |||||

| Common equity Tier 1 risk-based capital | 12.14 | % | 12.34 | % | 12.10 | % | 12.74 | % | 13.02 | % | |||||

| Tier 1 risk-based capital | 12.45 | % | 12.67 | % | 12.43 | % | 13.10 | % | 13.40 | % | |||||

| Total risk-based capital | 14.61 | % | 14.88 | % | 14.65 | % | 15.35 | % | 15.70 | % | |||||

| (1) A reconciliation of the non-GAAP measures are set forth at the end of this earnings release. | |||||||||||||||

| (2) Core deposits are defined as all deposits excluding BaaS-brokered and all time deposits. | |||||||||||||||

| (3) Share and per share amounts are based on total common shares outstanding. | |||||||||||||||

| (4) We calculate book value per share as total shareholders’ equity at the end of the relevant period divided by the outstanding number of our common shares at the end of each period. | |||||||||||||||

| (5) Tangible book value per share is a non-GAAP financial measure. We calculate tangible book value per share as total shareholders’ equity at the end of the relevant period, less goodwill and other intangible assets, divided by the outstanding number of our common shares at the end of each period. The most directly comparable GAAP financial measure is book value per share. We had no goodwill or other intangible assets as of any of the dates indicated. As a result, tangible book value per share is the same as book value per share as of each of the dates indicated. | |||||||||||||||

| (6) Annualized calculations. | |||||||||||||||

| (7) Capital ratios are for the Company, Coastal Financial Corporation. | |||||||||||||||

Non-GAAP Financial Measures

The Company uses certain non-GAAP financial measures to provide meaningful supplemental information regarding the Company’s operational performance and to enhance investors’ overall understanding of such financial performance. However, these non-GAAP financial measures are supplemental and are not a substitute for an analysis based on GAAP measures. As other companies may use different calculations for these adjusted measures, this presentation may not be comparable to other similarly titled adjusted measures reported by other companies.

The following non-GAAP measures are presented to illustrate the impact of provision for loan losses and provision for income taxes on net income and return on average assets.

Pre-tax, pre-provision net income is a non-GAAP measure that excludes the impact of provision for loan losses and provision for income taxes from net income. The most directly comparable GAAP measure is net income.

Pre-tax, pre-provision return on average assets is a non-GAAP measure that excludes the impact of provision for loan losses and provision for income taxes from return on average assets. The most directly comparable GAAP measure is return on average assets.

Reconciliations of the GAAP and non-GAAP measures are presented below.

| As of and for the Three Months Ended | As of and for the Nine Months Ended | |||||||||||||||||||||||||||

| (Dollars in thousands, unaudited) | September 30, 2020 | June 30, 2020 | March 31, 2020 | December 31, 2019 | September 30, 2019 | September 30, 2020 | September 30, 2019 | |||||||||||||||||||||

| Pre-tax, pre-provision net income and pre-tax, pre-provision return on average assets: | ||||||||||||||||||||||||||||

| Total average assets | $ | 1,704,874 | $ | 1,538,546 | $ | 1,141,453 | $ | 1,095,343 | $ | 1,031,969 | $ | 1,462,512 | $ | 1,010,620 | ||||||||||||||

| Total net income | 4,090 | 3,671 | 2,724 | 3,608 | 3,511 | 10,485 | 9,593 | |||||||||||||||||||||

| Plus: provision for loan losses | 2,200 | 1,930 | 1,578 | 820 | 637 | 5,708 | 1,724 | |||||||||||||||||||||

| Plus: provision for income taxes | 1,082 | 967 | 714 | 947 | 919 | 2,763 | 2,514 | |||||||||||||||||||||

| Pre-tax, pre-provision net income | $ | 7,372 | $ | 6,568 | $ | 5,016 | $ | 5,375 | $ | 5,067 | $ | 18,956 | $ | 13,831 | ||||||||||||||

| Return on average assets | 0.95 | % | 0.96 | % | 0.96 | % | 1.31 | % | 1.35 | % | 0.96 | % | 1.27 | % | ||||||||||||||

| Pre-tax, pre-provision return on average assets: | 1.72 | % | 1.72 | % | 1.77 | % | 1.95 | % | 1.95 | % | 1.73 | % | 1.83 | % | ||||||||||||||

The following non-GAAP financial measures are presented to illustrate and identify the impact of PPP loans on loans receivable related measures. By removing these significant items and showing what the results would have been without them, we are providing investors with the information to better compare results with periods that did not have these significant items. These measures include the following:

Adjusted allowance for loan losses to loans receivable is a non-GAAP measure that excludes the impact of PPP loans on balance sheet. The most directly comparable GAAP measure is allowance for loan losses to loans receivable.

Adjusted yield on loans receivable is a non-GAAP measure that excludes the impact of PPP loans on balance sheet. The most directly comparable GAAP measure is yield on loans.

Adjusted contractual yield on loans receivable, excluding earned fees is a non-GAAP measure that excludes the impact of PPP loans on balance sheet. The most directly comparable GAAP measure is contractual yield on loans, excluding fees.

Reconciliations of the GAAP and non-GAAP measures are presented below.

| As of and for the | As of and for the | ||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||

| (Dollars in thousands, unaudited) | September 30, 2020 | June 30, 2020 | September 30, 2020 | ||||||||

| Adjusted allowance for loan losses to loans receivable: | |||||||||||

| Total loans, net of deferred fees | $ | 1,509,389 | $ | 1,447,144 | $ | 1,509,389 | |||||

| Less: PPP loans | (452,846 | ) | (438,077 | ) | (452,846 | ) | |||||

| Less: net deferred fees on PPP loans | 8,586 | 10,639 | 8,586 | ||||||||

| Adjusted loans, net of deferred fees | $ | 1,065,129 | $ | 1,019,707 | $ | 1,065,129 | |||||

| Allowance for loan losses | $ | (17,046 | ) | $ | (14,847 | ) | $ | (17,046 | ) | ||

| Allowance for loan losses to loans receivable | 1.13 | % | 1.03 | % | 1.13 | % | |||||

| Adjusted allowance for loan losses to loans receivable | 1.60 | % | 1.46 | % | 1.60 | % | |||||

| Adjusted yield on loans receivable: | |||||||||||

| Total average loans receivable | $ | 1,493,024 | $ | 1,334,991 | $ | 1,265,705 | |||||

| Less: average PPP loans | (448,313 | ) | (335,200 | ) | (261,854 | ) | |||||

| Plus: average deferred fees on PPP loans | 9,599 | 8,700 | 6,112 | ||||||||

| Adjusted total average loans receivable | $ | 1,054,310 | $ | 1,008,491 | $ | 1,009,964 | |||||

| Interest income on loans | $ | 16,244 | $ | 15,154 | $ | 44,025 | |||||

| Less: interest and deferred fee income recognized on PPP loans | (3,566 | ) | (2,759 | ) | (6,325 | ) | |||||

| Adjusted interest income on loans | $ | 12,678 | $ | 12,395 | $ | 37,700 | |||||

| Yield on loans receivable | 4.33 | % | 4.57 | % | 4.65 | % | |||||

| Adjusted yield on loans receivable: | 4.78 | % | 4.94 | % | 4.99 | % | |||||

| Adjusted contractual yield on loans receivable, excluding earned fees and interest on PPP loans: | |||||||||||

| Total average loans receivable | $ | 1,493,024 | $ | 1,334,991 | $ | 1,265,705 | |||||

| Less: average PPP loans | (448,313 | ) | (335,200 | ) | (261,854 | ) | |||||

| Plus: average deferred fees on PPP loans | $ | 9,599 | $ | 8,700 | $ | 6,112 | |||||

| Adjusted total average loans receivable, excluding earned fees | $ | 1,054,310 | $ | 1,008,491 | $ | 1,009,964 | |||||

| Interest and earned fee income on loans | $ | 16,244 | $ | 15,154 | $ | 44,025 | |||||

| Less: earned fee income on all loans | $ | (2,693 | ) | $ | (2,182 | ) | $ | (5,303 | ) | ||

| Less: interest income on PPP loans | (1,129 | ) | (837 | ) | (1,966 | ) | |||||

| Adjusted interest income on loans | $ | 12,422 | $ | 12,135 | $ | 36,756 | |||||

| Contractual yield on loans receivable, excluding earned fees | 3.61 | % | 3.91 | % | 4.08 | % | |||||

| Adjusted contractual yield on loans receivable, excluding earned fees and interest on PPP loans: | 4.69 | % | 4.84 | % | 4.86 | % | |||||

APPENDIX A

As of September 30, 2020

Industry Concentration

We have a diversified loan portfolio, representing a wide variety of industries. Three of our largest categories of our loans are commercial real estate, commercial and industrial, and construction, land and land development loans. Together they represent $942.5 million in outstanding loan balances, or 88.3% of total gross loans outstanding, excluding PPP loans of $452.8 million. When combined with $232.4 million in unused commitments the total of these three categories is $1.17 billion, or 89.0% of total outstanding loans and loan commitments.

Commercial real estate loans represent the largest segment of our loans, comprising 66.1% of our total balance of outstanding loans, excluding PPP loans, as of September 30, 2020. Unused commitments to extend credit represents an additional $15.6 million, the combined total exposure in commercial real estate loans represents $720.8 million, or 54.6% of our total outstanding loans and loan commitments, excluding PPP loans.

The following table summarizes our exposure by industry for our commercial real estate portfolio as of September 30, 2020:

| (Dollars in thousands, unaudited) | Outstanding Balance | Available Loan Commitments | Total Exposure | % of Total Loans (Outstanding Balance & Available Commitment) | Average Loan Balance | Number of Loans | |||||||||||||||||

| Hotel/Motel | $ | 111,316 | $ | 986 | $ | 112,302 | 8.5 | % | $ | 4,281 | 26 | ||||||||||||

| Apartments | 92,556 | 3,159 | 95,715 | 7.3 | 1,402 | 66 | |||||||||||||||||

| Retail | 73,247 | 55 | 73,302 | 5.6 | 927 | 79 | |||||||||||||||||

| Office | 76,151 | 3,012 | 79,163 | 6.0 | 810 | 94 | |||||||||||||||||

| Mixed use | 68,011 | 4,428 | 72,439 | 5.5 | 791 | 86 | |||||||||||||||||

| Convenience Store | 69,725 | - | 69,725 | 5.3 | 1,835 | 38 | |||||||||||||||||

| Warehouse | 62,611 | 14 | 62,625 | 4.7 | 1,181 | 53 | |||||||||||||||||

| Manufacturing | 35,810 | 500 | 36,310 | 2.8 | 995 | 36 | |||||||||||||||||

| Mini Storage | 33,169 | 857 | 34,026 | 2.6 | 3,317 | 10 | |||||||||||||||||

| Groups < 2.0% of total | 82,590 | 2,593 | 85,183 | 6.5 | 1,073 | 77 | |||||||||||||||||

| Total | $ | 705,186 | $ | 15,604 | $ | 720,790 | 54.6 | % | $ | 1,248 | 565 | ||||||||||||

Commercial and industrial loans comprise 12.8% of our total balance of outstanding loans, excluding PPP loans, as of September 30, 2020. Unused commitments to extend credit represents an additional $140.5 million, the combined total exposure in commercial and industrial loans represents $276.9 million, or 21.0% of our total outstanding loans and loan commitments, excluding PPP loans.

The following table summarizes our exposure by industry, excluding PPP loans, for our commercial and industrial loan portfolio as of September 30, 2020:

| (Dollars in thousands, unaudited) | Outstanding Balance | Available Loan Commitments | Total Exposure | % of Total Loans (Outstanding Balance & Available Commitment) | Average Loan Balance | Number of Loans | |||||||||||||||||

| Capital Call Lines | $ | 43,776 | $ | 79,238 | $ | 123,014 | 9.3 | % | $ | 1,122 | 39 | ||||||||||||

| Construction/Contractor Services | 14,052 | 22,916 | 36,968 | 2.8 | 96 | 146 | |||||||||||||||||

| Financial Institutions | 15,400 | - | 15,400 | 1.2 | 3,850 | 4 | |||||||||||||||||

| Family and Social Services | 9,994 | 5,247 | 15,241 | 1.2 | 769 | 13 | |||||||||||||||||

| Manufacturing | 8,293 | 6,172 | 14,465 | 1.1 | 151 | 55 | |||||||||||||||||

| Medical / Dental / Other Care | 13,584 | 483 | 14,067 | 1.1 | 203 | 67 | |||||||||||||||||

| Groups < 1.0% of total | 31,259 | 26,480 | 57,739 | 4.4 | 101 | 311 | |||||||||||||||||

| Total | $ | 136,358 | $ | 140,536 | $ | 276,894 | 21.0 | % | $ | 215 | 635 | ||||||||||||

Construction, land and land development loans comprise 9.5% of our total balance of outstanding loans, excluding PPP loans, as of September 30, 2020. Unused commitments to extend credit represents an additional $76.3 million, the combined total exposure in construction, land and land development loans represents $177.3 million, or 13.4% of our total outstanding loans and loan commitments, excluding PPP loans.

The following table details our exposure for our construction, land and land development portfolio as of September 30, 2020:

| (Dollars in thousands, unaudited) | Outstanding Balance | Available Loan Commitments | Total Exposure | % of Total Loans (Outstanding Balance & Available Commitment) | Average Loan Balance | Number of Loans | |||||||||||||||||

| Commercial construction | $ | 46,674 | $ | 53,820 | $ | 100,494 | 7.6 | % | $ | 2,223 | 21 | ||||||||||||

| Residential construction | 24,149 | 14,493 | 38,642 | 2.9 | 894 | 27 | |||||||||||||||||

| Developed land loans | 13,097 | 236 | 13,333 | 1.0 | 409 | 32 | |||||||||||||||||

| Undeveloped land loans | 9,726 | 332 | 10,058 | 0.8 | 486 | 20 | |||||||||||||||||

| Land development | 7,309 | 7,423 | 14,732 | 1.1 | 731 | 10 | |||||||||||||||||

| Total | $ | 100,955 | $ | 76,304 | $ | 177,259 | 13.4 | % | $ | 918 | 110 | ||||||||||||

Payment Modifications and Deferrals

As part of our ongoing commitment to our customers we have been continuously proactive in contacting customers impacted by the stay-at-home order in Washington State, temporary business closures, or that have otherwise been impacted by the COVID-19 pandemic and responses thereto. In addition to the PPP loans we made to assist customers, as of September 30, 2020, we have $52.5 million in deferred or modified payments, pursuant to federal guidance, representing 44 loans. During the quarter ended September 30, 2020, there were an additional 7 loans, or $10.2 million, that were granted deferred or modified payments and 169 loans, representing $161.9 million, that moved back to active status from deferral status. In total, we have deferred or modified payments on 245 loans, or $224.6 million. As of September 30, 2020, $93.1 million, or 128 loans, have successfully resumed payments as scheduled, $76.0 million, or 65 loans, have moved to active status and have a payment due in the fourth quarter of 2020, $3.0 million, or 8 loans, have closed and paid-in-full, leaving $52.5 million, or 44 loans, on deferral. All of the loans that were on modified or deferred status as of September 30, 2020 are scheduled to return to active status during the fourth quarter 2020. The graph below illustrates the status of all the loans that were part of the COVID-19 deferral program:

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/52a3af9b-02e7-4ca8-b14b-bc4225265725

The graph below indicates the percentage of loans that remain on a COVID-19 deferral. This illustration is based on total loans outstanding as of as of September 30, 2020.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/4a798c79-e29b-4527-92b2-9be617bd7b76

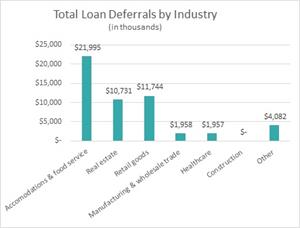

Remaining deferrals by industry as of September 30, 2020:

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/fbe810c7-8540-47da-b039-4ddf7fce9878

As a result of our proactive approach with customers, we did not see material downgrades in credit during quarter ended September 30, 2020 related to the COVID-19 pandemic. We will continue to be diligent in monitoring credit and changes in the economy, keeping the lines of communication open with our customers, but the full impact of these challenging economic times on our financial condition and liquidity remains to be seen at this time.

![]()

Status of All Deferred Loans (in thousands)

Status of All Deferred Loans (in thousands)

Current Deferrals Compared to September 30, 2020 Total Loans (in thousands)

Current Deferrals Compared to September 30, 2020 Total Loans (in thousands)

Total Loan Deferrals by Industry (in thousands)